Costco 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

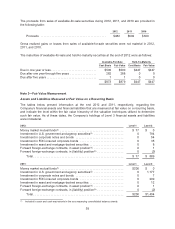

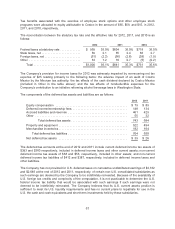

(2) $12 and $782 included in cash and cash equivalents and short-term investments, respectively, in the accompanying

consolidated balance sheets at the end of 2012. $73 and $1,104 included in cash and cash equivalents and short-term

investments, respectively, in the accompanying consolidated balance sheet at the end of 2011.

(3) The asset and the liability values are included in deferred income taxes and other current assets and other current liabilities,

respectively, in the accompanying consolidated balance sheets. See Note 1 for additional information on derivative

instruments.

All financial assets and liabilities measured at fair value on a recurring basis using significant

unobservable inputs (Level 3) during 2012 and 2011 were immaterial. There were no transfers in or out

of Level 1, 2, or 3 during 2012 and 2011.

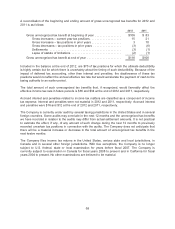

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

Financial assets measured at fair value on a nonrecurring basis include held-to-maturity investments

that are carried at amortized cost and are not remeasured to fair value on a recurring basis. There

were no fair value adjustments to these financial assets during 2012 and 2011. See Note 4 for

discussion on the fair value of long-term debt.

Nonfinancial assets measured at fair value on a nonrecurring basis include items such as long lived

assets resulting from impairment, if deemed necessary. Fair value adjustments to these nonfinancial

assets and liabilities during 2012 and 2011 were immaterial.

Note 4—Debt

Short-Term Borrowings

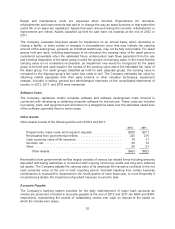

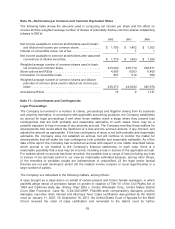

The Company enters into various short-term bank credit facilities. There were no amounts outstanding

under these facilities at the end of 2012 and 2011, and the total credit available was $438 and $391,

respectively. The various credit facilities provide for applicable interest rates ranging from 0.58% to

3.96% in 2012 and 0.58% to 4.39% in 2011.

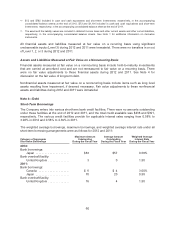

The weighted average borrowings, maximum borrowings, and weighted average interest rate under all

short-term borrowing arrangements were as follows for 2012 and 2011:

Category of Aggregate

Short-term Borrowings

Maximum Amount

Outstanding

During the Fiscal Year

Average Amount

Outstanding

During the Fiscal Year

Weighted Average

Interest Rate

During the Fiscal Year

2012:

Bank borrowings:

Japan ...................... $83 $57 0.58%

Bank overdraft facility:

United Kingdom .............. 3 0 1.50

2011:

Bank borrowings:

Canada .................... $ 6 $ 4 3.00%

Japan ...................... 70 20 0.58

Bank overdraft facility:

United Kingdom .............. 16 4 1.50

60