CarMax 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2003 19

to sales growth in fiscal 2002.The growth in total comparable

store vehicle units reflects increased store traffic that, combined

with better in-store execution, resulted in comparable store

unit sales growth for both used and new cars. We believe that

the higher traffic levels were driven by the effectiveness of our

marketing programs, carmax.com and word-of-mouth

customer referrals. In addition, traffic was bolstered in October,

November and December by cross-shopping from zero-

percent financing incentive programs introduced by new car

manufacturers to counteract an industry-wide slowdown in

new car sales. Increased used car average retail prices resulting

from a higher mix of later-model used cars, luxury vehicles and

sport utility vehicles and higher new car average retail prices

also contributed to the sales growth.

A CarMax store is included in comparable store retail sales

after the store has been open for a full year (in the store’s

fourteenth full month of operation).

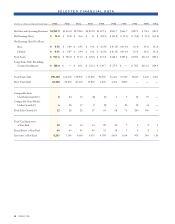

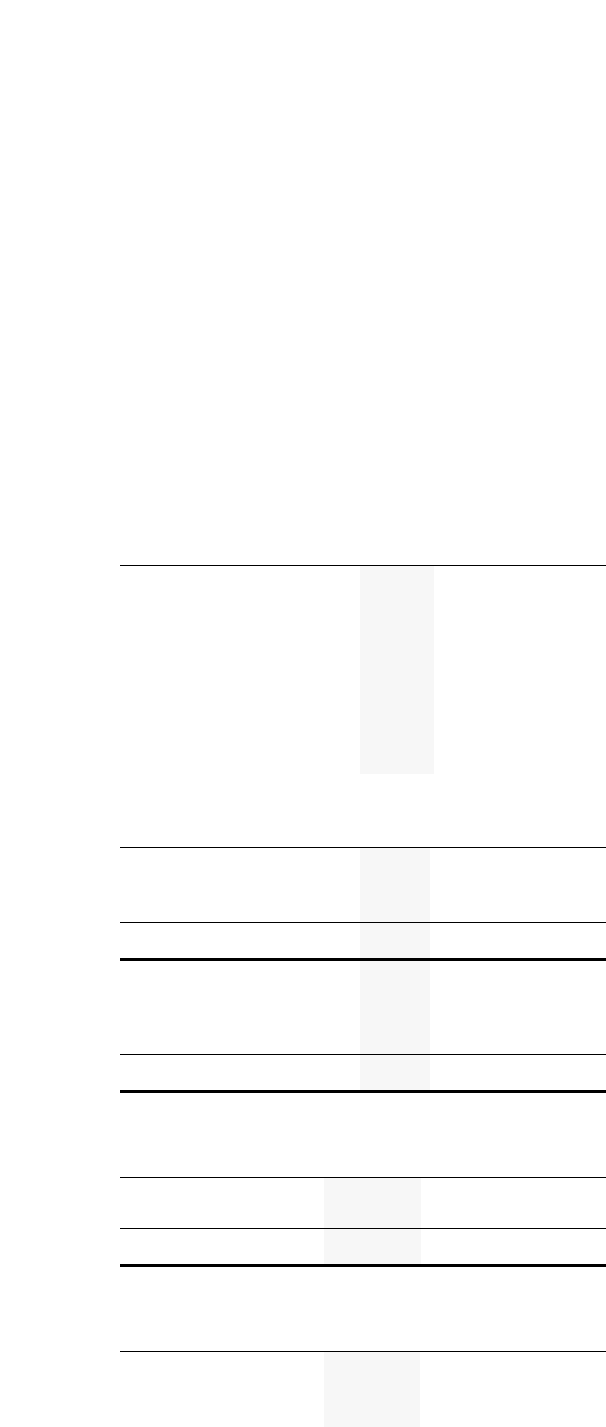

Comparable Store Retail Vehicle Sales Change

Fiscal 2003 2002 2001

Vehicle units:

Used vehicles 8% 24% 13%

New vehicles (3)% 21% 9%

Total 6% 23% 12%

Vehicle dollars:

Used vehicles 8% 30% 19%

New vehicles (3)% 24% 9%

Total 6% 28% 17%

Percent Retail Vehicle Sales

Fiscal 2003 2002 2001

Vehicle units:

Used vehicles 89 % 87% 87%

New vehicles 11 13 13

Total 100 % 100% 100%

Vehicle dollars:

Used vehicles 85 % 82% 81%

New vehicles 15 18 19

Total 100 % 100% 100%

Retail Unit Sales

Fiscal 2003 2002 2001

Used vehicles 190,100 164,000 132,900

New vehicles 22,400 24,200 20,100

Total 212,500 188,200 153,000

Average Retail Selling Prices

Fiscal 2003 2002 2001

Used vehicles $15,200 $15,100 $14,400

New vehicles $23,200 $23,100 $22,600

Total vehicles $16,100 $16,200 $15,500

Wholesale Vehicle Sales. CarMax’s operating strategy is

to build customer confidence and satisfaction by offering

high-quality vehicles; therefore, fewer than half of the

vehicles acquired from consumers through the appraisal

purchase process meet our standards for reconditioning and

subsequent retail sale. Those vehicles that do not meet our

standards are sold at our on-site wholesale auctions. Total

wholesale vehicle units sold at these auctions were 104,600

in fiscal 2003; 90,900 in fiscal 2002; and 73,300 in fiscal

2001.Wholesale vehicle sales totaled $366.6 million in fiscal

2003, $325.6 million in fiscal 2002 and $253.5 million in

fiscal 2001. The increase in fiscal 2003 resulted from an

increase in the rate of acceptance of our vehicle appraisal

offer.The impact of this increase was partially offset by lower

average wholesale prices.The increase in fiscal 2002 resulted

from an increase in the number of appraisals performed

while the rate of customer acceptance of the appraisal offer

remained consistent with fiscal 2001.

Other Sales and Revenues. Other sales and revenues

include extended warranty revenues, service department sales,

appraisal purchase processing fees collected from customers

for the purchase of their vehicles and third-party finance fees.

These totaled $171.4 million in fiscal 2003, $151.1 million in

fiscal 2002 and $119.7 million in fiscal 2001.

CarMax sells extended warranties on behalf of unrelated

third parties who are the primary obligors. Under these third-

party warranty programs, the company has no contractual

liability to the customer. Extended warranty revenue

represents commissions from the unrelated third parties and

was $68.1 million in fiscal 2003, $55.3 million in fiscal 2002

and $45.0 million in fiscal 2001. These increases in warranty

revenue reflect improved penetration, a result in part of the

continuing enhancement of the extended warranty offer, and

strong sales growth for used cars, which achieve a higher

extended warranty penetration rate than new cars.

Service department sales were $58.6 million in fiscal 2003,

$55.9 million in fiscal 2002 and $44.8 million in fiscal 2001.

The increase in service department sales for fiscal 2003 reflects

the continued overall increase in CarMax’s customer base,

offset modestly by the initial effect of a rollout of the new

electronic repair order system to our stores. As each store

implemented the new electronic repair order system, service

department sales were impacted based on the time required

for the training of service managers and technicians. The

increase in fiscal 2002 relates to an overall increase in

CarMax’s customer base.

Appraisal purchase processing fees were $28.5 million in

fiscal 2003, $24.2 million in fiscal 2002 and $18.5 million in

fiscal 2001. Appraisal purchase processing fees collected from

customers are designed to cover some of the costs of our

appraisal and wholesale operations.The increase in fiscal 2003

resulted from the increased consumer response to the vehicle

appraisal offer. The increase in fiscal 2002 was the result of

increased traffic, increased consumer response to the vehicle

appraisal offer and an increase in the fee amount.