Costco 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 15, 2011. The Company plans to adopt this guidance at the beginning of its first quarter of

fiscal year 2013. Adoption of this guidance is not expected to have a material impact on the Company’s

consolidated financial statements and will impact the financial statements’ presentation only. A portion

of the new comprehensive income guidance required entities to present reclassification adjustments

out of accumulated other comprehensive income by component in both the statement in which net

income is presented and the statement in which other comprehensive income is presented. In

December 2011, the FASB issued guidance which indefinitely defers the guidance related to the

presentation of reclassification adjustments on the face of the financial statements.

In September 2011, the FASB issued guidance to amend and simplify the rules related to testing

goodwill for impairment. The revised guidance allows an initial qualitative evaluation, based on the

entity’s events and circumstances, to determine whether it is more likely than not that the fair value of a

reporting unit is less than its carrying amount. The results of this qualitative assessment determine

whether it is necessary to perform the currently required two-step impairment test. The new guidance

is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after

December 15, 2011. Early adoption is permitted. The Company plans to adopt this guidance at the

beginning of its first quarter of fiscal year 2013. Adoption of this guidance is not expected to have a

material impact on the Company’s consolidated financial statements.

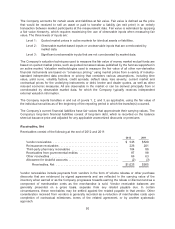

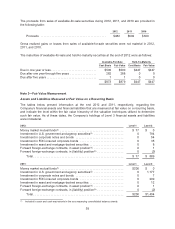

Note 2—Investments

The Company’s investments at the end of 2012 and 2011 were as follows:

2012:

Cost

Basis

Unrealized

Gains

Recorded

Basis

Available-for-sale:

U.S. government and agency securities .................... $ 776 $6 $ 782

Corporate notes and bonds .............................. 54 0 54

FDIC-insured corporate bonds ............................ 35 0 35

Asset and mortgage-backed securities ..................... 8 0 8

Total available-for-sale .............................. 873 6 879

Held-to-maturity:

Certificates of deposit ................................... 447 447

Total Short-Term Investments ........................ $1,320 $6 $1,326

2011:

Cost

Basis

Unrealized

Gains

Recorded

Basis

Available-for-sale:

U.S. government and agency securities .................... $1,096 $ 8 $1,104

Corporate notes and bonds .............................. 6 1 7

FDIC-insured corporate bonds ............................ 208 1 209

Asset and mortgage-backed securities ..................... 12 0 12

Total available-for-sale .............................. 1,322 10 1,332

Held-to-maturity:

Certificates of deposit ................................... 272 272

Total Short-Term Investments ........................ $1,594 $10 $1,604

At the end of 2012, 2011 and 2010 the Company’s available-for-sale securities that were in continuous

unrealized-loss position were not material. Gross unrealized gains and losses on cash equivalents

were not material at the end of 2012 and 2011.

58