Costco 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

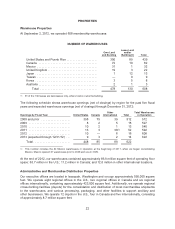

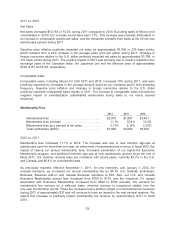

Changes in foreign currencies relative to the U.S. dollar negatively impacted membership fees in 2012

by approximately $10.

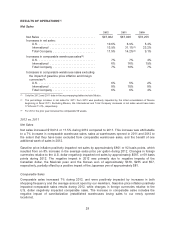

2011 vs. 2010

Membership fees increased 10.4% in 2011 compared to 2010. Excluding membership fees from

Mexico (not consolidated in 2010), the increase would have been 8.3% in 2011. This increase was due

to the higher penetration of our higher-fee Executive Membership program and the additional

membership sign-ups at the 20 net new warehouses opened during 2011.

Changes in foreign currencies relative to the U.S. dollar positively impacted membership fees by

approximately $30 in 2011, primarily due to the positive impacts of the Canadian dollar of $17.

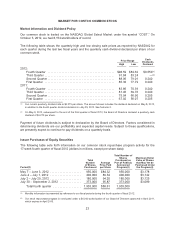

Gross Margin

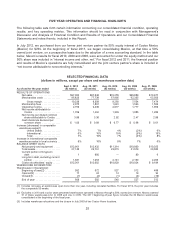

2012 2011 2010

Net sales .................................... $97,062 $87,048 $76,255

Less merchandise costs ....................... 86,823 77,739 67,995

Gross margin ................................ $10,239 $ 9,309 $ 8,260

Gross margin increase ........................ 10.0% 12.7% 9.4%

Gross margin as a percent of net sales ........... 10.55% 10.69% 10.83%

2012 vs. 2011

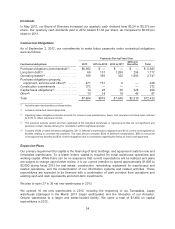

Gross margin as a percent of net sales decreased 14 basis points compared to 2011. Gross margin for

core merchandise categories (food and sundries, hardlines, softlines, and fresh foods) decreased 21

basis points, primarily due to decreases in hardlines and food and sundries resulting from our

investment in merchandise pricing. Excluding the effect of gasoline price inflation on net sales, gross

margin for core merchandise categories decreased 13 basis points. The gross margin comparison was

positively impacted by eight basis points due to a $21 LIFO inventory charge in 2012 compared to an

$87 LIFO charge recorded in 2011. The LIFO charge resulted from higher costs for our merchandise

inventories, primarily food and sundries and gasoline. Increased penetration of the Executive

Membership 2% reward program negatively impacted gross margin by two basis points due to

increased spending by Executive Members. Changes in foreign currencies relative to the U.S. dollar

negatively impacted gross margin by approximately $64 in 2012, primarily due to the negative impacts

of the Canadian dollar and Mexican peso of approximately $33 and $29, respectively.

2011 vs. 2010

Gross margin as a percent of net sales decreased 14 basis points compared to 2010. Gross margin for

core merchandise categories, when expressed as a percent of core merchandise sales rather than

total net sales, increased 18 basis points, primarily due to hardlines and food and sundries. However,

when the core merchandise gross margin is expressed as a percentage of total net sales, it decreased

two basis points from the prior year due primarily to the increased sales penetration of the lower-

margin gasoline business. Warehouse ancillary and other businesses gross margins decreased by two

basis points as a percent of total net sales. The gross margin comparison was also negatively

impacted by $87 or 10 basis points, due to a LIFO inventory charge recorded in 2011. The charge

resulted from higher costs for our merchandise inventories, primarily food and sundries and gasoline.

There was no LIFO inventory charge recorded in 2010.

30