Costco 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

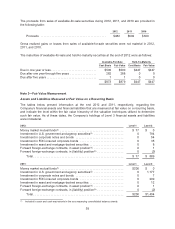

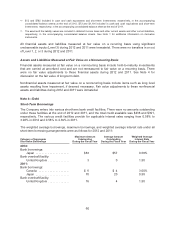

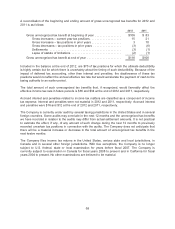

Long-Term Debt

The carrying value and estimated fair value of the Company’s long-term debt at the end of 2012 and

2011 consisted of the following:

2012 2011

Carrying

Value

Fair

Value

Carrying

Value

Fair

Value

5.5% Senior Notes due March 2017 ....... $1,097 $1,325 $1,097 $1,314

5.3% Senior Notes due March 2012 ....... 0 0 900 924

Other long-term debt .................... 285 338 156 197

Total long-term debt .................... 1,382 1,663 2,153 2,435

Less current portion .................... 1 1 900 924

Long-term debt, excluding current portion . . . $1,381 $1,662 $1,253 $1,511

The estimated fair value of the Company’s debt was based primarily on reported market values,

recently completed market transactions and estimates based upon interest rates, maturities, and credit

risk.

In February 2007, the Company issued $900 of 5.3% Senior Notes that were due March 15, 2012

(2012 Notes) at a discount of $2 and $1,100 of 5.5% Senior Notes due March 15, 2017 at a discount of

$6 (together the 2007 Senior Notes). Interest on the 2007 Senior Notes is payable semi-annually on

March 15 and September 15 of each year until their respective maturity date. The discount and

issuance costs associated with the Senior Notes have been amortized to interest expense over the

terms of those notes. The Company, at its option, may redeem the remaining 2007 Senior Notes at any

time, in whole or in part, at a redemption price plus accrued interest. The redemption price is equal to

the greater of 100% of the principal amount of the remaining 2007 Senior Notes to be redeemed or the

sum of the present values of the remaining scheduled payments of principal and interest to maturity.

Additionally, the Company will be required to make an offer to purchase the remaining 2007 Senior

Notes at a price of 101% of the principal amount plus accrued and unpaid interest to the date of

repurchase, upon certain events as defined by the terms of the 2007 Senior Notes. In March 2011, the

Company reclassified its 2012 Notes, to a current liability within the current portion of long-term debt of

the consolidated balance sheets to reflect its remaining maturity of less than one year. On March 15,

2012, the Company paid the outstanding principal balance and associated interest on the 2012 Notes

with its existing sources of cash and cash equivalents and short-term investments. These notes are

classified as a Level 2 measurement in the fair value hierarchy.

In October and December 2011, the Company’s Japanese subsidiary issued two series of 1.18%

Yen-denominated promissory notes through a private placement. For both series, interest is payable

semi-annually, and principal is due in October 2018. These notes are included in other long-term debt

in the table above and are classified as a Level 3 measurement in the fair value hierarchy.

In June 2008, the Company’s Japanese subsidiary entered into a ten-year term loan with a variable

rate of interest of Yen TIBOR (6-month) plus a 0.35% margin (0.78% and 0.79% at the end of 2012

and 2011, respectively) on the outstanding balance. Interest is payable semi-annually and principal is

due in June 2018. This debt is included in other long-term debt in the table above and is classified as a

Level 3 measurement in the fair value hierarchy.

In October 2007, the Company’s Japanese subsidiary issued promissory notes through a private

placement, bearing interest at 2.695%. Interest is payable semi-annually, and principal is due in

October 2017. These notes are included in other long-term debt in the table above and are classified

as a Level 3 measurement in the fair value hierarchy.

61