Costco 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

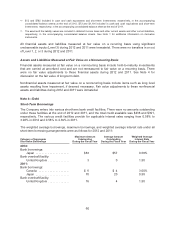

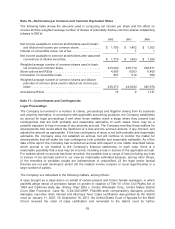

In August 1997, the Company sold $900 principal amount at maturity 3.5% Zero Coupon Convertible

Subordinated Notes (Zero Coupon Notes) due in August 2017. The Zero Coupon Notes were priced

with a yield to maturity of 3.5%, resulting in gross proceeds to the Company of $450. The remaining

Zero Coupon Notes outstanding are convertible into a maximum of 832,000 shares of Costco Common

Stock shares at an initial conversion price of $22.71. The Company, at its option, may redeem the Zero

Coupon Notes (at the discounted issue price plus accrued interest to date of redemption) any time after

August 2002. These notes are included in other long-term debt in the table above and are classified as

a Level 2 measurement in the fair value hierarchy. At the end of 2012, $864 in principal amount of Zero

Coupon Notes had been converted by note holders into shares of Costco Common Stock.

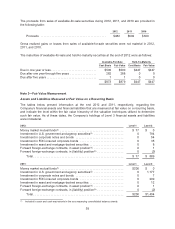

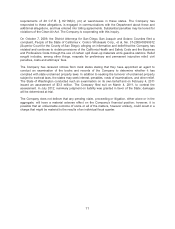

Maturities of long-term debt during the next five fiscal years and thereafter are as follows:

2013 ........................................................ $ 1

2014 ........................................................ 1

2015 ........................................................ 1

2016 ........................................................ 0

2017 ........................................................ 1,128

Thereafter ................................................... 251

Total .................................................... $1,382

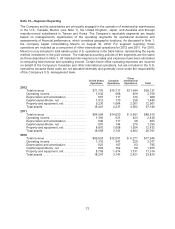

Note 5—Leases

Operating Leases

The aggregate rental expense for 2012, 2011 and 2010 was $220, $208, and $187, respectively.

Sublease income, included in interest income and other, net, and contingent rents are not material.

Capital Leases

Gross assets recorded under capital leases were $187 and $170, at the end of 2012 and 2011,

respectively. These assets are recorded net of accumulated amortization of $19 and $13 at the end of

2012 and 2011, respectively.

At the end of 2012, future minimum payments, net of sub-lease income of $177 for all years combined,

under non-cancelable operating leases with terms of at least one year and capital leases were as

follows:

Operating

Leases

Capital

Leases

2013 ...................................................... $ 189 $ 14

2014 ...................................................... 184 14

2015 ...................................................... 171 14

2016 ...................................................... 164 15

2017 ...................................................... 156 15

Thereafter ................................................. 1,883 328

Total .................................................. $2,747 400

Less amount representing interest ............................. (217)

Net present value of minimum lease payments ................... 183

Less current installments(1) .................................... (2)

Long-term capital lease obligations less current installments(2) ....... $181

(1) Included in other current liabilities.

(2) Included in deferred income taxes and other liabilities.

62