Costco 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

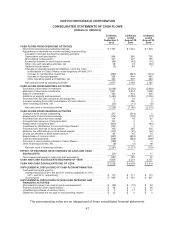

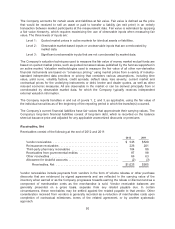

COSTCO WHOLESALE CORPORATION

CONSOLIDATED STATEMENTS OF EQUITY

AND COMPREHENSIVE INCOME

(dollars in millions)

Common Stock Additional

Paid-in

Capital

Accumulated

Other

Comprehensive

Income

Retained

Earnings

Total Costco

Stockholders’

Equity

Noncontrolling

Interests

Total

EquityShares (000’s) Amount

BALANCE AT AUGUST 30,

2009 ........................ 435,974 $2 $3,811 $ 110 $6,101 $10,024 $ 80 $10,104

Comprehensive Income:

Net income ................ 1,303 1,303 20 1,323

Foreign-currency translation

adjustment and other, net . . . 12 12 1 13

Comprehensive income .......... 1,315 21 1,336

Stock-based compensation ....... 190 190 190

Stock options exercised, including

tax effects ................... 5,576 0 243 243 243

Release of vested restricted stock

units (RSUs), including tax

effects ...................... 1,885 0 (38) (38) (38)

Conversion of convertible notes . . . 18 0 1 1 1

Repurchases of common stock .... (9,943) 0 (92) (476) (568) (568)

Cash dividends declared ......... (338) (338) (338)

BALANCE AT AUGUST 29,

2010 ........................ 433,510 2 4,115 122 6,590 10,829 101 10,930

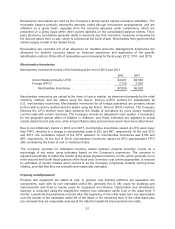

Initial consolidation of

noncontrolling interest in Costco

Mexico ...................... 0 357 357

Comprehensive Income:

Net income ................ 1,462 1,462 80 1,542

Foreign-currency translation

adjustment and other, net . . . 251 251 24 275

Comprehensive income .......... 1,713 104 1,817

Stock-based compensation ....... 207 207 207

Stock options exercised, including

tax effects ................... 7,245 0 332 332 332

Release of vested RSUs, including

tax effects ................... 2,385 0 (51) (51) (51)

Conversion of convertible notes . . . 65 0 2 2 2

Repurchases of common stock .... (8,939) 0 (89) (552) (641) (641)

Cash dividends declared ......... (389) (389) (389)

Investment by noncontrolling

interest ...................... 99

BALANCE AT AUGUST 28,

2011 ........................ 434,266 2 4,516 373 7,111 12,002 571 12,573

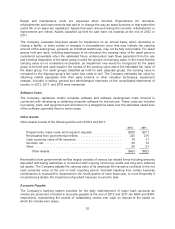

Comprehensive Income:

Net income ................ 1,709 1,709 58 1,767

Foreign-currency translation

adjustment and other, net . . . (62) (62) (34) (96)

Comprehensive income .......... 1,647 24 1,671

Stock-based compensation ....... 241 241 241

Stock options exercised, including

tax effects ................... 2,756 0 142 142 142

Release of vested RSUs, including

tax effects ................... 2,554 0 (76) (76) (76)

Conversion of convertible notes . . . 46 0 2 2 2

Repurchases of common stock .... (7,272) 0 (77) (540) (617) (617)

Cash dividends declared ......... (446) (446) (446)

Distribution to noncontrolling

interest ...................... (183) (183)

Purchase of noncontrolling interest

in Costco Mexico ............. (379) (155) (534) (255) (789)

BALANCE AT SEPTEMBER 2,

2012 ........................ 432,350 $2 $4,369 $ 156 $7,834 $12,361 $ 157 $12,518

The accompanying notes are an integral part of these consolidated financial statements.

46