Cigna 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8 Financial Statements and Supplementary Data

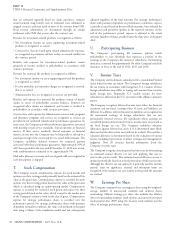

Realignment and Efficiency Plan

During the third quarter of 2012, the Company, in connection with Global Health Care segment reported $65 million pre-tax

the execution of its strategy, committed to a series of actions to further ($42 million after-tax) of the charge. The remainder was reported as

improve its organizational alignment, operational effectiveness, and follows: $9 million pre-tax ($6 million after-tax) in Global

efficiency. As a result, the Company recognized charges in other Supplemental Benefits and $3 million pre-tax ($2 million after-tax) in

operating expenses of $77 million pre-tax ($50 million after-tax) in Group Disability and Life.

the third quarter of 2012 consisting primarily of severance costs. The

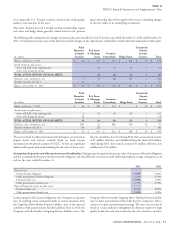

Summarized below is activity for 2012.

(In millions)

Severance Real estate Total

Third quarter 2012 charge $ 72 $ 5 $ 77

less: Fourth quarter 2012 payments 5 1 6

Balance, December 31, 2012 $ 67 $ 4 $ 71

The severance costs are expected to be substantially paid in 2013.

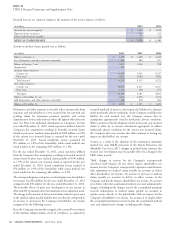

Guaranteed Minimum Death Benefit Contracts

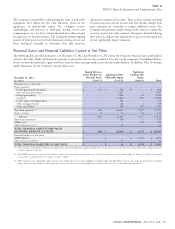

As discussed in Note 25, the Company reinsured the guaranteed (mean investment performance and discount rate) and volatility.

minimum death benefit (‘‘GMDB’’) business on February 4, 2013. These assumptions are based on the Company’s experience and future

expectations over the long-term period, consistent with the long-term

The Company’s reinsurance operations, that were discontinued in nature of this product. The Company regularly evaluates these

2000 and are now an inactive business in run-off mode, reinsured a assumptions and changes its estimates if actual experience or other

GMDB, also known as variable annuity death benefits (‘‘VADBe’’), evidence suggests that assumptions should be revised.

under certain variable annuities issued by other insurance companies.

These variable annuities are essentially investments in mutual funds The following provides information about the Company’s reserving

combined with a death benefit. The Company has equity and other methodology and assumptions for GMDB as of December 31, 2012:

market exposures as a result of this product. In periods of declining The reserves represent estimates of the present value of net amounts

equity markets and in periods of flat equity markets following a expected to be paid, less the present value of net future premiums.

decline, the Company’s liabilities for these guaranteed minimum Included in net amounts expected to be paid is the excess of the

death benefits increase. Conversely, in periods of rising equity guaranteed death benefits over the values of the contractholders’

markets, the Company’s liabilities for these guaranteed minimum accounts (based on underlying equity and bond mutual fund

death benefits decrease. investments).

In 2000, the Company determined that the GMDB reinsurance The reserves include an estimate for partial surrenders (that allow

business was premium deficient because the recorded future policy most contractholders to withdraw substantially all of their mutual

benefit reserve was less than the expected present value of future fund investments while retaining the death benefit coverage in effect

claims and expenses less the expected present value of future at the time of the withdrawal, essentially locking in the death benefit

premiums and investment income using revised assumptions based on for a particular policy) based on annual election rates that vary from

actual and expected experience. The Company tests for premium 0% to 13% depending on the net amount at risk for each policy and

deficiency by reviewing its reserve each quarter using current market whether surrender charges apply.

conditions and its long-term assumptions. Under premium deficiency

The assumed mean investment performance (‘‘growth interest rate’’)

accounting, if the recorded reserve is determined to be insufficient, an

for the underlying equity mutual funds for the portion of the

increase to the reserve is reflected as a charge to current period income.

liability that is covered by the Company’s growth interest rate hedge

Consistent with GAAP, the Company does not recognize gains on

program is based on the market-observable LIBOR swap curve. The

premium deficient long duration products.

assumed mean investment performance for the remainder of the

See Note 13 for further information on the Company’s dynamic underlying equity mutual funds considers the Company’s GMDB

hedge programs. These programs were used to reduce certain equity equity hedge program using futures contracts, and is based on the

and interest rate exposures associated with this business and were Company’s view that short-term interest rates will average 4% over

discontinued after February 4, 2013. future periods, but considers that current short-term rates are less

The determination of liabilities for GMDB requires the Company to than 4%. The mean investment performance assumption for the

make critical accounting estimates. The Company estimates its underlying fixed income mutual funds (bonds and money market)

liabilities for GMDB exposures with an internal model using many is 5% based on a review of historical returns. The investment

scenarios and based on assumptions regarding lapse, future partial performance for underlying equity and fixed income mutual funds

surrenders, claim mortality (deaths that result in claims), interest rates is reduced by fund fees ranging from 1% to 3% across all funds.

CIGNA CORPORATION - 2012 Form 10-K 83

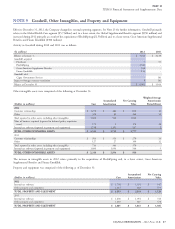

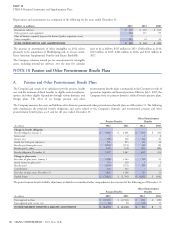

NOTE 6

NOTE 7

•

•

•