CarMax 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2003 9

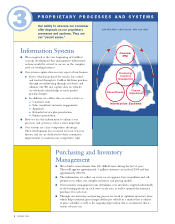

Reconditioning

■In reconditioning, we balance three conflicting imperatives:

●High quality. ●Low cost. ●Short cycle time.

■Over the past three years, we have reduced cycle time 50% using a process engineering

approach to reconditioning and applying continuous process and systems improvements.

■During fiscal 2003 we introduced our Electronic Repair Order system, or “ERO,”

which drives the sequencing of vehicle reconditioning procedures.We expect ERO to:

●help reduce cycle time even further.

●provide information that will help increase quality.

●drive down the cost of reconditioning by reducing rework.

Training and Development

■People deliver the consumer offer, execute procedures, develop systems, analyze data and make the decisions. CarMax

is only as good as its people.Training and development is a vital part of assuring the best from our associates.

■Associates in our core store disciplines—sales, service, buying and business operations—receive classroom training and

formal mentoring. Online training provides easily accessible continuing education and competency certification.

Finance Originations

■CarMax provides a superior loan origination channel that yields consistent, predictable performance because of the

integrity of the data with which loan decisions are made.The three risks in used auto lending are reduced or eliminated

entirely at CarMax:

●The consumer risk is the basic risk borne by all lenders.

●The risk of the car is reduced by the consistent, high quality of the cars that CarMax sells, the fact that most of our

customers also buy an extended service plan, and the consistency of the relationship between wholesale and retail val-

ues of CarMax vehicles. CarMax Auto Finance and our third-party lenders have found they can rely on CarMax

information to determine true vehicle worth.

●The “intermediary” risk is eliminated at CarMax.There is no commission-driven finance manager to distort

the facts on pricing, car quality or consumer credit information.Thus both CarMax Auto Finance and outside

lenders benefit from superior information quality in making financing decisions.

■At CarMax, the sales consultant sends the loan application electronically to CarMax Auto Finance and to our third-party,

prime-credit lender, where the vast majority of credit applications are scored electronically. Prime offers are sent to the

customer via the sales office computer. If there is no prime offer, the application is electronically routed to the third-party

lenders of non-prime credit who then determine their offers to the consumer. If the consumer has multiple offers, the

consumer chooses the offer that best suits his or her needs.