Cigna 2012 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8 Financial Statements and Supplementary Data

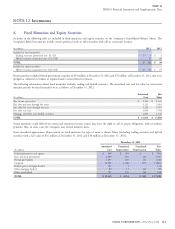

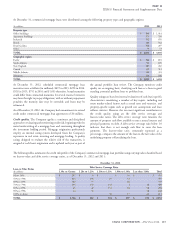

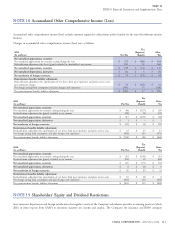

Impaired commercial mortgage loans. The carrying value of the Company’s impaired commercial mortgage loans and related valuation reserves

were as follows:

2012 2011

(In millions)

Gross Reserves Net Gross Reserves Net

Impaired commercial mortgage loans

with valuation reserves $ 72 $ (7) $ 65 $ 154 $ (19) $ 135

Impaired commercial mortgage loans

with no valuation reserves 60 - 60 60 - 60

TOTAL $ 132 $ (7) $ 125 $ 214 $ (19) $ 195

During 2012, the Company recorded a $10 million pre-tax underlying investment. Additional interest income that would have

($7 million after-tax) increase in valuation reserves on three impaired been reflected in net income if interest on non-accrual commercial

commercial mortgage loans collateralized by industrial properties and mortgage loans had been received in accordance with the original

one impaired commercial mortgage loan collateralized by a retail terms was not significant for 2012 or 2011. Interest income on

property. The average recorded investment in impaired loans was impaired commercial mortgage loans was not significant for 2012 or

$167 million during 2012 and $176 million during 2011. The 2011. See Note 2 for further information on impaired commercial

Company recognizes interest income on problem mortgage loans only mortgage loans.

when payment is actually received because of the risk profile of the

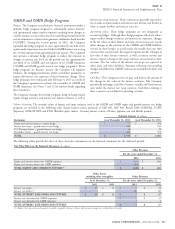

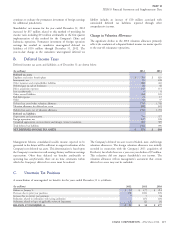

The following table summarizes the changes in valuation reserves for commercial mortgage loans:

(In millions)

2012 2011

Reserve balance, January 1, $19$12

Increase in valuation reserves 10 16

Charge-offs upon sales and repayments, net of recoveries (3) (1)

Transfers to other long-term investments (16) -

Transfers to foreclosed real estate (3) (8)

RESERVE BALANCE, DECEMBER 31, $7$19

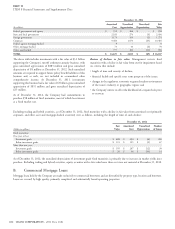

C. Real Estate

As of December 31, 2012 and 2011, real estate investments consisted primarily of office and industrial buildings in California. Investments with a

carrying value of $49 million as of December 31, 2012 and 2011 were non-income producing during the preceding twelve months. As of

December 31, 2012, the Company had commitments to contribute additional equity of $7 million to real estate investments.

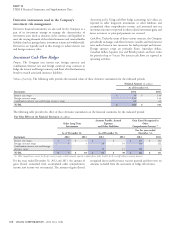

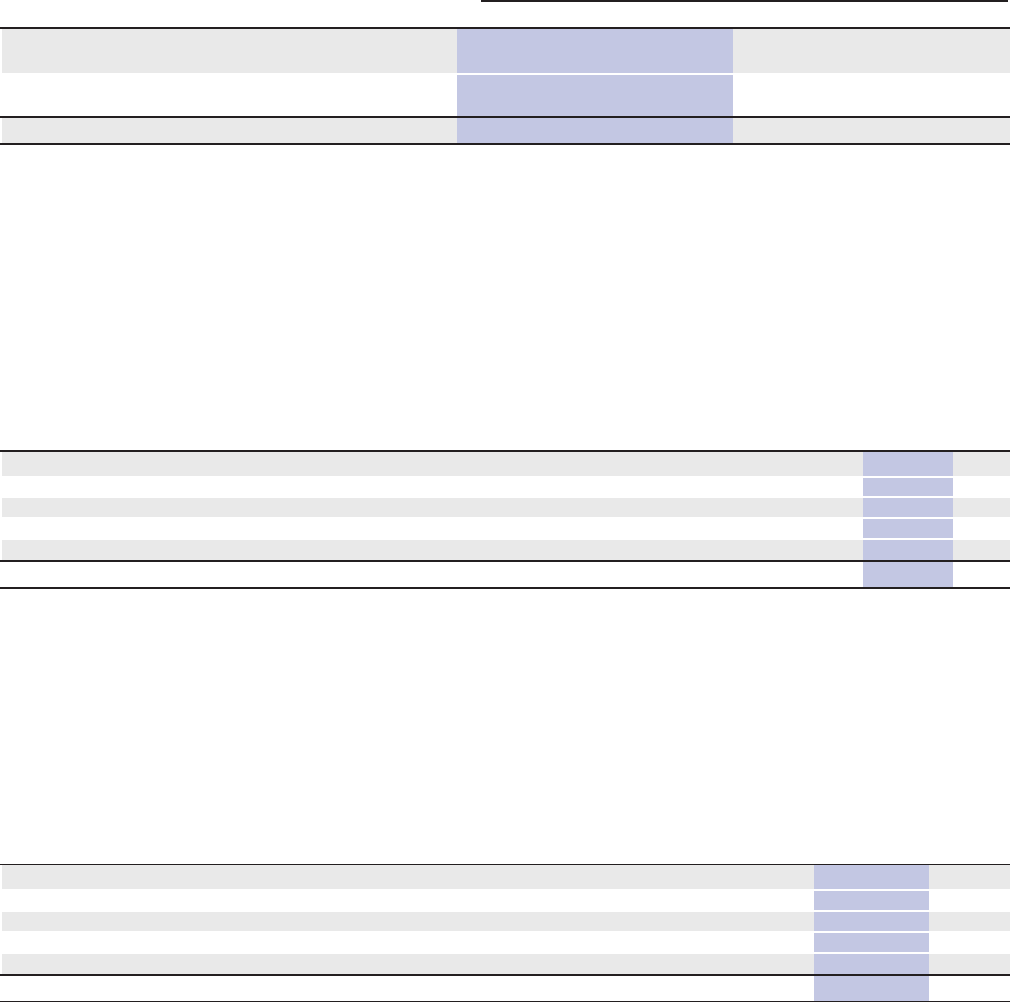

D. Other Long-Term Investments

As of December 31, other long-term investments consisted of the following:

(In millions)

2012 2011

Real estate entities $ 823 $ 665

Securities partnerships 343 298

Interest rate and foreign currency swaps 612

Mezzanine loans 31 31

Other 52 52

TOTAL $ 1,255 $ 1,058

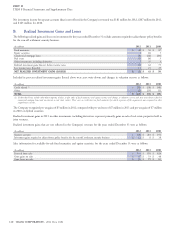

Investments in real estate entities and securities partnerships with a $312 million to entities that hold securities diversified by issuer and

carrying value of $199 million at December 31, 2012 and maturity date.

$171 million at December 31, 2011 were non-income producing The Company expects to disburse approximately 50% of the

during the preceding twelve months. committed amounts in 2013.

As of December 31, 2012, the Company had commitments to

contribute:

$197 million to limited liability entities that hold either real estate

or loans to real estate entities that are diversified by property type

and geographic region; and

CIGNA CORPORATION - 2012 Form 10-K 105

•

•