Cigna 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

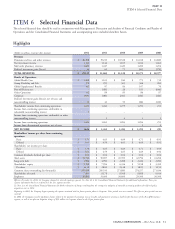

Summarized below is adjusted income from operations by segment and other key consolidated financial data:

Adjusted Income (Loss) From Operations

(In millions)

2012 2011 2010

Global Health Care $ 1,480 $ 1,104 $ 940

Group Disability and Life 281 290 305

Global Supplemental Benefits 148 100 84

Run-off Reinsurance (29) (48) (27)

Other Operations 82 85 85

Corporate (228) (170) (176)

TOTAL $ 1,734 $ 1,361 $ 1,211

Other Key Consolidated Financial Data

Global medical customers (in thousands) 14,045 12,680 12,473

Cash flows from operating activities $ 2,350 $ 1,491 $ 1,743

Shareholders’ equity $ 9,769 $ 7,994 $ 6,356

Shareholders’ net income decreased 1% in 2011 compared with

Consolidated Results of Operations – 2012

2010, due to significantly higher GMIB losses principally reflecting

Compared to 2011

lower interest rates, substantially offset by higher adjusted income

from operations.

Revenues increased 33% in 2012, primarily reflecting contributions

from HealthSpring as well as higher revenues in each of the Adjusted income from operations increased 12% in 2011

Company’s ongoing businesses from continued growth in the compared with 2010 primarily due to higher earnings contributions

Company’s targeted global market segments. See further detailed from the Company’s Global Health Care and Global Supplemental

discussion of revenues below and segment revenues in the individual Benefits segments. These results reflect solid business growth in

segment discussions of this MD&A. strategically targeted markets and continued low medical services

utilization trend.

Shareholders’ net income increased 29% in 2012, primarily

resulting from substantially higher adjusted income from operations Global medical customers increased 2%, reflecting growth in

as discussed below and significantly improved GMIB results due to targeted markets, primarily the middle and select market segments

more favorable market conditions in 2012. See the Run-off domestically as well as growth in the international health care

Reinsurance section of this MD&A for additional information on business. These increases were partially offset by exits from certain

GMIB results. These favorable effects were partially offset by the non-strategic markets, primarily Medicare IPFFS.

2012 special items for litigation and the realignment and efficiency

plan.

Liquidity and Financial Condition

Adjusted income from operations increased 27% in 2012, largely

During 2012, the following items affected the Company’s liquidity

attributable to earnings contributions from HealthSpring, as well as

and financial condition:

overall revenue growth in the other ongoing operating segments and

lower charges related to the GMDB business. See the individual Cash flows from operating activities. For 2012, cash flows from

segment sections of this MD&A for further discussion. operating activities were higher than 2011 primarily attributable to

strong earnings and business growth in the Company’s ongoing

Global medical customers increased 11% primarily attributable to

operating segments.

growth in strategically targeted global markets reflecting solid

customer persistency and strong new sales as well as the acquisition Acquisitions. During 2012, the Company acquired HealthSpring,

of HealthSpring. Great American Supplemental Benefits and Finans Emeklilik for a

combined purchase price of approximately $4.2 billion. See Note 3

to the Consolidated Financial Statement for additional information.

Consolidated Results of Operations – 2011

Repayment of Debt. During the first quarter of 2012, the

Compared to 2010

Company repaid the acquired HealthSpring debt of $326 million.

Revenues rose 3% in 2011 compared with 2010, reflecting solid See Note 16 to the Consolidated Financial Statements for additional

growth in the Company’s strategically targeted domestic and information.

international customer segments of its ongoing global health care, Pension Plan Contributions. During 2012, the Company

global supplemental benefits, and group disability and life contributed $250 million to the Company’s domestic qualified

businesses. In addition, the increase in revenue reflects the effect of pension plans; See Note 10 to the Consolidated Financial

the programs to hedge equity and growth interest rate exposures in Statements for additional information; and

the run-off reinsurance operations. See the Run-off Reinsurance

section of this MD&A beginning on page 47 for additional Share Repurchase. The Company repurchased 4.4 million shares

information. These increases were partially offset by the exit from of stock for $208 million. See the Liquidity and Capital Resources

certain non-strategic markets, primarily the Medicare Advantage section of this MD&A for additional information.

Individual Private Fee For Service (‘‘Medicare IPFFS’’) business.

36 CIGNA CORPORATION - 2012 Form 10-K

•

•

•

•

•

•

•

•

•

•

•

•

•