CarMax 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2003 3

completely from Circuit City in a tax-free distribution

of shares. In our first partial year as an independent

company, we’re off to a good start.

Sales.

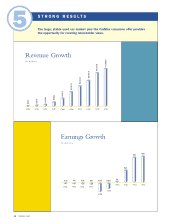

Strong sales and earnings growth characterized

fiscal 2003 through the first nine months of the year.

This was interrupted in the fourth quarter when Mother

Nature delivered a tough winter, particularly in our

mid-Atlantic and Southeastern markets. Nonetheless, we

finished the year having grown comp store used unit sales

8% and total sales 12% to nearly $4 billion.

Earnings.

Fiscal 2003 was a transition year for SG&A

expenses and, therefore, for earnings growth. First, we

experienced the stepped-up expenses related to ramping

up our geographic growth.These expenses include pre-

opening, recruiting, training, relocation and the continued

development of our management bench in anticipation

of the store openings planned for the next three years.

During the latter half of the year, we also began to

experience the incremental costs associated with being

an independent company.These totaled approximately

$9 million for the second half of the year and included

higher costs for health and welfare benefits (more than

half the increase), as well as added expenses for fully

assuming such functions as legal, treasury and media buy-

ing. Consequently, the expense leverage that we would

otherwise have expected from strong comp store used

unit growth was offset.We also had non-tax-deductible,

separation expenses of $7.8 million, or 7 cents per share.

Net earnings for the year were $95 million, or 91 cents

per share. Excluding the separation costs, net earnings

were $103 million or 98 cents per share.

Productivity.

We continued to enhance our opera-

tional capabilities. One major undertaking in fiscal 2003

was the rollout of a new electronic repair order system.This

further automated our reconditioning processes by comput-

erizing the reconditioning flow sequence.We also added

new systems to significantly improve our appraisal process,

new tools to increase the effectiveness of our sales manage-

ment, and continued enhancements to carmax.com. All of

these improvements will further increase our efficiency and

our lead over existing and potential competitors.

WHERE WE’RE GOING

Our original goal was to create value for Circuit City

shareholders in the 21st century.We’ve made a good start

there, as well. As of our separation on October 1, 2002,

we have created more than $1 billion in market value for

our original Circuit City shareholders on no net equity

investment…we repaid the original Circuit City venture

loan in full, with interest, at the time of our tracking stock

IPO in 1997. More importantly, we believe the opportu-

nity before us is now to create one of America’s great

retail success stories on behalf of our CarMax customers,

associates and shareholders.

Growth Plan.

Our plan to grow the CarMax con-

cept nationwide will be key to our value creation.We’ve

gotten off to a strong start by opening eight stores from

February 2002 through March 2003.These new stores

have also significantly exceeded our expectations in both

sales and profitability.We expect to open seven or eight

additional stores during the balance of fiscal 2004. Going

forward, we expect to open used car superstores equal to

15% to 20% of our store base each year.

Of equal importance in creating value will be continu-

ing to grow our used car market share and improve our

operating productivity in all stores.Through a combination

of these efforts, we believe we should be able to generate

comp store used unit sales growth in the 5% to 9% range

for the next several years.

After our separation anniversary in October, we should

also begin realizing significant overhead leverage on our cor-

porate SG&A expenses as we continue our growth.We have

estimated the annual impact of the incremental costs of sepa-

ration to be $20–22 million, approximately $9 million of

which we experienced in fiscal 2003.We expect an additional

$11–13 million in incremental separation costs in fiscal 2004.

We also expect CarMax Auto Finance to continue to be

a contributor to our success. It is important to remember,

however, that its share of total profit contribution is expected

to decline as the unusually high interest rate spreads of the

last several years diminish.While CarMax Auto Finance

provided approximately 15% of pre-SG&A profit margin in

fiscal 2003, we expect that its contribution will return to a

more normal 10-11% over the next two years.

THANKS

We owe a debt of gratitude to many who’ve helped

CarMax get off to a great start over the last decade.

Alan McCollough, Circuit City’s CEO, and the entire

Circuit City team were great parents and advisors.The

many Circuit City board members through the years

also offered consistent support. I especially want to thank

Walter Salmon,Ted Nierenberg and Alan Wurtzel, three

experienced retail leaders who were particularly enthusi-

astic supporters in our early days.

Rick Sharp, our co-founder and now chairman, and

the new CarMax board have worked hard to help us put

in place a world-class corporate governance process.

And most importantly, our 8,000-plus CarMax associates

have stayed focused on doing what really matters: buying,

reconditioning and selling great quality used cars and

providing a superior customer service experience every

day, no matter the challenges. My thanks to all of you.

AUSTIN LIGON

PRESIDENT AND CHIEF EXECUTIVE OFFICER

MARCH 31, 2003