CarMax 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

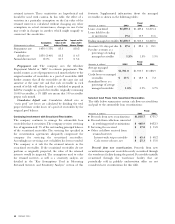

36 CARMAX 2003

In November 1998, CarMax entered into a four-year, $5

million unsecured promissory note.A portion of the principal

amount was due annually with interest payable periodically at

8.25%. The outstanding balance at February 28, 2002, was

$826,000 and was included in current installments of long-

term debt.The note was repaid in January 2003 using existing

working capital.

The weighted average interest rate on the outstanding

short-term debt was 3.2% during fiscal 2003, 4.4% during

fiscal 2002 and 6.8% during fiscal 2001.

The company capitalizes interest in connection with the

construction of certain facilities. Capitalized interest totaled

$956,000 in fiscal 2003 and $530,000 in fiscal 2002. No

interest was capitalized in fiscal 2001.

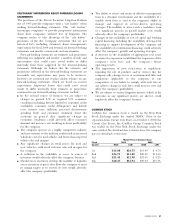

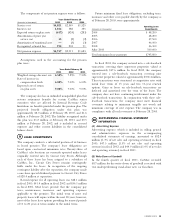

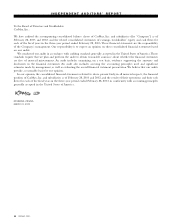

INCOME TAXES

The components of the provision for income taxes on net

earnings are as follows:

Years Ended February 28

(Amounts in thousands) 2003 2002 2001

Current:

Federal $47,600 $47,389 $16,986

State 5,415 5,103 2,174

53,015 52,492 19,160

Deferred:

Federal 8,614 3,067 8,494

State 266 95 264

8,880 3,162 8,758

Provision for income taxes $61,895 $55,654 $27,918

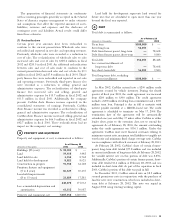

The effective income tax rate differed from the federal

statutory income tax rate as follows:

Years Ended February 28

2003 2002 2001

Federal statutory

income tax rate 35.0% 35.0% 35.0%

State and local income taxes,

net of federal benefit 3.0 3.0 3.0

Non-deductible

separation costs 1.5 ——

Effective income tax rate 39.5% 38.0% 38.0%

The tax effects of temporary differences that give rise to a

significant portion of the deferred tax assets and liabilities are

as follows:

As of February 28

(Amounts in thousands) 2003 2002

Deferred tax assets:

Accrued expenses $ 7,220 $ 6,719

Other 120 187

Total gross deferred tax assets 7,340 6,906

Deferred tax liabilities:

Depreciation and amortization 5,748 3,615

Securitized receivables 29,138 22,593

Inventory 5,447 4,257

Prepaid expenses 831 1,385

Total gross deferred tax liabilities 41,164 31,850

Net deferred tax liability $33,824 $24,944

Based on the company’s historical and current pretax

earnings, management believes the amount of gross deferred

tax assets will more likely than not be realized through future

taxable income; therefore, no valuation allowance is necessary.

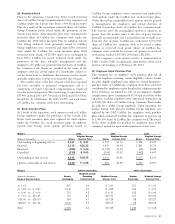

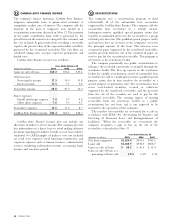

COMMON STOCK AND STOCK-BASED INCENTIVE PLANS

(A) Shareholder Rights Plan

In conjunction with the separation from Circuit City

Stores, a shareholder rights plan was adopted. CarMax, Inc.

shareholders received preferred stock purchase rights as a

dividend at the rate of one right for each share of CarMax,

Inc. common stock owned. The rights are exercisable only

upon the attainment of, or the commencement of a tender

offer to attain, a specified ownership interest in CarMax by

a person or group. When exercisable, each CarMax right

would entitle the holder to buy one one-thousandth of a

share of Cumulative Participating Preferred Stock, Series A,

$20 par value, at an exercise price of $140 per share, subject

to adjustment. A total of 120,000 shares of such preferred

stock, which have preferential dividend and liquidation

rights, have been authorized and designated. No such shares

are outstanding. In the event that an acquiring person or

group acquires the specified ownership percentage of

CarMax, Inc. common stock (except pursuant to a cash

tender offer for all outstanding shares determined to be fair

by the board of directors) or engages in certain transactions

with CarMax after the rights become exercisable, each right

will be converted into a right to purchase, for half the

current market price at that time, shares of the CarMax, Inc.

common stock valued at two times the exercise price. The

company also has an additional 19,880,000 shares of

undesignated preferred stock authorized of which no shares

are outstanding.

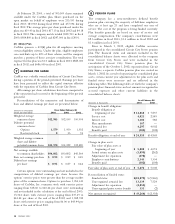

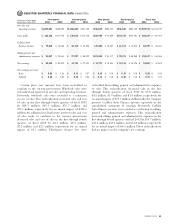

6

5