Costco 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

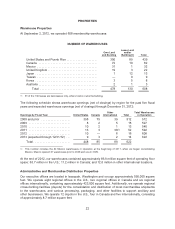

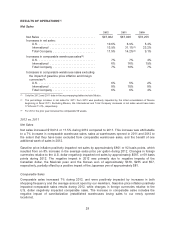

Interest Expense

2012 2011 2010

Interest Expense ...................................... $95 $116 $111

Interest expense primarily relates to our $900 of 5.3% and $1,100 of 5.5% Senior Notes issued in fiscal

2007 (described in further detail under the heading “Financing Activities” below and in Note 4 to the

consolidated financial statements included in Item 8 of this Report). The outstanding principal balance

and associated interest on the 5.3% Senior Notes was paid on March 15, 2012, resulting in a decrease

in interest expense in 2012. This debt was paid with existing sources of cash and cash equivalents and

short-term investments.

Interest Income and Other, Net

2012 2011 2010

Interest income ........................................ $ 49 $41 $23

Foreign-currency transaction gains (losses), net .............. 40 9 14

Earnings of affiliates and other, net ........................ 14 10 51

Interest income and other, net ......................... $103 $60 $88

2012 vs. 2011

The increase in interest income in 2012 compared to 2011 was attributable to higher cash balances

and interest rates in our foreign subsidiaries. The changes in foreign-currency transaction gains and

losses, net in 2012 compared to 2011 were related to the revaluation or settlement of monetary assets

and monetary liabilities, primarily our Canadian subsidiary’s U.S. dollar-denominated payables. See

Derivatives and Foreign Currency sections in Note 1 of this Report.

2011 vs. 2010

The increase in interest income in 2011 compared to 2010 was attributable to increases in our cash

and cash equivalents, including short-term investments, slightly higher interest rates, and the

consolidation of our Mexico operations. See the section titled “Derivatives” in Note 1 to the

consolidated financial statements included in Item 8 of this Report. In addition, the decrease in

earnings of affiliates and other, net is primarily due to the previously discussed change in the

accounting treatment of Mexico (see further discussion in Note 1 included in this Report).

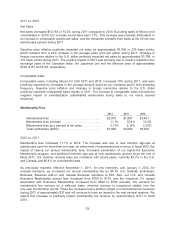

Provision for Income Taxes

2012 2011 2010

Provision for income taxes ........................... $1,000 $ 841 $ 731

Effective tax rate ................................... 36.1% 35.3% 35.6%

Our provision for income taxes for fiscal year 2012 was adversely impacted by nonrecurring net tax

expense of $25 relating primarily to the following items: the adverse impact of an audit of Costco

Mexico by the Mexican tax authority; the tax effects of a cash dividend declared by Costco Mexico; and

the tax effects of nondeductible expenses for our contribution to an initiative reforming alcohol

beverage laws in Washington State.

32