Cigna 2012 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8 Financial Statements and Supplementary Data

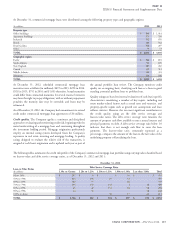

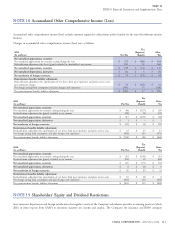

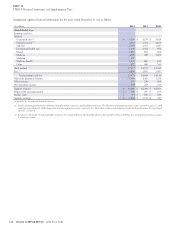

Accumulated Other Comprehensive Income (Loss)

Accumulated other comprehensive income (loss) excludes amounts required to adjust future policy benefits for the run-off settlement annuity

business.

Changes in accumulated other comprehensive income (loss) were as follows:

Tax

2012 (Expense) After-

(In millions) Pre-Tax Benefit Tax

Net unrealized appreciation, securities:

Net unrealized appreciation on securities arising during the year $ 271 $ (90) $ 181

Reclassification adjustment for losses (gains) included in shareholders’ net income (52) 18 (34)

Net unrealized appreciation, securities $ 219 $ (72) $ 147

Net unrealized depreciation, derivatives $ (7) $ 2 $ (5)

Net translation of foreign currencies $ 78 $ (12) $ 66

Postretirement benefits liability adjustment:

Reclassification adjustment for amortization of net losses from past experience and prior service costs,

and settlement charges $ 52 $ (18) $ 34

Net change arising from assumption and plan changes and experience (181) 55 (126)

Net postretirement benefits liability adjustment $ (129) $ 37 $ (92)

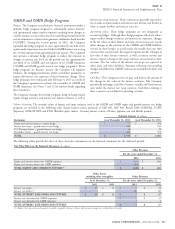

Tax

2011 (Expense) After-

(In millions) Pre-Tax Benefit Tax

Net unrealized appreciation, securities:

Net unrealized appreciation on securities arising during the year $ 366 $ (127) $ 239

Reclassification adjustment for (gains) included in net income (49) 18 (31)

Net unrealized appreciation, securities $ 317 $ (109) $ 208

Net unrealized appreciation, derivatives $1$–$1

Net translation of foreign currencies $ (21) $ (1) $ (22)

Postretirement benefits liability adjustment:

Reclassification adjustment for amortization of net losses from past experience and prior service costs $ 22 $ (7) $ 15

Net change arising from assumption and plan changes and experience (580) 205 (375)

Net postretirement benefits liability adjustment $ (558) $ 198 $ (360)

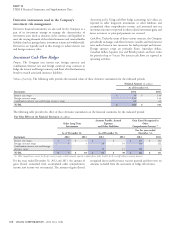

Tax

2010 (Expense) After-

(In millions) Pre-Tax Benefit Tax

Net unrealized appreciation, securities:

Net unrealized appreciation on securities arising during the year $ 319 $ (109) $ 210

Reclassification adjustment for (gains) included in net income (92) 32 (60)

Net unrealized appreciation, securities $ 227 $ (77) $ 150

Net unrealized appreciation, derivatives $8$(2)$6

Net translation of foreign currencies $40 $(7) $33

Postretirement benefits liability adjustment:

Reclassification adjustment for amortization of net losses from past experience and prior service costs $ 10 $ (4) $ 6

Net change arising from assumption and plan changes and experience (311) 116 (195)

Net postretirement benefits liability adjustment $ (301) $ 112 $ (189)

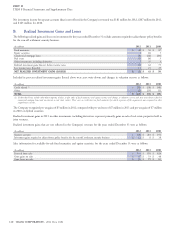

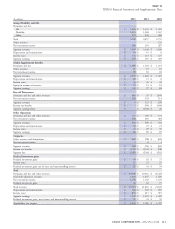

Shareholders’ Equity and Dividend Restrictions

State insurance departments and foreign jurisdictions that regulate certain of the Company’s subsidiaries prescribe accounting practices (which

differ in some respects from GAAP) to determine statutory net income and surplus. The Company’s life insurance and HMO company

CIGNA CORPORATION - 2012 Form 10-K 113

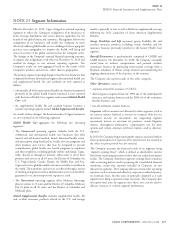

NOTE 18

NOTE 19