Cigna 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

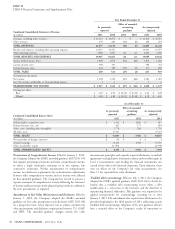

at December 31, 2011 reflecting the reinsurance of the remaining net In 2012, the primary effect of a hypothetical decrease in the market

prices of equity exposures was a 10% decrease in the value of equity

GMIB liability in 2013.

securities reported as investment assets because the equity exposures of

The effect of a hypothetical strengthening of the U.S. dollar relative to the Company’s GMIB contracts were significantly reduced by the

the foreign currencies held by the Company was estimated to be 10% 2013 reinsurance agreement.

of the U.S. dollar equivalent fair value. The Company’s foreign

In 2011, the effect of a hypothetical decrease in the market prices of

operations hold investment assets, such as fixed maturities, cash, and

equity exposures was estimated based on a 10% decrease in mutual

cash equivalents, that are generally invested in the currency of the

fund values underlying GMIB contracts and the equity futures

related liabilities. Due to the increase in the fair value of these

contracts used to partially hedge these GMIB equity exposures, as well

investments in 2012, that are primarily denominated in the South

as the value of equity securities held by the Company.

Korean won, the effect of a hypothetical 10% strengthening in U.S.

dollar to foreign currencies at December 31, 2012 was greater than As noted above, the Company manages its exposures to market risk by

that effect at December 31, 2011. matching investment characteristics to its obligations.

Cautionary Statement for Purposes of the ‘‘Safe Harbor’’ Provisions of the Private

Securities Litigation Reform Act of 1995

Cigna Corporation and its subsidiaries (the ‘‘Company’’) and its risks associated with pending and potential state and federal class

representatives may from time to time make written and oral forward- action lawsuits, disputes regarding reinsurance arrangements,

looking statements, including statements contained in press releases, other litigation and regulatory actions challenging the

in the Company’s filings with the Securities and Exchange Company’s businesses, including disputes related to payments to

Commission, in its reports to shareholders and in meetings with health care professionals, government investigations and

analysts and investors. Forward-looking statements may contain proceedings, tax audits and related litigation, and regulatory

information about financial prospects, economic conditions, trends market conduct and other reviews, audits and investigations,

and other uncertainties. These forward-looking statements are based including the possibility that the acquired HealthSpring business

on management’s beliefs and assumptions and on information may be adversely affected by potential changes in risk adjustment

available to management at the time the statements are or were made. data validation audit and payment adjustment methodology;

Forward-looking statements include, but are not limited to, the challenges and risks associated with implementing improvement

information concerning possible or assumed future business strategies, initiatives and strategic actions in the ongoing operations of the

financing plans, competitive position, potential growth opportunities, businesses, including those related to: (i) growth in targeted

potential operating performance improvements, trends and, in geographies, product lines, buying segments and distribution

particular, the Company’s strategic initiatives, litigation and other channels, (ii) offering products that meet emerging market

legal matters, operational improvement initiatives in the health care needs, (iii) strengthening underwriting and pricing effectiveness,

operations, and the outlook for the Company’s full year 2013 and (iv) strengthening medical cost results and a growing medical

beyond results. Forward-looking statements include all statements customer base, (v) delivering quality service to members and

that are not historical facts and can be identified by the use of forward- health care professionals using effective technology solutions,

looking terminology such as the words ‘‘believe’’, ‘‘expect’’, ‘‘plan’’, and (vi) lowering administrative costs;

‘‘intend’’, ‘‘anticipate’’, ‘‘estimate’’, ‘‘predict’’, ‘‘potential’’, ‘‘may’’,

‘‘should’’ or similar expressions. the unique political, legal, operational, regulatory and other

challenges associated with expanding our business globally;

By their nature, forward-looking statements: (i) speak only as of the

date they are made, (ii) are not guarantees of future performance or challenges and risks associated with the successful management

results and (iii) are subject to risks, uncertainties and assumptions that of the Company’s outsourcing projects or key vendors;

are difficult to predict or quantify. Therefore, actual results could

the ability of the Company to execute its growth plans by

differ materially and adversely from those forward-looking statements

successfully leveraging capabilities and integrating acquired

as a result of a variety of factors. Some factors that could cause actual

businesses, including the HealthSpring businesses by, among

results to differ materially from the forward-looking statements

include: other things, operating Medicare Advantage plans and

HealthSpring’s prescription drug plan, retaining and growing the

health care reform legislation, as well as additional changes in customer base, realizing revenue, expense and other synergies,

state or federal regulation, that could, among other items, affect renewing contracts on competitive terms or maintaining

the way the Company does business, increase costs, limit the performance under Medicare contracts, successfully leveraging

ability to effectively estimate, price for and manage medical the information technology platform of the acquired businesses,

costs, and affect the Company’s products, services, market and retaining key personnel;

segments, technology and processes;

risks associated with security or interruption of information

adverse changes in state, federal and international laws and systems, that could, among other things, cause operational

regulations, including increased medical, administrative, disruption;

technology or other costs resulting from new legislative and

regulatory requirements imposed on the Company’s businesses;

CIGNA CORPORATION - 2012 Form 10-K 61

3.

4.

5.

6.

7.

1.

8.

2.