Costco 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.computer systems and our back-up systems are damaged or cease to function properly, we may have

to make significant investments to fix or replace them, and we may suffer interruptions in our

operations in the interim. Any material interruption in our computer systems could have a material

adverse effect on our business or results of operations.

We expect to make significant technology investments in the coming years, which are key to managing

our business. We must monitor and choose the right investments and implement them at the right

pace. Excessive technological change could impact the effectiveness of adoption, and could make it

more difficult for us to realize benefits from the technology. Targeting the wrong opportunities, failing to

make the best investments or making an investment commitment significantly above or below our

needs could result in the loss of our competitive position and adversely impact our financial condition

or results of operations. Additionally, the potential problems and interruptions associated with

implementing technology initiatives could disrupt or reduce the efficiency of our operations in the short

term. These initiatives might not provide the anticipated benefits or may provide them on a delayed

schedule or at a higher cost.

If we do not successfully develop and maintain a relevant multichannel experience for our

members, our results of operations could be adversely impacted.

Multichannel retailing is rapidly evolving and we must keep pace with changing member expectations

and new developments by our competitors. Our members are increasingly using computers, tablets,

mobile phones, and other devices to shop online. As part of our multichannel strategy, we are making

technology investments in our websites and recently launched a mobile application for mobile phones

and other electronic devices. If we are unable to make, improve, or develop relevant member-facing

technology in a timely manner, our ability to compete and our results of operations could be adversely

affected. In addition, if our online businesses or our other member-facing technology systems do not

function as designed, we may experience a loss of member confidence, data security breaches, lost

sales, or be exposed to fraudulent purchases, which could adversely affect our reputation and results

of operations.

Our inability to attract, train and retain highly qualified employees could adversely impact our

business, financial condition and results of operations.

Our success depends to a significant degree on the continued contributions of members of our senior

management and other key operations, merchandising and administrative personnel, and the loss of

any such person(s) could have a material adverse effect on our business. Other than an annual

agreement with our CEO, Mr. Jelinek, we have no employment agreements with our officers. We must

attract, train and retain a large and growing number of highly qualified employees, while controlling

related labor costs and maintaining our core values. Our ability to control labor costs is subject to

numerous external factors, including prevailing wage rates and healthcare and other insurance costs.

We compete with other retail and non-retail businesses for these employees and invest significant

resources in training and motivating them. There is no assurance that we will be able to attract or retain

highly qualified employees in the future, which could have a material adverse effect on our business,

financial condition and results of operations. We do not maintain key man insurance.

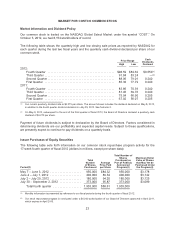

Failure to meet market expectations for our financial performance could adversely affect the

market price and volatility of our stock.

We believe that the price of our stock generally reflects high market expectations for our future

operating results. Any failure to meet or delay in meeting these expectations, including our comparable

warehouse sales growth rates, margins, earnings and earnings per share or new warehouse openings

could cause the market price of our stock to decline, as could changes in our dividend or stock

repurchase policies.

21