Costco 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual

Report

2012

2012

YEAR ENDED SEPTEMBER 2, 2012

Table of contents

-

Page 1

Annual Report 2012 2012 YEAR ENDED SEPTEMBER 2, 2012 -

Page 2

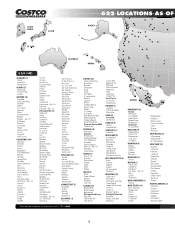

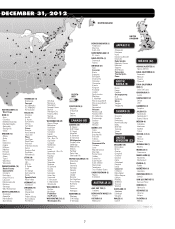

...Map of Warehouse Locations ...Business Overview ...Risk Factors ...Properties: Warehouses, Administrative and Merchandise Distribution Properties ...Market for Costco Common Stock, Dividend Policy and Stock Repurchase Program ...Five Year Operating and Financial Highlights ...Management's Discussion... -

Page 3

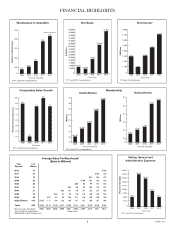

... Fiscal Year 2011 2012 At Fiscal Year End Fiscal Year *2011 and 2012 Include Mexico *2011 and 2012 Include Mexico *All Years Include Mexico Comparable Sales Growth Gold Star Members 10% 8% 8% 7% 7% 10% Membership 26.736 6.5 Business Members 6.442 6.335 6.3 27 26 25 24.845 Percent Increase... -

Page 4

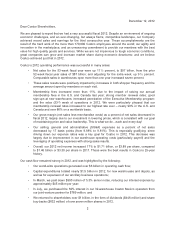

... we are not impervious to tough economic conditions, great companies can grow and increase market share during economic downturns; and we believe Costco achieved just that in 2012. Costco's 2012 operating performance was successful in many areas: • Net sales for the 53-week fiscal year were up 11... -

Page 5

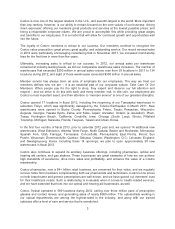

... when it comes to health-related services, and we have extended that trust into our optical and hearing aid businesses, as well. Costco Optical operated in 589 locations during 2012, selling over three million pairs of prescription glasses and contact lenses, and generating sales of nearly $900... -

Page 6

...to bring new Kirkland Signature products to market. Our Kirkland Signature private label items must meet or exceed the quality of the leading national brands, and must offer our members the greatest value for their dollar. New Kirkland Signature items in 2012 included a number of food products, such... -

Page 7

..., while providing our members with the quality products they demand, and at the same time growing our business. This global perspective was an enduring theme for our Company in 2012 and will be into the future. It permeates almost every aspect of our business, and our employees are committed... -

Page 8

... Brooklyn Commack Holbrook Lawrence Manhattan Melville Nanuet Nesconset New Rochelle Port Chester Queens Rego Park Staten Island Westbury Yonkers NORTH CAROLINA (7) Charlotte Durham Greensboro Matthews Raleigh Wilmington Winston-Salem New warehouse openings and relocations since FY 2011 in bold. 6 -

Page 9

... W. Henrico 7 4 PUERTO RICO 2 Leesburg Manassas Newington Newport News Norfolk Pentagon City Potomac Mills Sterling Winchester WASHINGTON (29) Aurora Village Bellingham Burlington Clarkston Covington Everett Federal Way Fife - Bus. Ctr. Gig Harbor Issaquah Kennewick Kirkland Lacey Lynnwood - Bus... -

Page 10

... 2, 2012. References to 2011 and 2010 relate to the 52-week fiscal years ended August 28, 2011 and August 29, 2010, respectively. We operate membership warehouses based on the concept that offering our members low prices on a limited selection of nationally branded and select private-label products... -

Page 11

...Marketing and promotional activities generally relate to new warehouse openings, occasional direct mail to prospective new members, and regular direct marketing programs (such as The Costco Connection, a magazine we publish for our members, coupon mailers, weekly emails from costco.com and costco.ca... -

Page 12

... to our warehouses provide expanded products and services and encourage members to shop more frequently. The following table indicates the number of ancillary businesses in operation at fiscal year-end: 2012 2011 20102 Food Court ...One-Hour Photo Centers ...Optical Dispensing Centers ...Pharmacies... -

Page 13

... This program, excluding Mexico, offers additional savings and benefits on various business and consumer services, such as check printing services, auto and home insurance, the Costco auto purchase program, online investing, and merchant credit-card processing. The services are generally provided by... -

Page 14

... remaining employees are non-union. We consider our employee relations to be very good. Competition Our industry is highly competitive, based on factors such as price, merchandise quality and selection, warehouse location and member service. We compete with over 800 warehouse club locations across... -

Page 15

... in new and replacement air conditioning systems. We have completed a greenhouse gas emissions inventory for our operations in the U.S. and Puerto Rico, Canada, the United Kingdom, and more recently Australia, that we believe meets standards established by the GHG Protocol Corporate Accounting and... -

Page 16

...these Risk Factors carefully in conjunction with Management's Discussion and Analysis of Financial Condition and Results of Operations and our consolidated financial statements and related notes in this Report. We face strong competition from other retailers and warehouse club operators, which could... -

Page 17

... growth rates and expectations; negative trends in operating expenses, including increased labor, healthcare and energy costs; cannibalizing existing locations with new warehouses; shifts in sales mix toward lower gross margin products; changes or uncertainties in economic conditions in our markets... -

Page 18

... business, merchandise inventories, sales and profit margins. We depend heavily on our ability to purchase merchandise in sufficient quantities at competitive prices. We have no assurances of continued supply, pricing or access to new products, and any vendor could at any time change the terms upon... -

Page 19

..., financial condition and results of operations. Factors associated with climate change could adversely affect our business. We use natural gas, diesel fuel, gasoline, and electricity in our distribution and warehouse operations. Increased U.S and foreign government and agency regulations to limit... -

Page 20

... and economic factors specific to the countries or regions in which we operate which could adversely affect our business, financial condition and results of operations. During 2012, our international operations, including Canada, generated 28% of our consolidated net sales. We plan to continue... -

Page 21

... in the pronouncements relating to accounting for income taxes could have a material adverse affect on our financial condition and results of operations. Significant changes in, or failure to comply with, federal, state, regional, local and international laws and regulations relating to the use... -

Page 22

...online operations at www.costco.com and www.costco.ca depend upon the secure transmission of confidential information over public networks, including information permitting cashless payments. A compromise of our security systems or those of our business partners that results in our members' personal... -

Page 23

... pace with changing member expectations and new developments by our competitors. Our members are increasingly using computers, tablets, mobile phones, and other devices to shop online. As part of our multichannel strategy, we are making technology investments in our websites and recently launched... -

Page 24

... the end of 2012, our warehouses contained approximately 86.9 million square feet of operating floor space: 63.7 million in the U.S.; 11.2 million in Canada; and 12.0 million in other international locations. Administrative and Merchandise Distribution Properties Our executive offices are located in... -

Page 25

... Securities The following table sets forth information on our common stock repurchase program activity for the 17-week fourth quarter of fiscal 2012 (dollars in millions, except per share data): Total Number of Shares Purchased as Part of Publicly Announced Program(4) Maximum Dollar Value of Shares... -

Page 26

... of all dividends. Available Information Our internet website is www.costco.com. We make available through the Investor Relations section of that site, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements and Forms 3, 4 and... -

Page 27

... per share and warehouse number data) As of and for the year ended Sept. 2, 2012 (53 weeks) Aug. 28, 2011 (52 weeks) Aug. 29, 2010 (52 weeks) Aug. 30, 2009 (52 weeks) Aug. 31, 2008 (52 weeks) RESULTS OF OPERATIONS Net sales ...Merchandise costs ...Gross margin ...Membership fees ...Operating income... -

Page 28

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (dollars in millions, except per share, membership fee data, and warehouse number data) OVERVIEW We believe that the most important driver of increasing our profitability is sales growth, particularly comparable ... -

Page 29

... extra week of membership fees in fiscal 2012, the impact of raising our annual membership fees, increased penetration of our higher-fee Executive Membership program, and additional member sign-ups at new warehouses opened since the end of fiscal 2011; Gross margin (net sales less merchandise costs... -

Page 30

...excluded from comparable warehouse sales, and the benefit of one additional week of sales in 2012. Gasoline price inflation positively impacted net sales by approximately $801 or 92 basis points, which resulted from an 8% increase in the average sales price per gallon during 2012. Changes in foreign... -

Page 31

... of our higher-fee Executive Membership program, and additional member sign-ups at new warehouses opened since the end of fiscal 2011. Our member renewal rates are consistent with recent years, currently 89.7% in the U.S. and Canada, and 86.4% on a worldwide basis. As previously reported, effective... -

Page 32

...from higher costs for our merchandise inventories, primarily food and sundries and gasoline. Increased penetration of the Executive Membership 2% reward program negatively impacted gross margin by two basis points due to increased spending by Executive Members. Changes in foreign currencies relative... -

Page 33

... expenses include costs for startup operations related to new warehouses and the expansion of ancillary operations at existing warehouses. Preopening expenses vary due to the number of warehouse openings, the timing of the opening relative to our year-end, whether the warehouse is owned or leased... -

Page 34

... attributable to increases in our cash and cash equivalents, including short-term investments, slightly higher interest rates, and the consolidation of our Mexico operations. See the section titled "Derivatives" in Note 1 to the consolidated financial statements included in Item 8 of this Report. In... -

Page 35

... and short-term investment balances. Of these balances, approximately $1,161 and $982 at the end of 2012 and 2011, respectively, represented debit and credit card receivables, primarily related to sales within the last week of our fiscal year. Net cash provided by operating activities totaled... -

Page 36

... our information systems and related activities. These expenditures are expected to be financed with a combination of cash provided from operations and existing cash and cash equivalents and short-term investments. We plan to open 27 to 30 net new warehouses in 2013. We opened 16 net new warehouses... -

Page 37

... by our international operations, $224 is guaranteed by the Company. We maintain bank credit facilities for working capital and general corporate purposes. There were no outstanding short-term borrowings under any of the bank credit facilities at the end of 2012 and 2011. The Company has letter of... -

Page 38

... no off-balance sheet arrangements that have had, or are reasonably likely to have, a material current or future effect on our financial condition or consolidated financial statements. Stock Repurchase Programs In April 2011, our Board of Directors authorized a stock repurchase program in the amount... -

Page 39

... to hold the investment. We also consider specific adverse conditions related to the financial health of and business outlook for the issuer, including industry and sector performance, operational and financing cash flow factors, and rating agency actions. Once a decline in fair value is determined... -

Page 40

... financial instruments for trading purposes. Interest Rate Risk Our exposure to market risk for changes in interest rates relates primarily to our investment holdings that are diversified among money market funds, U.S. government and agency securities, Federal Deposit Insurance Corporation insured... -

Page 41

...the fair value of the fixed-rate debt and may affect the interest expense related to the variable rate debt. See Note 4 to the consolidated financial statements included in this Report for more information on our long-term debt. Foreign Currency-Exchange Risk Our foreign subsidiaries conduct certain... -

Page 42

... executive officers have 25 or more years of service with the Company. Effective January 1, 2012, Jim Sinegal retired as our Chief Executive Officer but is continuing with the Company in an advisory role until February 2013. In addition, he will continue to serve on the Board of Directors. Executive... -

Page 43

...of management, including our Chief Executive Officer and Chief Financial Officer, of our disclosure controls and procedures (as defined in Rules 13a-15(e) or 15d-15(e) under the Securities and Exchange Act of 1934 (the Exchange Act)). Based upon that evaluation, our Chief Executive Officer and Chief... -

Page 44

... and Chief Financial Officer REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Shareholders Costco Wholesale Corporation: We have audited the accompanying consolidated balance sheets of Costco Wholesale Corporation and subsidiaries as of September 2, 2012 and... -

Page 45

...the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of the Company as of September 2, 2012 and August 28, 2011, and the related consolidated statements of income, equity and comprehensive income, and cash flows for the 53-week period ended September 2, 2012... -

Page 46

COSTCO WHOLESALE CORPORATION CONSOLIDATED BALANCE SHEETS (dollars in millions, except par value and share data) September 2, 2012 August 28, 2011 ASSETS CURRENT ASSETS Cash and cash equivalents ...Short-term investments ...Receivables, net ...Merchandise inventories ...Deferred income taxes and ... -

Page 47

COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF INCOME (dollars in millions, except per share data) 53 weeks ended September 2, 2012 52 weeks ended August 28, 2011 52 weeks ended August 29, 2010 REVENUE Net sales ...Membership fees ...Total revenue ...OPERATING EXPENSES Merchandise costs ... -

Page 48

...Repurchases of common stock ...Cash dividends declared ...Distribution to noncontrolling interest ...Purchase of noncontrolling interest in Costco Mexico ...BALANCE AT SEPTEMBER 2, 2012 ...) (389) (540) (446) The accompanying notes are an integral part of these consolidated financial statements. 46 -

Page 49

... of the initial consolidation of Costco Mexico at the beginning of fiscal 2011: Increase in merchandise inventories ...Increase in accounts payable ...Other operating assets and liabilities, net ...Net cash provided by operating activities ...CASH FLOWS FROM INVESTING ACTIVITIES Purchases of short... -

Page 50

... CONSOLIDATED FINANCIAL STATEMENTS (dollars in millions, except share data) Note 1-Summary of Significant Accounting Policies Description of Business Costco Wholesale Corporation and its subsidiaries operate membership warehouses based on the concept that offering our members low prices on a limited... -

Page 51

... reported consolidated financial statements. Cash and Cash Equivalents The Company considers as cash and cash equivalents all highly liquid investments with a maturity of three months or less at the date of purchase and proceeds due from credit and debit card transactions with settlement terms... -

Page 52

... of the reporting period in which the transfer(s) occurred. The Company's current financial liabilities have fair values that approximate their carrying values. The Company's long-term financial liabilities consist of long-term debt, which is recorded on the balance sheet at issuance price and... -

Page 53

... presented on a gross basis within other current liabilities on the consolidated balance sheets. Thirdparty pharmacy receivables generally relate to amounts due from members' insurance companies for the amount above their co-pay, which is collected at the point-of-sale. Receivables from governmental... -

Page 54

... incurred to date. Accounts Payable The Company's banking system provides for the daily replenishment of major bank accounts as checks are presented. Included in accounts payable at the end of 2012 and 2011 are $565 and $108, respectively, representing the excess of outstanding checks over cash on... -

Page 55

...to the consolidated balance sheets are recognized as information becomes known. In the event the Company leaves the reinsurance program, the Company is not relieved of its primary obligation to the policyholders for activity prior to the termination of the annual agreement. Other Current Liabilities... -

Page 56

...-exchange contracts. These items resulted in a net gain of $41, $8 and $13 in 2012, 2011, and 2010, respectively. Revenue Recognition The Company generally recognizes sales, which include shipping fees where applicable, net of estimated returns, at the time the member takes possession of merchandise... -

Page 57

...-year membership period. The Company's Executive Members qualify for a 2% reward (beginning November, 1, 2011 the reward increased from a maximum of $500 to $750 per year on qualified purchases), which can be redeemed at Costco warehouses. The Company accounts for this reward as a reduction in sales... -

Page 58

... on the consolidated statements of income. See Note 7 for additional information on the Company's stock-based compensation plans. Leases The Company leases land and/or buildings at warehouses and certain other office and distribution facilities, primarily under operating leases. Operating leases... -

Page 59

..., from tax authorities. When facts and circumstances change, the Company reassesses these probabilities and records any changes in the consolidated financial statements as appropriate. See Note 9 for additional information. Net Income per Common Share Attributable to Costco The computation of basic... -

Page 60

... Company's consolidated financial statements. Note 2-Investments The Company's investments at the end of 2012 and 2011 were as follows: 2012: Cost Basis Unrealized Gains Recorded Basis Available-for-sale: U.S. government and agency securities ...Corporate notes and bonds ...FDIC-insured corporate... -

Page 61

...these dates, the Company's holdings of Level 3 financial assets and liabilities were immaterial. 2012: Level 1 Level 2 Money market mutual ...Investment in U.S. government and agency securities(2) ...Investment in corporate notes and bonds ...Investment in FDIC-insured corporate bonds ...Investment... -

Page 62

... 4-Debt Short-Term Borrowings The Company enters into various short-term bank credit facilities. There were no amounts outstanding under these facilities at the end of 2012 and 2011, and the total credit available was $438 and $391, respectively. The various credit facilities provide for applicable... -

Page 63

... as a Level 3 measurement in the fair value hierarchy. In June 2008, the Company's Japanese subsidiary entered into a ten-year term loan with a variable rate of interest of Yen TIBOR (6-month) plus a 0.35% margin (0.78% and 0.79% at the end of 2012 and 2011, respectively) on the outstanding balance... -

Page 64

...Level 2 measurement in the fair value hierarchy. At the end of 2012, $864 in principal amount of Zero Coupon Notes had been converted by note holders into shares of Costco Common Stock. Maturities of long-term debt during the next five fiscal years and thereafter are as follows: 2013 ...2014 ...2015... -

Page 65

... in the accompanying consolidated balance sheets. Note 6-Stockholders' Equity Dividends The Company's current quarterly dividend rate is $0.275 per share. Stock Repurchase Programs The Company's stock repurchase program is conducted under a $4,000 authorization by the Board of Directors approved in... -

Page 66

... Term (in years) Number Of Options (in 000's) WeightedAverage Exercise Price Aggregate Intrinsic Value(1) Outstanding at the end of 2011 ...Exercised ...Outstanding at the end of 2012 ...(1) 5,917 (2,756) 3,161 $40.07 39.11 $40.90 2.06 $180 The difference between the exercise price and market... -

Page 67

... provides for accelerated vesting for employees and non-employee directors that have attained twenty-five or more years and five or more years of service with the Company, respectively. Recipients are not entitled to vote or receive dividends on non-vested and undelivered shares. At the end of 2012... -

Page 68

... deferrals into the 401(k) plan which the Company matches (50% of the first five hundred dollars of employee contributions) and provides each eligible participant a contribution based on hours worked and years of service. California union employees participate in a defined benefit plan sponsored by... -

Page 69

... end of 2012 and 2011, respectively, of certain non-U.S. consolidated subsidiaries as such earnings are deemed by the Company to be indefinitely reinvested. Because of the availability of U.S. foreign tax credits and complexity of the computation, it is not practicable to determine the U.S. federal... -

Page 70

...Gross increases - tax positions in prior years ...Gross decreases - tax positions in prior years ...Settlements ...Lapse of statute of limitations ...Gross unrecognized tax benefit at end of year ... $106 15 3 (3) (3) (2) $116 $ 83 21 10 (6) (1) (1) $106 Included in the balance at the end of 2012... -

Page 71

... the matter for developments that will make the loss contingency both probable and reasonably estimable. As of the date of this report, the Company has recorded an accrual with respect to one matter described below, which accrual is not material to the Company's financial statements. In each case... -

Page 72

... California, Florida, Georgia, Kentucky, Nevada, New Mexico, North Carolina, South Carolina, Tennessee, Texas, Utah, and Virginia. Other than payments to class representatives, the settlement does not provide for cash payments to class members. On September 22, 2011, the court preliminarily approved... -

Page 73

...State of California v. Costco Wholesale Corp., et al, No. 37-2009-00099912 (Superior Court for the County of San Diego), alleging on information and belief that the Company has violated and continues to violate provisions of the California Health and Safety Code and the Business and Professions Code... -

Page 74

... and Korea. The Company's reportable segments are largely based on management's organization of the operating segments for operational decisions and assessments of financial performance, which considers geographic locations. As discussed in Note 1, the Company began consolidating Mexico on August... -

Page 75

..., subsequent to the end of the third quarter of 2012, the Board of Directors declared a quarterly cash dividend of $0.275 per share. Includes a $12 increase to merchandise costs for a LIFO inventory adjustment (see Note 1-Merchandise Inventories). Our current quarterly dividend rate is $0.275 per... -

Page 76

First Quarter 12 Weeks 52 Weeks Ended August 28, 2011 Second Third Fourth Quarter Quarter Quarter 12 Weeks 12 Weeks 16 Weeks Total 52 Weeks REVENUE Net sales ...Membership fees ...Total revenue ...OPERATING EXPENSES Merchandise costs ...Selling, general and administrative ...Preopening expenses ... -

Page 77

... Manager - Midwest Region Richard A. Galanti Executive Vice President, Chief Financial Officer Jaime Gonzalez Senior Vice President, General Manager - Mexico Bruce Greenwood Senior Vice President, General Manager - Los Angeles Region Robert D. Hicok Senior Vice President, General Manager - San Diego... -

Page 78

...Klauer GMM - Corporate Non-Foods Gary Kotzen GMM - Corporate Foods Paul Latham Membership, Marketing, Services & Costco Travel Robert Leuck Operations - Northeast Region Gerry S. Liben GMM - Ancillaries - Canadian Division Phil Lind Business Centers Steve Mantanona GMM - Merchandising - Mexico Tracy... -

Page 79

... be provided to any shareholder upon written request directed to Investor Relations, Costco Wholesale Corporation, 999 Lake Drive, Issaquah, Washington 98027. Internet users can access recent sales and earnings releases, the annual report and SEC filings, as well as our Costco Online web site, at... -

Page 80

13C0106_A 10/12