CarMax 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2003 25

Investing Activities

Net cash used in investing activities was $80.4 million in

fiscal 2003. Net cash provided by investing activities was

$57.5 million in fiscal 2002 and $3.3 million in fiscal 2001.

Capital expenditures were $122.0 million in fiscal 2003,

$41.4 million in fiscal 2002 and $10.8 million in fiscal 2001.

A majority of the capital expenditures for fiscal 2003 and

fiscal 2002 were a result of our geographic expansion.

Capital expenditures have been funded primarily through

sale-leaseback transactions, short- and long-term debt and

internally generated funds. Net proceeds from sales of property

and equipment, including sale-leasebacks totaled $41.6 million

in fiscal 2003, $99.0 million in fiscal 2002 and $15.5 million in

fiscal 2001. In September 2002, CarMax entered into a sale-

leaseback transaction covering three superstore properties

valued at approximately $37.6 million. In August 2001,

CarMax entered into a sale-leaseback transaction covering

nine superstores valued at approximately $102.4 million.These

transactions were structured at competitive rates with initial

lease terms of 15 years and two 10-year renewal options.

In fiscal 2004, we anticipate capital expenditures of

approximately $200 million. Planned expenditures primarily

relate to new store construction, including furniture, fixtures

and equipment; land purchases; and leasehold improvements

to existing properties. In addition to one standard-sized

superstore originally planned in fiscal 2003 but opened in

March of fiscal 2004, we expect to open seven or eight more

superstores during fiscal 2004, approximately three of which

will be prototype satellite superstores. We also plan in Los

Angeles to co-locate our two remaining stand-alone

franchises with a used car superstore.

Financing Activities

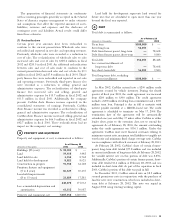

Net cash provided by financing activities was $39.8 million in

fiscal 2003, compared with net cash used of $105.7 million in

fiscal 2002 and $22.5 million in fiscal 2001. In May 2002,

CarMax entered into a $200 million credit agreement

secured by vehicle inventory. During the fourth quarter of

fiscal year 2003, the credit agreement was increased from

$200 million to $300 million.The credit agreement includes

a $200 million revolving loan commitment and a $100

million term loan. Short-term debt is primarily funded

through the revolving credit facility. Principal is due in full at

maturity with interest payable monthly at a LIBOR-based

rate.The credit agreement is scheduled to terminate on May

17, 2004. The termination date of the agreement will be

automatically extended one year each May 17 unless CarMax

or either lender elects, prior to the extension date, not to

extend the agreement. As of February 28, 2003, the amount

outstanding under this credit agreement was $156.1 million.

Under this agreement, CarMax must meet financial

covenants relating to minimum current ratio, maximum total

liabilities to tangible net worth ratio and minimum fixed

charge coverage ratio. CarMax was in compliance with all

such covenants at February 28, 2003.

CarMax used a portion of the proceeds from the term loan

for the repayment of debt to and the payment of a one-time

special dividend to Circuit City Stores of $28.4 million, as

well as the payment of separation expenses, and for general

corporate purposes. Refer to “Contractual Obligations” for

further discussion of the special dividend payment.

In December 2001, CarMax entered into an $8.5 million

secured promissory note in conjunction with the purchase of

land for new store construction.This note, which was paid in

August 2002, was included in short-term debt as of February

28, 2002. Prior to separation, the company repaid $77.8

million of long-term debt from Circuit City Stores.This debt

was included in current installments of long-term debt. In

November 1998, the company entered into a four-year, $5.0

million unsecured promissory note.The outstanding balance

at February 28, 2002, was $826,000 and was included in

current installments of long-term debt. The note was repaid

in January 2003 using existing working capital.

The aggregate principal amount of automobile loan

receivables funded through securitizations discussed in Notes

11 and 12 to the company’s consolidated financial statements

totaled $1.86 billion at February 28, 2003, and $1.49 billion

at February 28, 2002. During fiscal 2003, the company

completed two public securitizations for $512.6 million and

$500 million. At February 28, 2003, the unused capacity of

the warehouse facility was $276 million. Note 2(C) to the

company’s consolidated financial statements includes a

discussion regarding the warehouse facility. The warehouse

facility program matures in June 2003. The company

anticipates that it will be able to expand or enter into new

securitization arrangements to meet the future needs of the

automobile loan finance operation.

The company expects that proceeds from the credit

agreement secured by vehicle inventory, sale-leaseback

transactions, new securitization arrangements and cash generated

by operations will be sufficient to fund capital expenditures and

working capital requirements for the foreseeable future.

Off-Balance Sheet Arrangements

CarMax Auto Finance is the company’s finance operation.

CAF’s lending business is limited to providing prime auto

loans for CarMax’s used and new car sales.The company uses

a securitization program to fund substantially all of the

automobile loan receivables originated by CAF. The company

sells the automobile loan receivables to a wholly owned,

bankruptcy-remote, qualified special purpose entity that

transfers an undivided interest in the receivables to a group of

third-party investors. This program is referred to as the

warehouse facility.

The company periodically uses public securitizations to

refinance the receivables previously securitized through the

warehouse facility to free up capacity in the warehouse

facility. In a public securitization, a pool of automobile loan

receivables are sold to a bankruptcy-remote, qualified special

purpose entity that in turn transfers the receivables to a

special purpose securitization trust.

Additional information regarding the nature, business

purpose and importance of our off-balance sheet

arrangement to our liquidity and capital resources can be

found in the CarMax Auto Finance Income, Financial

Condition, and Market Risk sections of this Management’s

Discussion and Analysis, as well as in Notes 11 and 12 to the

company’s consolidated financial statements.