Cigna 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

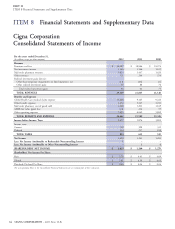

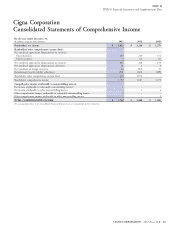

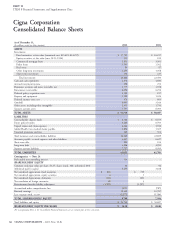

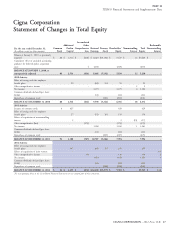

ITEM 8 Financial Statements and Supplementary Data

annuity business include adjustments for investment returns statutory disability or other group disability benefit plans. For awards

consistent with requirements of GAAP when a premium deficiency of such offsets that have not been finalized, the Company estimates

exists. the probability and amount of the offset based on the Company’s

experience over the past three to five years.

Certain reinsurance contracts contain GMDB under variable

annuities issued by other insurance companies. These obligations The Company discounts certain claim liabilities related to group

represent the guaranteed death benefit in excess of the contractholder’s long-term disability and workers’ compensation because benefit

account values (based on underlying equity and bond mutual fund payments may be made over extended periods. Discount rate

investments). These obligations are estimated based on assumptions assumptions are based on projected investment returns for the asset

regarding lapse, partial surrenders, mortality, interest rates (mean portfolios that support these liabilities and range from 1.83% to

investment performance and discount rate), market volatility as well 6.25%. When estimates change, the Company records the adjustment

as investment returns and premiums, consistent with the in benefits and expenses in the period in which the change in estimate

requirements of GAAP when a premium deficiency exists. Lapse, is identified. Discounted liabilities associated with the long-term

partial surrenders, mortality, interest rates and volatility are based on disability and certain workers’ compensation businesses were

management’s judgment considering the Company’s experience and $3.2 billion at December 31, 2012 and 2011.

future expectations. The results of futures and swap contracts used in

the GMDB equity and growth interest rate hedge programs are

N. Global Health Care Medical Claims

reflected in the liability calculation as a component of investment

Payable

returns. See also Note 7 for additional information.

Medical claims payable for the Global Health Care segment include

both reported claims and estimates for losses incurred but not yet

M. Unpaid Claims and Claims Expenses

reported including amounts owed for services from providers and

Liabilities for unpaid claims and claim expenses are estimates of under risk-sharing and quality management arrangements with

payments to be made under insurance coverages (primarily long-term providers. The Company develops estimates for Global Health Care

disability, workers’ compensation and life and health) for reported medical claims payable using actuarial principles and assumptions

claims and for losses incurred but not yet reported. consistently applied each reporting period, and recognizes the

actuarial best estimate of the ultimate liability within a level of

The Company develops these estimates for losses incurred but not yet

confidence, as required by actuarial standards of practice, which

reported using actuarial principles and assumptions based on

require that the liabilities be adequate under moderately adverse

historical and projected claim incidence patterns, claim size,

conditions.

subrogation recoveries and the length of time over which payments are

expected to be made. The Company consistently applies these The liability is primarily calculated using ‘‘completion factors’’ (a

actuarial principles and assumptions each reporting period, with measure of the time to process claims), which are developed by

consideration given to the variability of these factors, and recognizes comparing the date claims were incurred, generally the date services

the actuarial best estimate of the ultimate liability within a level of were provided, to the date claims were paid. The Company uses

confidence, as required by actuarial standards of practice, that require historical completion factors combined with an analysis of current

the liabilities to be adequate under moderately adverse conditions. trends and operational factors to develop current estimates of

completion factors. The Company estimates the liability for claims

The Company’s estimate of the liability for disability claims reported

incurred in each month by applying the current estimates of

but not yet paid is primarily calculated as the present value of expected

completion factors to the current paid claims data. This approach

benefit payments to be made over the estimated time period that a

implicitly assumes that historical completion rates will be a useful

policyholder remains disabled. The Company estimates the expected

indicator for the current period. It is possible that the actual

time period that a policyholder may be disabled by analyzing the rate

completion rates for the current period will develop differently from

at which an open claim is expected to close (claim resolution rate).

historical patterns, which could have a material impact on the

Claim resolution rates may vary based upon the length of time a

Company’s medical claims payable and shareholders’ net income.

policyholder is disabled, the covered benefit period, cause of disability,

benefit design and the policyholder’s age, gender and income level. Completion factors are impacted by several key items including

The Company uses historical resolution rates combined with an changes in: 1) electronic (auto-adjudication) versus manual claim

analysis of current trends and operational factors to develop current processing, 2) provider claims submission rates, 3) membership and

estimates of resolution rates. The reserve for the gross monthly 4) the mix of products. As noted, the Company uses historical

disability benefits due to a policyholder is reduced (offset) by the completion factors combined with an analysis of current trends and

income that the policyholder receives under other benefit programs, operational factors to develop current estimates of completion factors.

such as Social Security Disability Income, workers’ compensation,

74 CIGNA CORPORATION - 2012 Form 10-K