Cigna 2012 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8 Financial Statements and Supplementary Data

The Company may redeem these Notes, at any time, in whole or in $198 million, including accrued interest and expenses, to settle the

part, at a redemption price equal to the greater of: Notes, resulting in an after-tax loss on early debt extinguishment of

$18 million.

100% of the principal amount of the Notes to be redeemed; or

In December 2010, the Company issued $250 million of 4.375%

the present value of the remaining principal and interest payments Notes ($249 million net of debt discount, with an effective interest

on the Notes being redeemed discounted at the applicable Treasury rate of 5.1%). Interest is payable on June 15 and December 15 of

rate plus 20 basis points (10-Year 4.5% Notes due 2021) or 25 basis each year beginning December 15, 2010. These Notes will mature

points (30-Year 5.875% Notes due 2041). on December 15, 2020. The proceeds of this debt were used to fund

During 2011, the Company repaid $449 million in maturing the tender offer for the 8.5% Senior Notes due 2019 and the 6.35%

long-term debt. Senior Notes due 2018 described above.

In the fourth quarter of 2010, the Company entered into the In May 2010, the Company issued $300 million of 5.125% Notes

following transactions related to its long-term debt: ($299 million, net of debt discount, with an effective interest rate of

5.36% per year). Interest is payable on June 15 and December 15 of

In December 2010 the Company offered to settle its 8.5% Notes

each year beginning December 15, 2010. These Notes will mature on

due 2019, including accrued interest from November 1 through the

June 15, 2020. The proceeds of this debt were used for general

settlement date. The tender price equaled the present value of the

corporate purposes.

remaining principal and interest payments on the Notes being

redeemed, discounted at a rate equal to the 10-year Treasury rate The Company may redeem the Notes issued in 2010 at any time, in

plus a fixed spread of 100 basis points. The tender offer priced at a whole or in part, at a redemption price equal to the greater of:

yield of 4.128% and principal of $99 million was tendered, with

100% of the principal amount of the Notes to be redeemed; or

$251 million remaining outstanding. The Company paid

$130 million, including accrued interest and expenses, to settle the the present value of the remaining principal and interest payments

Notes, resulting in an after-tax loss on early debt extinguishment of on the Notes being redeemed discounted at the applicable Treasury

$21 million. rate plus 25 basis points.

In December 2010 the Company offered to settle its 6.35% Notes Maturities of debt and capital leases are as follows (in millions): $1 in

due 2018, including accrued interest from September 16 through 2013, $23 in 2014, none in 2015, $600 in 2016, $250 in 2017 and

the settlement date. The tender price equaled the present value of the remainder in years after 2017. Interest expense on long-term debt,

the remaining principal and interest payments on the Notes being short-term debt and capital leases was $268 million in 2012,

redeemed, discounted at a rate equal to the 10-year Treasury rate $202 million in 2011, and $182 million in 2010.

plus a fixed spread of 45 basis points. The tender offer priced at a

The Company was in compliance with its debt covenants as of

yield of 3.923% and principal of $169 million was tendered, with

$131 million remaining outstanding. The Company paid December 31, 2012.

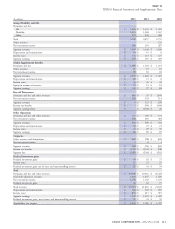

Common and Preferred Stock

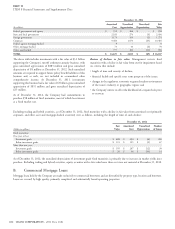

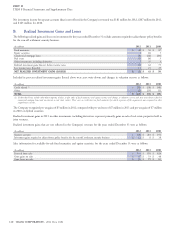

As of December 31, the Company had issued the following shares:

(Shares in thousands)

2012 2011

Common: Par value $0.25 600,000 shares authorized

Outstanding – January 1 285,533 271,880

Issuance of common stock - 15,200

Issued for stock option and other benefit plans 4,695 3,735

Repurchase of common stock (4,399) (5,282)

Outstanding – December 31 285,829 285,533

Treasury stock 80,316 80,612

ISSUED – DECEMBER 31 366,145 366,145

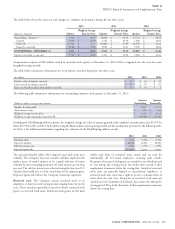

On November 16, 2011, the Company issued 15.2 million shares of During 2012, and through February 28, 2013, the Company

its common stock at $42.75 per share. Proceeds of $650 million repurchased 4.4 million shares for $208 million. On February 27,

($629 million net of underwriting discount and fees) were used to 2013, the Company’s Board of Directors increased share repurchase

partially fund the HealthSpring acquisition in January 2012. authority by $500 million. Accordingly, the total remaining share

repurchase authorization as of February 28, 2013 was $815 million.

The Company maintains a share repurchase program, which was The Company repurchased 5.3 million shares for $225 million during

authorized by its Board of Directors. The decision to repurchase 2011.

shares depends on market conditions and alternative uses of capital.

The Company has, and may continue from time to time, to The Company has authorized a total of 25 million shares of $1 par

repurchase shares on the open market through a Rule 10b5-1 plan value preferred stock. No shares of preferred stock were outstanding at

that permits a company to repurchase its shares at times when it December 31, 2012 or 2011.

otherwise might be precluded from doing so under insider trading

laws or because of self-imposed trading blackout periods.

112 CIGNA CORPORATION - 2012 Form 10-K

•

•

•

•

•

•

•

NOTE 17