CarMax 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 CARMAX 2003

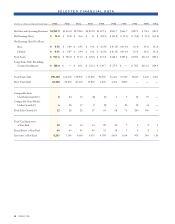

We also anticipate a reduction in yield spreads from CAF

when interest rates rise above the historical lows experienced

over the last two years. In the event that interest rates remain

low, we would anticipate a more moderate reduction in yield

spreads in order to maintain our competitive consumer offer.As

the spread between the cost of funds and the retail interest rate

paid by consumers ultimately returns to more normal levels,

CAF’s contribution as a percent of sales is expected to decrease.

RECENT ACCOUNTING PRONOUNCEMENTS

In August 2001, the Financial Accounting Standards Board

(“FASB”) issued Statement of Financial Accounting Standards

(“SFAS”) No. 143,“Accounting for Asset Retirement Obliga-

tions.” This statement addresses financial accounting and

reporting for obligations associated with the retirement of

tangible long-lived assets and the associated asset retirement

costs. It is effective for fiscal years beginning after June 15,

2002. The company does not expect the application of the

provisions of SFAS No. 143 to have an impact on its financial

position, results of operations or cash flows.

In June 2002, the FASB issued SFAS No. 146,“Accounting

for Costs Associated with Exit or Disposal Activities.” This

statement addresses financial accounting and reporting for

costs associated with exit or disposal activities and nullifies

Emerging Issues Task Force (“EITF”) Issue No. 94-3,

“Liability Recognition for Certain Employee Termination

Benefits and Other Costs to Exit an Activity (including

Certain Costs Incurred in a Restructuring).” SFAS No. 146 is

effective for exit or disposal activities initiated after December

31, 2002.The company does not expect the application of the

provisions of SFAS No. 146 to have an impact on its financial

position, results of operations or cash flows.

In December 2002, the FASB issued SFAS No. 148,

“Accounting for Stock-Based Compensation—Transition and

Disclosure.”This statement amends SFAS No. 123,“Accounting

for Stock-Based Compensation,” to provide alternative

methods of transition for a voluntary change to the fair value

based method of accounting for stock-based employee

compensation. In addition, this statement amends the disclosure

requirements of SFAS No. 123 to require prominent disclosures

in both annual and interim financial statements about the

method of accounting for stock-based employee compensation

and the effect of the method used on reported results. It is

effective for financial statements for fiscal years ending after

December 15, 2002.The company has revised its disclosures to

meet the requirements under this standard.

In November 2002, the FASB issued FASB Interpretation

(“FIN”) No. 45, “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees

of Indebtedness of Others.” FIN No. 45 requires the

recognition of a liability for certain guarantee obligations

issued or modified after December 31, 2002. FIN No. 45

also clarifies disclosure requirements to be made by a

guarantor of certain guarantees. The disclosure provisions of

FIN No. 45 are effective for fiscal years ending after

December 15, 2002. We have adopted the disclosure

provisions of FIN No. 45 as of February 28, 2003. The

company does not expect the adoption of FIN No. 45 to

have a material impact on its financial position, results of

operations or cash flows.

In January 2003, the FASB issued FIN No. 46,

“Consolidation of Variable Interest Entities, an Interpretation

of ARB No. 51.” FIN No. 46 requires certain variable interest

entities to be consolidated by the primary beneficiary of the

entity if the equity investors in the entity do not have the

characteristics of a controlling financial interest or do not

have sufficient equity at risk for the entity to finance its

activities without additional subordinated financial support

from other parties. FIN No. 46 is effective for all new variable

interest entities created or acquired after January 31, 2003.

For variable interest entities created or acquired prior to

February 1, 2003, the provisions of FIN No. 46 must be

applied for the first interim or annual period beginning after

June 15, 2003. The company is currently analyzing the

existing guidance and reviewing any developments with

regard to the proposed FASB Staff Positions issued on the

implementation of FIN No. 46 which are currently subject

to public comment. Therefore, the company cannot

determine whether there will be an impact on its financial

position, results of operations, or cash flows at this time.

In January 2003, the FASB issued EITF Issue No. 02-16,

“Accounting by a Customer (Including a Reseller) for Certain

Consideration Received from a Vendor.” This EITF addresses

the accounting by a vendor for consideration (vendor

allowances) given to a customer, including a reseller of the

vendor’s products, and the accounting by a reseller for cash

consideration received from a vendor. It is effective for certain

arrangements entered into after November 21, 2002, and for all

new arrangements, including modifications to existing

arrangements, entered into after December 31, 2002. The

company adopted the provisions of the EITF in the fourth

quarter of fiscal 2003 and, as the company’s policies were

already consistent with those of EITF 02-16, the adoption of

this standard did not have a material impact on the company’s

financial position, results of operations or cash flows.

FINANCIAL CONDITION

Cash Provided by Operating Activities

The company generated net cash from operating activities

of $72.0 million in fiscal 2003, $42.6 million in fiscal 2002

and $18.0 million in fiscal 2001. The fiscal 2003

improvement primarily resulted from an increase in net

earnings and an increase in accounts payable and accrued

expenses associated with the separation from Circuit City

Stores. In previous years, certain liabilities such as the

workers’ compensation liability were recorded through the

debt from our former parent as a financing activity. The

fiscal 2002 improvement primarily resulted from an increase

in net earnings, partly offset by an increase in accounts

receivable. The accounts receivable increase resulted from

increased sales generating increased automobile loans, as

well as increased yield spreads from the finance operation.