Cigna 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8 Financial Statements and Supplementary Data

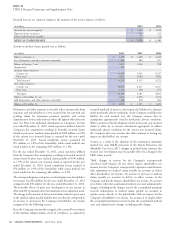

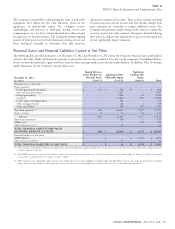

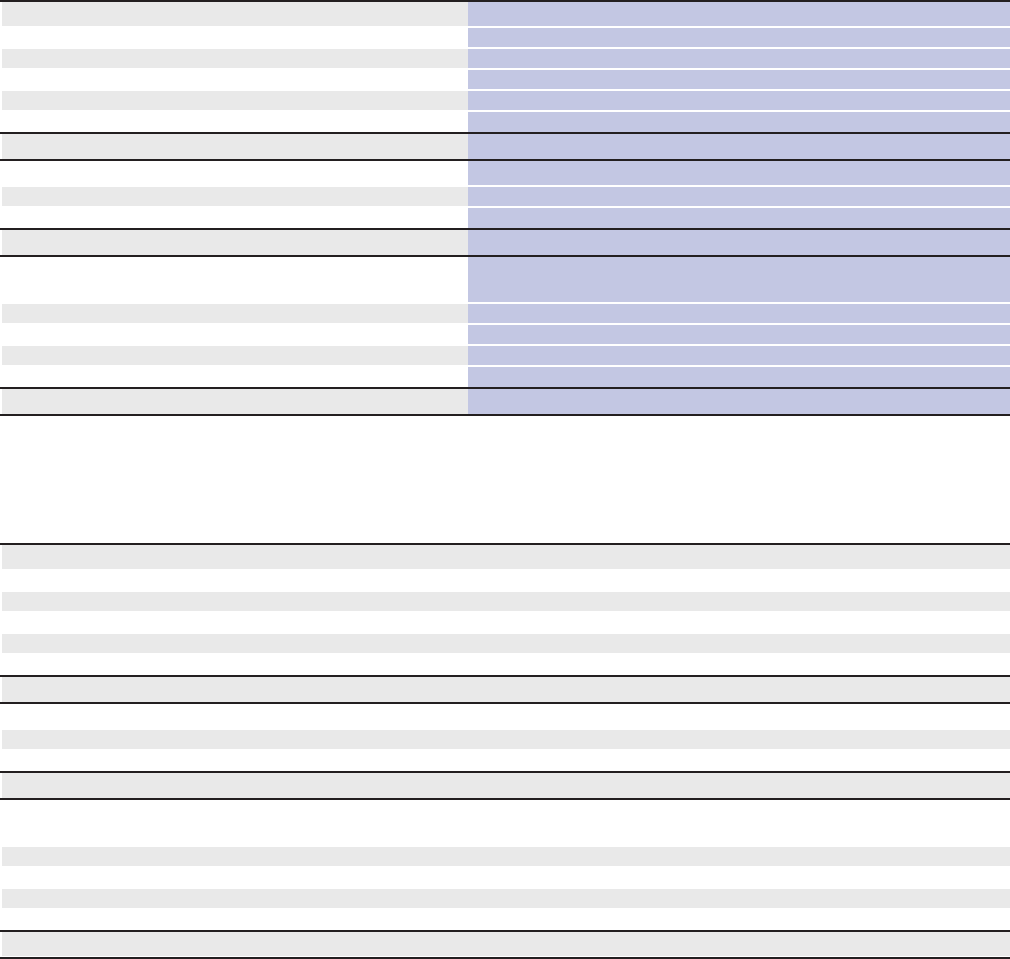

The fair values of plan assets by category and by the fair value hierarchy as defined by GAAP are as follows. See Note 11 for a description of how

fair value is determined, including the level within the fair value hierarchy and the procedures the Company uses to validate fair value

measurements.

Quoted Prices in Significant

Active Markets for Significant Other Unobservable

Identical Assets Observable Inputs Inputs

December 31, 2012

(In millions)

(Level 1) (Level 2) (Level 3) Total

Plan assets at fair value:

Fixed maturities:

Federal government and agency $ - $ 4 $ - $ 4

Corporate - 416 27 443

Mortgage and other asset-backed - 8 5 13

Fund investments and pooled separate accounts

(1)

- 519 3 522

TOTAL FIXED MATURITIES - 947 35 982

Equity securities:

Domestic 1,202 4 10 1,216

International, including funds and pooled separate accounts

(1)

158 149 - 307

TOTAL EQUITY SECURITIES 1,360 153 10 1,523

Real estate and mortgage loans, including pooled separate

accounts

(1)

- - 351 351

Securities partnerships - - 328 328

Hedge funds - - 327 327

Guaranteed deposit account contract - - 47 47

Cash equivalents - 107 - 107

TOTAL PLAN ASSETS AT FAIR VALUE $ 1,360 $ 1,207 $ 1,098 $ 3,665

(1) A pooled separate account has several participating benefit plans and each owns a share of the total pool of investments.

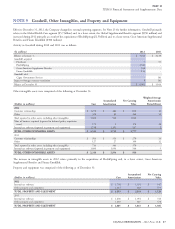

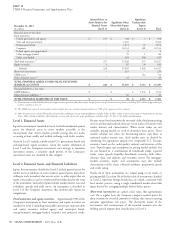

Quoted Prices in Significant

Active Markets for Significant Other Unobservable

Identical Assets Observable Inputs Inputs

December 31, 2011

(In millions)

(Level 1) (Level 2) (Level 3) Total

Plan assets at fair value:

Fixed maturities:

Federal government and agency $ - $ 5 $ - $ 5

Corporate - 332 7 339

Mortgage and other asset-backed - 8 2 10

Fund investments and pooled separate accounts

(1)

- 546 3 549

TOTAL FIXED MATURITIES - 891 12 903

Equity securities:

Domestic 1,153 1 14 1,168

International, including funds and pooled separate accounts

(1)

141 137 - 278

TOTAL EQUITY SECURITIES 1,294 138 14 1,446

Real estate and mortgage loans, including pooled separate

accounts

(1)

- - 303 303

Securities partnerships - - 314 314

Hedge Fund - - 148 148

Guaranteed deposit account contract - - 39 39

Cash equivalents - 145 - 145

TOTAL PLAN ASSETS AT FAIR VALUE $ 1,294 $ 1,174 $ 830 $ 3,298

(1) A pooled separate account has several participating benefit plans and each owns a share of the total pool of investments.

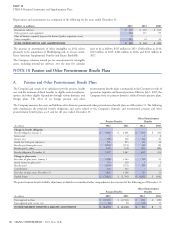

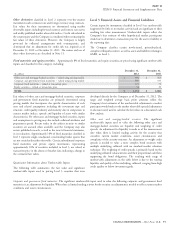

Plan assets in Level 1 include exchange-listed equity securities. Level 2 Because many fixed maturities do not trade daily, fair values are often

assets primarily include: derived using recent trades of securities with similar features and

characteristics. When recent trades are not available, pricing models

fixed income and international equity funds priced using their daily are used to determine these prices. These models calculate fair values

net asset value that is the exit price; and by discounting future cash flows at estimated market interest rates.

fixed maturities valued using recent trades of similar securities or Such market rates are derived by calculating the appropriate spreads

pricing models as described below.

90 CIGNA CORPORATION - 2012 Form 10-K

•

•