Cigna 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

2012 CIGNA ANNUAL REPORT

YOU

INVESTING

IN

Table of contents

-

Page 1

INVESTING

INYOU

201 2 C I G N V V N NUV L R E P O RT

-

Page 2

BELIEVING IN YOUR POTENTIAL.

We believe in our customers' potential as much as they do.

CONTENTS

4 8 TO OUR SHVREHOLDERS GROWING

10 LEVDING 12 SERVING 14 CIGNV IN PERSPECTIVE 16 CORPORVTE & BOVRD OF DIRECTORS

2

-

Page 3

... to financial management - is an investment in the health, well-being and sense of security of our customers and all those who depend on us. Our diverse, global investments of time, talent and technology come in many forms. We work around the clock, handling up to 100,000 calls a day, to provide...

-

Page 4

... financial flexibility, with continued delivery of significant free cash flow and strong return on capital from each of our businesses - positioning us well to further enhance value in 2013 and beyond. • Continuing to deepen our presence in existing geographies, customer segments and product lines...

-

Page 5

... our specialty products through our Administrative Services Only (ASO) business.

Global Supplemental Benefits

Cigna's Global Supplemental Benefits segment - which provides supplemental health, life, and accident insurance, including Medicare supplemental coverage, in the U.S. and in foreign markets...

-

Page 6

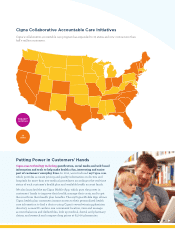

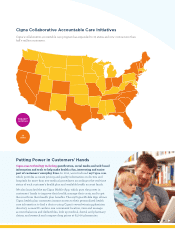

... sake of technology, these programs are at the forefront of the support we bring, and are serious investments to keep our customers healthy, which ultimately saves on medical costs. For example, in 2012, we enhanced myCigna.com to provide pricing and quality information on doctors and hospitals for...

-

Page 7

...the hospital to home - encouraging better quality of care and a more affordable outcome.

low-income seniors live in unsafe housing, we worked with a Habitat for Humanity program to renovate homes. Similarly, in Taiwan, Cigna helped to provide health and social services to disabled seniors living in...

-

Page 8

...growing seniors market while leveraging the successful HealthSpring model built on deep understanding of customers and working with physicians to deliver the care their patients need. Additionally, Cigna acquired Great American Supplemental Benefits, expanding the company's portfolio of products for...

-

Page 9

... allows Cigna health plan customers instant access to their personalized health care information to find a doctor using Cigna's award-winning physician directory, access ID cards in one convenient location, view and manage account balances and deductibles, look up medical, dental and pharmacy claims...

-

Page 10

... Startup companies often go without health care coverage, making it difficult for them to attract top talent and to keep their workforce healthy. The Partnership is a national movement of founders, experts and resources providing startups with access to the corporations, investors, and services they...

-

Page 11

... 2011. Hospital executives also rated Cigna as "the best payer to deal with" for the second year in a row. The survey asked hospital executives to rate health insurers on more than a dozen factors, from image and reputation to contract negotiation tactics and claims processing.

The Cigna Foundation...

-

Page 12

... return to health and productivity. Cigna and Achilles joined forces in 2012 to give Cigna's long-term disability customers access to Achilles programs, including coaching, training, and an opportunity to participate in races with other Achilles athletes. Two of the first Cigna customers to benefit...

-

Page 13

... to Corporate Responsibility

In 2012, Cigna launched Cigna Connects, a comprehensive corporate responsibility program tied to Cigna's mission to improve the health, well-being and sense of security for those we serve. Cigna Connects' vision is to gather, engage and activate key groups to achieve...

-

Page 14

.... Commercial offers a broad line of insured and self-insured medical, dental, behavioral health, vision, and prescription drug benefit plans, health advocacy programs and other products and services that may be integrated to provide comprehensive global health care benefit programs to employers and...

-

Page 15

... Group Disability and Life programs are designed to help improve employee productivity and lower employers' overall absence costs. All products are coupled with comprehensive tools and services for easy benefit management.

GLOBAL HEALTH CARE

By product: Medical 64% Dental 5% Government 31% Premiums...

-

Page 16

...ARAMARK Corporation, a provider of food services, facilities management and uniform and career apparel

JOSEPH P. SULLOVAN

Private Investor

EROC C. WOSEMAN

Chairman, President and Chief Executive Officer VF Corporation, an apparel company

JANE E. HENNEY, MD

Retired Professor of Medicine University...

-

Page 17

... and Global Chief Information Officer Cigna Corporation HERBERT A. FROTCH President Cigna HealthSpring DAVOD D. GUOLMETTE President, Global Employer Segment NOCOLE S. JONES Executive Vice President and General Counsel Cigna Corporation MATTHEW G. MANDERS President, Regional and Operations JOHN...

-

Page 18

... authorization form, contact Computershare Shareowner Services at 800.760.8864 or outside the United States and Canada at 201.680.6535. You can access your account online through the Computershare Shareowner Services website: www.computershare.com.

Stock Listing Cigna's common shares are listed...

-

Page 19

... the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

â...ª

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 29, 2012 was approximately $12.7 billion. As of January 31, 2013, 285,954,499 shares of the registrant's Common...

-

Page 20

...

PART I

ITEM 1

A. B. C. D. E. F. G. H. I.

1

Business ...1 Description of Business ...1

Global Health Care ...2 Group Disability and Life ...9 Global Supplemental Benefits ...11 Run-off Reinsurance ...12 Other Operations ...13 Investments and Investment Income ...13 Regulation ...14 Miscellaneous...

-

Page 21

...Other Corporate Governance Disclosures ...130 Executive Compensation ...130 Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...131 Certain Relationships, Related Transactions and Director Independence ...131 Principal Accountant Fees and Services ...131...

-

Page 22

(This page has been left blank intentionally.)

-

Page 23

..., mail order pharmacy, and investment income.

Strategy and Key Developments

Cigna is a global health services organization with a mission to help its customers improve their health, well-being and sense of security. Its insurance subsidiaries are major providers of medical, dental, disability, life...

-

Page 24

... operating segments: • Commercial (including the international health care business) • Government • Group Disability and Life • Global Supplemental Benefits • Run-off Reinsurance and • Other Operations, including Corporate-owned Life Insurance. Financial data for each of Cigna's business...

-

Page 25

...insured and self-insured medical, dental, behavioral health, vision, and prescription drug benefit plans, health advocacy programs and other products and services that may be integrated to provide comprehensive global health care benefit programs to employers and their employees, including globally...

-

Page 26

...health care case management services, employee assistance programs (EAP), and work/life programs to employers, government entities and other groups sponsoring health benefit plans. Cigna Behavioral Health focuses on integrating its programs and services with medical, pharmacy and disability programs...

-

Page 27

... self-insured plans with access to Global Health Care's applicable participating provider network and for providing other services and programs including: claim administration; quality management; utilization management; cost containment; health advocacy; 24-hour help line; 24/7 call center; case...

-

Page 28

... Cigna's commercial customers are enrolled in insured plans subject to the MLR requirements. For additional information related to the effects of Health Care Reform on these businesses, see the Regulation section of this Form 10-K. Medicare Advantage pricing is determined based upon expected medical...

-

Page 29

...health care business continues to be a leader in providing quality customer service. Its globally mobile customers have access to medical professionals, case management experts and claims specialists 24 hours a day, 365 days a year, through service centers dedicated to their unique needs. Cigna uses...

-

Page 30

... sell utilization review services, managed behavioral health care, pharmacy, and employee assistance services directly to insurance companies, HMOs, third party administrators and employer groups. As of December 31, 2012, the field sales force for the products and services of this segment consisted...

-

Page 31

... that provide group health and life insurance products; • Blue Cross and Blue Shield organizations; • stand-alone HMOs and PPOs; • HMOs affiliated with major insurance companies and hospitals; and • national managed pharmacy, behavioral health and utilization review services companies. The...

-

Page 32

..., and hospital indemnity products to professional or trade associations and financial institutions. Voluntary benefits are those paid by the employee and are offered at the employer's worksite. Cigna plans provide employers, among other services, flexible enrollment options, list billing, medical...

-

Page 33

... group insurance market remains highly competitive as the rising cost of providing medical coverage to employees has forced companies to re-evaluate their overall employee benefit spending. Demographic shifts have further driven demand for products and services that are sufficiently flexible to meet...

-

Page 34

...quality of claims and customer service. The primary competitors of the Medicare supplement business include U.S.-based health insurance companies. Cigna expects that the competitive environment will intensify as U.S. and Europe-based insurance and financial services providers pursue global expansion...

-

Page 35

..., external managers with whom Cigna's subsidiaries contract. Net investment income and realized investment gains (losses) are included as a component of earnings for each of Cigna's operating segments (Global Health Care, Group Disability and Life, Global Supplemental Benefits, Run-off Reinsurance...

-

Page 36

... of the information received from customers; • risk sharing arrangements with providers; • reimbursement or payment levels for Medicare services; • advertising; and • the operation of consumer-directed plans (including health savings accounts, health reimbursement accounts, flexible spending...

-

Page 37

...employers and customers covered under the Company's comprehensive medical insurance if certain annual minimum medical loss ratios (''MLR'') are not met. HHS regulations permit adjustments to be made to the claims used in the calculation for Cigna's international health care and limited benefit plans...

-

Page 38

... sale of such products. State and/or federal regulatory scrutiny of life and health insurance company and HMO marketing and advertising practices, including the adequacy of disclosure regarding products and their administration, may result in increased regulation. Products offering limited coverage...

-

Page 39

...and group Medicare Advantage (HMO) coverage; • contractual arrangements with the federal government for the processing of certain Medicare claims and other administrative services; and • those offering Medicare Pharmacy (Part D) products that are subject to federal Medicare regulations. In Cigna...

-

Page 40

... plans, health care providers and clearinghouses. Health insurers and HMOs are further subject to regulations related to guaranteed issuance (for groups with 50 or fewer lives), guaranteed renewal, and portability of health insurance. HIPAA also imposes minimum standards for the privacy and security...

-

Page 41

...'s Global Health Care segment; • causing employers to drop health care coverage for their employees; • driving potential cost shifting in the health care delivery system to health insurance companies and HMOs; • regulating business practices; • imposing new or increasing taxes and financial...

-

Page 42

... growth, increase health care, technology and administrative costs, including pension costs and capital requirements, require enhancements to the Company's compliance infrastructure and internal controls environment. Existing or future laws and rules could also require Cigna to take other actions...

-

Page 43

... in countries where our foreign businesses voluntarily operate or are required to operate with local business partners; • challenges associated with managing more geographically diverse operations and projects; • the need to provide sufficient levels of technical support in different locations...

-

Page 44

... achieve these anticipated benefits could result in increased costs, decreases in expected revenues, goodwill impairment charges, and diversion of management's time and energy. In January 2012, Cigna acquired HealthSpring, an operator of Medicare Advantage coordinated care plans in 13 states and the...

-

Page 45

... customers and health care professionals with Internet-enabled products and information to meet their needs. Cigna's ability to adequately price its products and services, establish reserves, provide effective and efficient service to its customers, and to timely and accurately report its financial...

-

Page 46

... provider or customer fraud that is not prevented or detected could impact Cigna's medical costs or those of its self-insured customers. Further, during an economic downturn, Cigna's segments, including Global Health Care, Group Disability and Life and Global Supplemental Benefits, may see increased...

-

Page 47

... Financial Statements for more information on the Company's obligations under the pension plan.

Significant changes in market interest rates affect the value of Cigna's financial instruments that promise a fixed return or benefit and the value of particular assets and liabilities.

As an insurer...

-

Page 48

...in the Company's employer group plans, lower enrollment in our non-employer individual plans and a higher number of employees opting out of Cigna's employer group plans. The adverse economic conditions could also cause employers to stop offering certain health care coverage as an employee benefit or...

-

Page 49

... payments in federal and state government coverage programs, such as Medicare and social security. In addition, the state and federal budgetary pressures could cause the government to impose new or a higher level of taxes or assessments on us, such as premium taxes on insurance companies and health...

-

Page 50

... United Arab Emirates, and the United Kingdom. Our principal, domestic office locations, including various support operations, along with Group Disability and Life Insurance, Health Services, Core Medical and Service Operations and the domestic office of Cigna's Global Supplemental Benefits business...

-

Page 51

... Officer, Xerox Corporation; Group President, Government Health Care, for Xerox Corporation/Affiliated Computer Services from March 2009 until April 2011; Executive Vice President and President of Wellpoint's Operations, Technology and Government Services unit, as well as other senior management...

-

Page 52

...Cigna's common stock is listed with, and trades on, the New York Stock Exchange under the symbol ''CI''.

Issuer Purchases of Equity Securities

The following table provides information about Cigna's share repurchase activity for the quarter ended December 31, 2012:

Approximate dollar value of shares...

-

Page 53

...Revenues Premiums and fees and other revenues Net investment income Mail order pharmacy revenues Realized investment gains (losses) TOTAL REVENUES Results of Operations: Global Health Care Group Disability and Life Global Supplemental Benefits Run-off Reinsurance Other Operations Corporate Realized...

-

Page 54

... Critical Accounting Estimates ...38 Segment Reporting ...40 Global Health Care ...41 Group Disability and Life ...44 Global Supplemental Benefits ...46 Run-off Reinsurance ...47 Other Operations ...50 Corporate ...50 Liquidity and Capital Resources ...51 Investment Assets ...56 Cautionary Statement...

-

Page 55

... international health care business) • Government • Group Disability and Life • Global Supplemental Benefits • Run-off Reinsurance and • Other Operations, including Corporate-owned Life Insurance. Prior year segment information has been conformed to the new segment structure.

• Medicare...

-

Page 56

... finalized. Health Care Reform also impacts Cigna's Medicare Advantage and Medicare Part D prescription drug plan businesses acquired with HealthSpring in a variety of additional ways, including reduced Medicare premium rates (that began with the 2011 contract year), mandated minimum reductions to...

-

Page 57

... investment gains, net of taxes SEGMENT EARNINGS Less: adjustments to reconcile to adjusted income from operations: Results of GMIB business (after-tax) Special items (after-tax): Charge for realignment and efficiency plan (See Note 6 to the Consolidated Financial Statements) Costs associated...

-

Page 58

...international customer segments of its ongoing global health care, global supplemental benefits, and group disability and life businesses. In addition, the increase in revenue reflects the effect of the programs to hedge equity and growth interest rate exposures in the run-off reinsurance operations...

-

Page 59

... 38% in 2012, compared with 2011, including contributions from the HealthSpring acquisition, customer growth in the other targeted market segments of the Global Health Care business and continued business growth in the Global Supplemental Benefits and Group Disability and Life segments. Premiums and...

-

Page 60

... analyses use assumptions and estimates including discount rates and projections of future earnings considering operating plans, revenues, claims, operating expenses, taxes, capital levels and long-term growth rates. Goodwill as of December 31 was as follows (in millions): • 2012 - $6,001 • 2011...

-

Page 61

...' equity of approximately $180 million as of December 31, 2012. If the expected long-term return on domestic qualified pension plan assets decreased by 50 basis points, annual pension costs for 2013 would increase by approximately $11 million after-tax. If the Company used the market value of...

-

Page 62

...Accounting Estimate

Effect if Different Assumptions Used

Valuation of fixed maturity investments Most fixed maturities are classified as available for sale and are carried at fair value with changes in fair value recorded in accumulated other comprehensive income (loss) within shareholders' equity...

-

Page 63

... segments: • The Commercial operating segment includes both the U.S. commercial and international health care businesses that offer insured and self-insured medical, dental, behavioral health, vision, and prescription drug benefit plans, health advocacy programs and other products and services...

-

Page 64

...-rated medical premium whereas the self funding portion of minimum premium revenue is reported in fees. Also, includes certain non-participating cases for which special customer level reporting of experience is required. (3) Includes fees related to the U.S. and international health care businesses...

-

Page 65

... claims expense increased 56% in 2012 compared with 2011, primarily reflecting growth in the government segment due to the acquisition of HealthSpring, growth in the international health care business driven by the conversion of Vanbreda business from service to insurance contracts, and medical cost...

-

Page 66

...certain disability and life insurance business previously reported in the former Health Care segment. Prior year information has been conformed to the new segment structure. Key factors for this segment are: • premium growth, including new business and customer retention; • net investment income...

-

Page 67

... by higher resolution rates reflecting the sustained strong performance of the Company's disability claims management process.

CIGNA CORPORATION - 2012 Form 10-K 45

Revenues

Premiums and fees increased 9% in 2012 compared with 2011 reflecting strong disability and life new sales, in-force growth...

-

Page 68

... the Consolidated Financial Statements, effective December 31, 2012, the Company changed its external reporting segments. Prior year information has been conformed to the new segment structure. The Global Supplemental segment includes supplemental health, life and accident insurance products offered...

-

Page 69

.... Loss ratios were flat in 2011 compared with 2010. Policy acquisition expenses increased in 2012 compared with 2011 reflecting the acquisitions and business growth, partially offset by lower acquisition costs in Europe reflecting a decision to cease selling

CIGNA CORPORATION - 2012 Form 10-K 47

-

Page 70

... and losses from futures and swap contracts used in the GMDB and GMIB equity and interest rate hedge programs. See Note 13 to the Consolidated Financial Statements for additional information. The components were as follows:

(In millions)

2012 $ (110) 5 (16) 2 (119) $

2011 (45) 31 4 6 (4) $

2010...

-

Page 71

... rates, partially offset by increases in underlying account values resulting from favorable equity and bond fund returns. The GMIB liabilities and related assets are calculated using an internal model and assumptions from the viewpoint of a hypothetical market participant. Payments for GMIB claims...

-

Page 72

... a tax sharing agreement. For more information regarding the sale of these businesses see Note 8 to the Consolidated Financial Statements.

Revenues

Premiums and fees reflect fees charged primarily on universal life insurance policies in the COLI business. Premiums and fees decreased 12% in 2012...

-

Page 73

... tax payments to the parent company. The Company's subsidiaries normally meet their operating requirements by: • maintaining appropriate levels of cash, cash equivalents and short-term investments; • using cash flows from operating activities; • selling investments;

CIGNA CORPORATION - 2012...

-

Page 74

... cash receipts and disbursements for premiums and fees, mail order pharmacy and other revenues, gains (losses) recognized in connection with the Company's GMDB and GMIB equity hedge programs, investment income, taxes, and benefits and expenses. Because certain income and expense transactions do not...

-

Page 75

..., the parent company will be required to fund a portion of the $2.2 billion reinsurance premium due to Berkshire. The premium will ultimately be paid to Berkshire in cash, that will be funded by the sale or internal transfer of investment assets supporting this business, tax benefits related to the...

-

Page 76

... for health, life and disability insurance policies and annuity contracts. Recorded contractholder deposit funds reflect current fund balances primarily from universal life customers. Contractual cash obligations for these universal life contracts are estimated by projecting future payments using...

-

Page 77

...swap contracts, and certain tax and reinsurance liabilities. Estimated payments of $75 million for deferred compensation, non-qualified and international pension plans and other postretirement and postemployment benefit plans are expected to be paid in less than one year. The Company's best estimate...

-

Page 78

...

Investments in fixed maturities include publicly traded and privately placed debt securities, mortgage and other asset-backed securities, preferred stocks redeemable by the investor and hybrid and trading securities. The Company estimates fair values using prices from third parties or internal...

-

Page 79

... 31, 2012 Indirect Exposure $ 1,240 583 185 38 2,046

National Public Finance Guarantee Assured Guaranty Municipal Corp AMBAC Financial Guaranty Insurance Co. TOTAL

$

Commercial Mortgage Loans

The Company's commercial mortgage loans are fixed rate loans, diversified by property type, location and...

-

Page 80

..., particularly in the commercial real estate market. The Company expects to recover its carrying value over the average remaining life of these investments of approximately 5 years. Given the current economic environment, future impairments are possible; however, management does not expect those...

-

Page 81

... effect on the Company's financial condition or liquidity. While management believes the commercial mortgage loan portfolio is positioned to perform well due to its solid aggregate loan-to-value ratio, strong debt service coverage and minimal underwater positions, broad commercial real estate market...

-

Page 82

... reinsurance agreement was effective as of December 31, 2012):

Loss in fair value Market scenario for certain non-insurance financial instruments (in millions) 100 basis point increase in interest rates 10% strengthening in U.S. dollar to foreign currencies 10% decrease in market prices for equity...

-

Page 83

...increase costs, limit the ability to effectively estimate, price for and manage medical costs, and affect the Company's products, services, market segments, technology and processes; adverse changes in state, federal and international laws and regulations, including increased medical, administrative...

-

Page 84

... amount and type of health care services provided to their workforce, loss in workforce and ability to pay their obligations), the businesses of hospitals and other providers (including increased medical costs) or state and federal budgets for programs, such as Medicare or social security, resulting...

-

Page 85

... revenues for the year ended December 31, 2012.

The Company's independent registered public accounting firm, PricewaterhouseCoopers, has audited the effectiveness of the Company's internal control over financial reporting, as stated in their report located on page 126 in this Form 10-K.

ITEM 7A...

-

Page 86

... realized investment gains TOTAL REVENUES Benefits and Expenses Global Health Care medical claims expense Other benefit expenses Mail order pharmacy cost of goods sold GMIB fair value (gain) loss Other operating expenses TOTAL BENEFITS AND EXPENSES Income before Income Taxes Income taxes: Current...

-

Page 87

...Consolidated Statements of Comprehensive Income

For the year ended December 31,

(In millions, except per share amounts)

2012 $ 1,623 $

2011 1,260 $

2010 1,279

Shareholders' net income Shareholders' other comprehensive income (loss): Net unrealized appreciation (depreciation) on securities: Fixed...

-

Page 88

...,257) Equity securities, at fair value (cost, $121; $124) Commercial mortgage loans Policy loans Real estate Other long-term investments Short-term investments Total investments Cash and cash equivalents Accrued investment income Premiums, accounts and notes receivable, net Reinsurance recoverables...

-

Page 89

... reported $ Cumulative effect of amended accounting guidance for deferred policy acquisition costs BALANCE AT JANUARY 1, 2010, as retrospectively adjusted 2010 Activity: Effect of issuing stock for employee benefit plans Other comprehensive income Net income Common dividends declared (per share...

-

Page 90

... investment gains Deferred income taxes Gains on sales of businesses (excluding discontinued operations) Net changes in assets and liabilities, net of non-operating effects: Premiums, accounts and notes receivable Reinsurance recoverables Deferred policy acquisition costs Other assets Insurance...

-

Page 91

.... The Company is a global health services organization with a mission to help its customers improve their health, well-being and sense of security. Its insurance subsidiaries are major providers of medical, dental, disability, life and accident insurance and related products and services, the...

-

Page 92

... 1, 2011. The amendment also required new disclosures to be provided beginning in the third quarter of 2011 addressing certain troubled debt restructurings. Adoption of the new guidance did not have a material effect to the Company's results of operations or

70 CIGNA CORPORATION - 2012 Form 10...

-

Page 93

.... See Note 13 for information on the Company's accounting policies for these derivative financial instruments. Short-term investments. Investments with maturities of greater than 90 days but less than one year from time of purchase are classified as short-term, available for sale and carried at fair...

-

Page 94

... universal life and other individual products, management estimates the present value of future revenues less expected payments. For group health and accident insurance products, management estimates the sum of unearned premiums and anticipated net investment income less future expected claims and...

-

Page 95

... value of estimated future obligations under long-term life and supplemental health insurance policies and annuity products currently in force. These obligations are estimated using actuarial methods and primarily consist of reserves for annuity contracts, life insurance benefits, guaranteed minimum...

-

Page 96

... businesses were $3.2 billion at December 31, 2012 and 2011.

N.

Global Health Care Medical Claims Payable

M.

Unpaid Claims and Claims Expenses

Liabilities for unpaid claims and claim expenses are estimates of payments to be made under insurance coverages (primarily long-term disability...

-

Page 97

... to reflect the estimated effect of rebates due to customers under the minimum medical loss ratio provisions of Health Care Reform. Premiums for individual life, accident and supplemental health insurance and annuity products, excluding universal life and investment-related products, are recognized...

-

Page 98

... the year ended December 31, 2012 were at risk, with reimbursements estimated to be approximately 1%. Mail order pharmacy revenues and cost of goods sold are recognized as each prescription is shipped.

adjusted regardless of the final outcome. For strategic performance shares with payment dependent...

-

Page 99

...of this business are reported in the Global Supplemental Benefits segment.

In accordance with GAAP, the total purchase price has been allocated to the tangible and intangible net assets acquired based on management's preliminary estimates of their fair value and may change as additional information...

-

Page 100

...Inc. (''HealthSpring'') for $55 per share in cash and Cigna stock awards, representing a cost of approximately $3.8 billion. HealthSpring provides Medicare Advantage coverage in 13 states and

the District of Columbia, as well as a large, national stand-alone Medicare prescription drug business. The...

-

Page 101

... Statements from the date of the acquisition. Revenues of HealthSpring included in the Company's results for the year ended December 31, 2012 were approximately $5.4 billion. During 2012, the Company recorded $53 million pre-tax ($40 million after-tax) of acquisition-related costs in other operating...

-

Page 102

...

In November 2011, the Company acquired FirstAssist Group Holdings Limited (''FirstAssist'') for approximately $115 million in cash. FirstAssist is based in the United Kingdom and provides travel and protection insurance services that the Company expects will enhance its individual business in the...

-

Page 103

...'s common stock for the period.

(In millions)

2012 2.5

2011 3.7

2010 6.3

Antidilutive options

NOTE 5 Global Health Care Medical Claims Payable

Medical claims payable for the Global Health Care segment reflects estimates of the ultimate cost of claims that have been incurred but not yet reported...

-

Page 104

... but not reported and pending claims for minimum premium products and certain administrative services only business where the right of offset does not exist. See Note 8 for additional information on reinsurance. For the year ended December 31, 2012, actual experience differed from the Company's key...

-

Page 105

... equity hedge program using futures contracts, and is based on the Company's view that short-term interest rates will average 4% over future periods, but considers that current short-term rates are less than 4%. The mean investment performance assumption for the underlying fixed income mutual funds...

-

Page 106

... of continued low short-term interest rates. This evaluation also led management to lower the mean investment performance for equity funds from 4.75% to 4.00% for those funds not subject to the growth interest rate hedge program. 2011: Reserve strengthening of $70 million ($45 million after-tax) was...

-

Page 107

...its Global Health Care, Group Disability and Life, and Global Supplemental Benefits segments as well as the corporate-owned life insurance business. Reinsurance recoverables are $345 million as of December 31, 2012, with 16% of the recoverable balance protected by collateral. The Company reviews its...

-

Page 108

...'s exit from a large, low-margin assumed government life insurance program. The effects of reinsurance on written premiums and fees for short-duration contracts were not materially different from the recognized premium and fee amounts shown in the table above.

86 CIGNA CORPORATION - 2012 Form 10-K

-

Page 109

... reporting segments. See Note 23 for further information. Goodwill primarily relates to the Global Health Care segment ($5.7 billion) and, to a lesser extent, the Global Supplemental Benefits segment ($350 million) and increased during 2012 primarily as a result of the acquisitions of HealthSpring...

-

Page 110

... benefit plans is immaterial to the Company's results of operations, liquidity and financial position. Effective July 1, 2009, the Company froze its primary domestic defined benefit pension plans.

The Company and certain of its subsidiaries provide pension, health care and life insurance...

-

Page 111

... return on pension plan investments over the long-term payout period of the pension benefit obligations. As funding levels improve, the Company

would expect to gradually reduce the allocation to equity securities and move into fixed income to mitigate the volatility in returns, while also providing...

-

Page 112

... account has several participating benefit plans and each owns a share of the total pool of investments.

Plan assets in Level 1 include exchange-listed equity securities. Level 2 assets primarily include: • fixed income and international equity funds priced using their daily net asset value...

-

Page 113

...of Level 3 Balance at December 31, 2011

The assets related to other postretirement benefit plans are invested in deposit funds with interest credited based on fixed income investments in the general account of CGLIC. As there are significant unobservable inputs used in determining the fair value of...

-

Page 114

... pricing services are based on reported trade activity and quoted market prices when available, and other market information that a market participant may use to estimate fair value. The internal pricing methods are performed by the Company's investment professionals, and generally involve using...

-

Page 115

... the Company's pension plan assets.

Quoted Prices in Active Markets for Identical Assets (Level 1) Significant Other Observable Inputs (Level 2) Significant Unobservable Inputs (Level 3)

December 31, 2012

(In millions)

Total

Financial assets at fair value: Fixed maturities: Federal government and...

-

Page 116

... and private corporate debt and equity securities, federal agency and municipal bonds, non-government mortgage-backed securities and preferred stocks.

94 CIGNA CORPORATION - 2012 Form 10-K

Because many fixed maturities do not trade daily, third-party pricing services and internal methods often use...

-

Page 117

... fair value and significant unobservable inputs used in pricing Level 3 securities that were

developed directly by the Company as of December 31, 2012. The range and weighted average basis point amounts reflect the Company's best estimates of the unobservable adjustments a market participant would...

-

Page 118

... the Company's valuation processes and controls. Guaranteed minimum income benefit contracts. The Company reports liabilities and assets as derivatives at fair value because the cash flows of these contracts are affected by equity markets and interest rates but are without significant life insurance...

-

Page 119

...

Changes in Level 3 Financial Assets and Financial Liabilities Carried at Fair Value

The following tables summarize the changes in financial assets and financial liabilities classified in Level 3 for the years ended December 31, 2012 and 2011. These tables exclude separate account assets as changes...

-

Page 120

... as the Company's best estimate of what a market participant would use to determine a current transaction price, become more or less significant to the fair value measurement. For the years ended December 31, 2012 and 2011, transfer activity between Level 3 and Level 2 primarily reflects changes in...

-

Page 121

...supporting the Company's pension plans, including $702 million classified in Level 3.

Separate account assets in Level 1 include exchange-listed equity securities. Level 2 assets primarily include: • corporate and structured bonds valued using recent trades of similar securities or pricing models...

-

Page 122

... 3 Level 2

December 31, 2012 Fair Value $ 2,999 $ 1,082 $ 5,821 Carrying Value $ 2,851 $ 1,056 $ 4,986

December 31, 2011 Fair Value $ 3,380 $ 1,056 $ 5,319 Carrying Value $ 3,301 $ 1,035 $ 4,984

Commercial mortgage loans Contractholder deposit funds, excluding universal life products Long-term...

-

Page 123

...cost: $84; $90)

Fixed maturities included federal government securities of $54 million at December 31, 2012 and $79 million at December 31, 2011, that were pledged as collateral to brokers as required under certain futures contracts. The following information about fixed maturities excludes trading...

-

Page 124

...fixed market rate.

Review of declines in fair value. Management reviews fixed maturities with a decline in fair value from cost for impairment based on criteria that include: • length of time and severity of decline; • financial health and specific near term prospects of the issuer; • changes...

-

Page 125

... origination professionals employ an internal rating system developed from the Company's experience in real estate investing and mortgage lending. A quality rating, designed to evaluate the relative risk of the transaction, is assigned at each loan's origination and is updated each year as part...

-

Page 126

... (no payment more than 59 days past due), but exhibit certain characteristics that increase the likelihood of future default. The characteristics management considers include, but are not limited to, the deterioration of debt service coverage below 1.0, estimated loan-to-value ratios increasing to...

-

Page 127

... value of $49 million as of December 31, 2012 and 2011 were non-income producing during the preceding twelve months. As of December 31, 2012, the Company had commitments to contribute additional equity of $7 million to real estate investments.

D.

(In millions)

Other Long-Term Investments

2012...

-

Page 128

... funds used to acquire HealthSpring. See Note 3 for further information.

Short-term investments and cash equivalents included corporate securities of $1.1 billion, federal government securities of $167 million and money market funds of $217 million as of December 31, 2012. The Company's short-term...

-

Page 129

...and international equity market exposures resulting from changes in variable annuity account values based on underlying mutual funds for certain reinsurance contracts that guarantee minimum death benefits (''GMDB''). During the second quarter of 2012, the Company expanded this hedge program to cover...

-

Page 130

... (such as paying claims, investment returns and withdrawals). Derivatives are typically used in this strategy to reduce interest rate and foreign currency risks.

Accounting policy. Using cash flow hedge accounting, fair values are reported in other long-term investments or other liabilities...

-

Page 131

... income for the years ended December 31 were as follows:

(In millions)

Fixed maturities Equity securities Commercial mortgage loans Policy loans Real estate Other long-term investments Short-term investments and cash Less investment expenses NET INVESTMENT INCOME

CIGNA CORPORATION - 2012 Form...

-

Page 132

...:

(In millions)

Separate accounts Investment gains required to adjust future policy benefits for the run-off settlement annuity business

$ $

2012 2011 2010 206 $ 210 $ 191 21 $ 8 $ 18

Sales information for available-for-sale fixed maturities and equity securities, for the years ended December 31...

-

Page 133

... as of December 31, 2012. On November 10, 2011, the Company issued $2.1 billion of long-term debt as follows: $600 million of 5-Year Notes due November 15, 2016 at a stated interest rate of 2.75% ($600 million, net of discount, with an effective interest rate of 2.936% per year), $750 million of 10...

-

Page 134

...to time, to repurchase shares on the open market through a Rule 10b5-1 plan that permits a company to repurchase its shares at times when it otherwise might be precluded from doing so under insider trading laws or because of self-imposed trading blackout periods.

112 CIGNA CORPORATION - 2012 Form 10...

-

Page 135

...

State insurance departments and foreign jurisdictions that regulate certain of the Company's subsidiaries prescribe accounting practices (which differ in some respects from GAAP) to determine statutory net income and surplus. The Company's life insurance and HMO company

CIGNA CORPORATION - 2012...

-

Page 136

...each of the Company's life insurance and HMO subsidiaries is sufficient to meet the minimum required by regulators. As of December 31, 2012, the Company's life insurance and HMO subsidiaries had investments on deposit with state departments of insurance with statutory carrying values of $337 million...

-

Page 137

...377 128 395 900 803

Deferred income tax assets and liabilities as of December 31 are shown below.

(In millions) Deferred tax assets Employee and retiree benefit plans Investments, net Other insurance and contractholder liabilities Deferred gain on sale of businesses Policy acquisition expenses Loss...

-

Page 138

... million in 2010. Stock options. The Company awards options to purchase the Company's common stock at the market price of the stock on the

grant date. Options vest over periods ranging from one to five years and expire no later than 10 years from grant date.

116 CIGNA CORPORATION - 2012 Form 10-K

-

Page 139

...share amounts)

Number (in thousands) Total intrinsic value Weighted average exercise price Weighted average remaining contractual life

Excluding the HealthSpring rollover options, the weighted average fair value of options granted under employee incentive plans was $14.99 for 2012, $13.96 for 2011...

-

Page 140

... years and their related costs are reported consistent with operating leases over the service period based on the pattern of use. The Company recorded in other operating expenses $86 million in 2012, $116 million in 2011 and $114 million in 2010 for these arrangements.

118 CIGNA CORPORATION - 2012...

-

Page 141

... segments: • The Commercial operating segment includes both the U.S. commercial and international health care businesses that offer insured and self-insured medical, dental, behavioral health, vision, and prescription drug benefit plans, health advocacy programs and other products and services...

-

Page 142

...

2011

2010

Global Health Care Premiums and fees: Medical: Guaranteed cost (1) Experience-rated (2) Stop loss International health care Dental Medicare Medicaid Medicare Part D Other Total medical Fees (3) Total premiums and fees Mail order pharmacy revenues Other revenues Net investment income...

-

Page 143

... Financial Statements and Supplementary Data

2012 2011 2010

(In millions)

Group Disability and Life Premiums and fees: Life Disability Other Total Other revenues Net investment income Segment revenues Depreciation and amortization Income taxes Segment earnings Global Supplemental Benefits Premiums...

-

Page 144

...by product type were as follows for the years ended December 31:

(In millions)

2012 $ 20,973 $ 1,413 3,680 1,623 242 27,931 $

2011 14,443 $ 1,268 3,117 1,447 382 20,657 $

2010 14,134 1,167 2,834 1,420 393 19,948

Medical Disability Supplemental Health, Life, and Accident Mail order pharmacy Other...

-

Page 145

...to health care issues, that could increase cost and affect the market for the Company's health care products and services; • changes in Employee Retirement Income Security Act of 1974 (''ERISA'') regulations resulting in increased administrative burdens and costs;

CIGNA CORPORATION - 2012 Form 10...

-

Page 146

... and regulations that interfere with the proper use of medical information for research, coordination of medical care and disease and disability management; • additional variations among state laws mandating the time periods and administrative processes for payment of health care provider claims...

-

Page 147

... 4, 2013 with the remainder to be paid by April 30, 2013. This premium will ultimately be funded from the sale or internal transfer of investment assets that were supporting this book of business, as well as tax benefits related to the transaction, and cash.

CIGNA CORPORATION - 2012 Form 10-K 125

-

Page 148

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was...

-

Page 149

...income taxes Shareholders' net income Shareholders' net income per share: Basic Diluted 2011 Total revenues Income from continuing operations before income taxes Shareholders' net income Shareholders' net income per share: Basic Diluted Stock and Dividend Data 2012 Price range of common stock - high...

-

Page 150

... 58

12/31/10

* Assumes that the value of the investment in Cigna common stock and each index was $100 on December 31, 2007 and that all dividends were reinvested. ** Weighted average of S&P Managed Health Care (75%) and Life & Health Insurance (25%) Indexes.

128 CIGNA CORPORATION - 2012 Form 10-K

-

Page 151

... Cigna's internal control over financial reporting. On January 31, 2012, the Company acquired HealthSpring, Inc. The Company is in the process of integrating HealthSpring, Inc. operations, processes and internal controls. See Note 3 to the Consolidated Financial Statements for additional information...

-

Page 152

...of Ethics and Other Corporate Governance Disclosures

Cigna's Code of Ethics is the Company's code of business conduct and ethics, and applies to Cigna's directors, officers (including the chief executive officer, chief financial officer and chief accounting officer) and employees. The Code of Ethics...

-

Page 153

... performance shares, shares in payment of dividend equivalent rights, shares in lieu of cash payable under the Company's other short- and long-term incentive compensation plans and non-tax qualified supplemental retirement benefit plans, or shares in payment of SPSs or SPUs.

The information...

-

Page 154

... the years ended December 31, 2012, 2011 and 2010. Notes to the Consolidated Financial Statements. Report of Independent Registered Public Accounting Firm. (2) The financial statement schedules are listed in the Index to Financial Statement Schedules on page FS-1.

132 CIGNA CORPORATION - 2012 Form...

-

Page 155

... duly authorized.

CIGNA CORPORATION Date: By: February 28, 2013 /s/ Ralph J. Nicoletti Ralph J. Nicoletti Executive Vice President and Chief Financial Officer (Principal Financial Officer)

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below...

-

Page 156

(This page has been left blank intentionally.)

-

Page 157

...INDEX TO FINANCIAL STATEMENT SCHEDULES

PAGE

Report of Independent Registered Public Accounting Firm on Financial Statement Schedules ...FS-2 Schedules I - Summary of Investments - Other Than Investments in Related Parties as of December 31, 2012 ...FS-3 II - Condensed Financial Information of Cigna...

-

Page 158

... Report on Internal Control over Financial Reporting, management has excluded Great American Supplemental Benefits Group from its assessment of internal control over financial reporting as of December 31, 2012 because it was acquired by the Company in a purchase business combination during the year...

-

Page 159

...Sheet

Type of Investment

(In millions)

Cost

Fair Value

Fixed maturities: Bonds: United States government and government agencies and authorities States, municipalities and political subdivisions Foreign governments Public utilities All other corporate bonds Asset backed securities: United States...

-

Page 160

PART IV ITEM 15 Exhibits and Financial Statement Schedules

Cigna Corporation and Subsidiaries Schedule II - Condensed Financial Information of Cigna Corporation - (Registrant)

Statements of Income

(in millions)

For the year ended December 31, 2012 2011 2010 $ 262 190 452 (452) (143) (309) 1,932 1,...

-

Page 161

... Investments in subsidiaries Intercompany Other assets TOTAL ASSETS LIABILITIES: Intercompany Short-term debt Long-term debt Other liabilities TOTAL LIABILITIES SHAREHOLDERS' EQUITY: Common stock (shares issued, 366; authorized, 600) Additional paid-in capital Net unrealized appreciation - fixed...

-

Page 162

... of long-term debt Issuance of common stock Common dividends paid Repurchase of common stock Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents, end of year

See Notes to Financial Statements on the following pages.

FS-6 CIGNA CORPORATION - 2012...

-

Page 163

... condensed financial statements, Cigna Corporation's (the Company) wholly owned and majority owned subsidiaries are recorded using the equity basis of accounting. Certain reclassifications have been made to prior years' amounts to conform to the 2012 presentation.

Note 2 - Short-term and long-term...

-

Page 164

... of its high-deductible self-insurance programs to indemnify the insurer for claim liabilities that fall within deductible amounts for policy years dating back to 1994. • The Company also provides solvency guarantees aggregating $34 million under state and federal regulations in support of its...

-

Page 165

...Segment

(In millions)

Unearned premiums and fees $ 111 26 388 24 549 103 26 346 27 502 87 27 271 31 416

Year Ended December 31, 2012: Global Health Care Group Disability and Life Global Supplemental Benefits Run-off Reinsurance Other Operations Corporate TOTAL Year Ended December 31, 2011: Global...

-

Page 166

... Global Health Care medical claims expense and other benefit expenses. Other operating expenses include mail order pharmacy cost of goods sold, GMIB fair value (gain) loss and other operating expenses, and excludes amortization of deferred policy acquisition expenses.

CIGNA CORPORATION - 2012 Form...

-

Page 167

... 31, 2011: Life insurance in force Premiums and fees: Life insurance and annuities Accident and health insurance TOTAL Year Ended December 31, 2010: Life insurance in force Premiums and fees: Life insurance and annuities Accident and health insurance TOTAL

FS-11 CIGNA CORPORATION - 2012 Form 10-K

-

Page 168

... of First Assist in November 2011. (3) Amounts for commercial mortgage loans primarily reflects charge-offs upon sales and repayments, as well as transfers to foreclosed real estate. 2012 amount also includes restructures reclassified to Other Long-term Investments.

CIGNA CORPORATION - 2012 Form 10...

-

Page 169

(This page has been left blank intentionally.)

-

Page 170

...10.3 Cigna Corporation Non-Employee Director Compensation Program Filed as Exhibit 10.3 to the registrant's Form 10-K for the year amended and restated effective January 1, 2012 ended December 31, 2011 and incorporated herein by reference. 10.4 Cigna Restricted Share Equivalent Plan for Non-Employee...

-

Page 171

...Benefits Plan as amended and restated effective April 27, 2010 Description of Severance Benefits for Executives in Non-Change of Control Circumstances Description of Cigna Corporation Strategic Performance Share Program Cigna Executive Incentive Plan amended and restated as of January 12, 2012 Cigna...

-

Page 172

... Certification of Chief Financial Officer of Cigna Corporation pursuant to 18 U.S.C. Section 1350

Method of Filing Furnished herewith. Furnished herewith.

Schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally to the Securities and...

-

Page 173

... to reflect changes resulting from the retrospective adoption of amended accounting guidance for deferred policy acquisition costs, effective January 1, 2012. See Note 2 to the Consolidated Financial Statements within this Form 10-K for additional information.

E-4 CIGNA CORPORATION - 2012 Form 10-K

-

Page 174

... Rule 1-02(w) of Regulation S-X. Cigna Holdings, Inc. (Delaware)

I. Connecticut General Corporation (Connecticut) A. Benefits Management Corp. (Montana) i. Allegiance Life & Health Insurance Company, Inc. (Montana) ii. Allegiance Re, Inc. (Montana) B. Cigna Arbor Life Insurance Company (Connecticut...

-

Page 175

... European Services (UK) Limited (United Kingdom) d. Cigna Global Insurance Company Limited (Guernsey, C.I.) e. Cigna Hayat Sigorta A.S. (Turkey) f. Cigna Health Solutions India Pvt. Ltd. (India) g. Cigna International Services Australia Pty. Ltd. (Australia) h. Cigna Life Insurance Company of Europe...

-

Page 176

...) a. Cigna Insurance Public Company Limited (Thailand) l. Vanbreda International N.V. (Belgium) i. Vanbreda International SDN.BHD (Malaysia) ii. Vanbreda International LLC (Flordia) Cigna Worldwide Insurance Company (Delaware) a. PT. Asuransi Cigna (Indonesia)

a.

CIGNA CORPORATION - 2012 Form 10...

-

Page 177

...033-60053 and No. 033-51791) of Cigna Corporation of our reports dated February 28, 2013 relating to the financial statements, the financial statement schedules and the effectiveness of internal control over financial reporting, which appear in this Form 10-K.

E-8 CIGNA CORPORATION - 2012 Form 10-K

-

Page 178

...'s ability to record, process, summarize and report financial information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting.

b)

b)

CIGNA CORPORATION - 2012 Form 10-K E-9

-

Page 179

...'s ability to record, process, summarize and report financial information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting.

b)

b)

E-10 CIGNA CORPORATION - 2012 Form 10-K

-

Page 180

... 32.1 Certification of Chief Executive Officer of Cigna Corporation pursuant to 18 U.S.C. Section 1350

I certify that, to the best of my knowledge and belief, the Annual Report on Form 10-K of Cigna Corporation for the fiscal period ending December 31, 2012 (the ''Report''): (1) complies with the...

-

Page 181

... 32.2 Certification of Chief Financial Officer of Cigna Corporation pursuant to 18 U.S.C. Section 1350

I certify that, to the best of my knowledge and belief, the Annual Report on Form 10-K of Cigna Corporation for the fiscal period ending December 31, 2012 (the ''Report''): (1) complies with the...

-

Page 182

... in the United States and throughout the world. Its subsidiaries are major providers of employee benefits offered through the workplace, with products and services including health care; group life, accident and disability insurance; dental; vision; behavioral health; and pharmacy. "Cigna" is...