Cigna 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Investment Assets

The Company’s investment assets do not include separate account hypothetical market participant would use to determine a current

assets. Additional information regarding the Company’s investment transaction price. These valuation techniques involve some level of

assets and related accounting policies is included in Notes 2, 11, 12, estimation and judgment that becomes significant with increasingly

13, 14, 15 and 18 to the Consolidated Financial Statements. complex instruments or pricing models.

The Company is responsible for determining fair value, as well as the

Fixed Maturities

appropriate level within the fair value hierarchy as defined in Note 11

to the Consolidated Financial Statements, based on the significance of

Investments in fixed maturities include publicly traded and privately unobservable inputs. The Company reviews methodologies and

placed debt securities, mortgage and other asset-backed securities, processes of third-party pricing services and compares prices on a test

preferred stocks redeemable by the investor and hybrid and trading basis to those obtained from other external pricing sources or internal

securities. The Company estimates fair values using prices from third estimates. The Company performs ongoing analyses of both prices

parties or internal pricing methods. Fair value estimates received from received from third-party pricing services and those developed

third-party pricing services are based on reported trade activity and internally to determine that they represent appropriate estimates of

quoted market prices when available, and other market information fair value. These analyses include reviewing to ensure that prices do

that a market participant may use to estimate fair value. Internal not become stale and whether changes from prior valuations are

pricing methods are performed by the Company’s investment reasonable or require additional review. The Company also performs

professionals, and generally involve using discounted cash flow sample testing of sales values to confirm the accuracy of prior fair

analyses, incorporating current market inputs for similar financial value estimates. Exceptions identified during these processes indicate

instruments with comparable terms and credit quality, as well as other that adjustments to prices are infrequent and do not significantly

qualitative factors. In instances where there is little or no market impact valuations.

activity for the same or similar instruments, fair value is estimated

using methods, models and assumptions that the Company believes a

The Company’s fixed maturity portfolio continues to be diversified by issuer and industry type with the consumer sector representing the largest

single industry concentration of approximately 10% of total invested assets as of December 31, 2012.

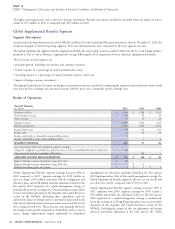

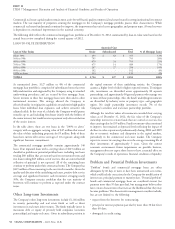

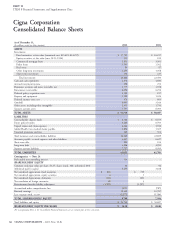

(In millions)

2012 2011

Federal government and agency $ 902 $ 958

State and local government 2,437 2,456

Foreign government 1,322 1,274

Corporate 11,896 10,513

Federal agency mortgage-backed 122 9

Other mortgage-backed 89 80

Other asset-backed 937 927

TOTAL $ 17,705 $ 16,217

As of December 31, 2012, $15.9 billion, or 90%, of the fixed on publicly-traded bonds with comparable credit risk. The Company

maturities in the Company’s investment portfolio were investment performs a credit analysis of each issuer, diversifies investments by

grade (Baa and above, or equivalent), and the remaining $1.8 billion industry and issuer and requires financial and other covenants that

were below investment grade. The majority of the bonds that are allow the Company to monitor issuers for deteriorating financial

below investment grade are rated at the higher end of the strength and pursue remedial actions, if warranted. Also included in

non-investment grade spectrum. These quality characteristics have corporate fixed maturities are investments in companies that are

not materially changed during the year. domiciled or have significant business interests in European countries

with the most significant political or economic concerns (Portugal,

The net appreciation of the Company’s fixed maturity portfolio Italy, Ireland, Greece and Spain). Fixed maturity investments in these

increased $264 million during 2012, driven by a decrease in market companies represent approximately $400 million at December 31,

yields. Although asset values are well in excess of amortized cost, there 2012, have an average quality rating of BAA and are diversified by

are specific securities with amortized cost in excess of fair value by industry sector. Financial institutions comprised less than 2% of

approximately $30 million in aggregate as of December 31, 2012. See investments in these companies.

Note 12 to the Consolidated Financial Statements for further

information. The Company invests in high quality foreign government obligations,

with an average quality rating of AA as of December 31, 2012. These

Corporate fixed maturities includes private placement investments of investments are primarily concentrated in Asia consistent with the

$5.4 billion, which are generally less marketable than publicly-traded geographic distribution of the international business operations,

bonds, but yields on these investments tend to be higher than yields including government obligations of South Korea, Indonesia, Taiwan

56 CIGNA CORPORATION - 2012 Form 10-K