CarMax 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2003 27

CAUTIONARY INFORMATION ABOUT FORWARD-LOOKING

STATEMENTS

The provisions of the Private Securities Litigation Reform

Act of 1995 provide companies with a “safe harbor” when

making forward-looking statements. This “safe harbor”

encourages companies to provide prospective information

about their companies without fear of litigation. The

company wishes to take advantage of the “safe harbor”

provisions of the Act. Company statements that are not

historical facts, including statements about management’s

expectations for fiscal 2004 and beyond, are forward-looking

statements and involve various risks and uncertainties.

Forward-looking statements are estimates and projections

reflecting our judgment and involve a number of risks and

uncertainties that could cause actual results to differ

materially from those suggested by the forward-looking

statements. Although we believe that the estimates and

projections reflected in the forward-looking statements are

reasonable, our expectations may prove to be incorrect.

Investors are cautioned not to place undue reliance on any

forward-looking statements, which are based on current

expectations. Important factors that could cause actual

results to differ materially from estimates or projections

contained in our forward-looking statements include:

■In the normal course of business, we are subject to

changes in general U.S. or regional U.S. economic

conditions including, but not limited to, consumer credit

availability, consumer credit delinquency and default

rates, interest rates, inflation, personal discretionary

spending levels and consumer sentiment about the

economy in general. Any significant changes in

economic conditions could adversely affect consumer

demand and increase costs resulting in lower profitability

for the company.

■The company operates in a highly competitive industry

and new entrants to the industry could result in increased

wholesale costs for used vehicles and lower-than-expected

vehicle sales and margins.

■Any significant changes in retail prices for used and

new vehicles could result in lower sales and margins for

the company.

■A reduction in the availability or access to sources of

inventory would adversely affect the company’s business.

■Should excess inventory develop, the inability to liquidate

excess inventory at prices that allow the company to meet

its margin targets or to recover its costs would adversely

affect the company’s profitability.

■The ability to attract and retain an effective management

team in a dynamic environment and the availability of a

suitable work force is vital to the company’s ability to

manage and support its service-driven operating

strategies. The inability to attract such a workforce team

or a significant increase in payroll market costs would

adversely affect the company’s profitability.

■Changes in the availability or cost of capital and working

capital financing, including the availability of long-term

financing to support development of the company and

the availability of securitization financing, could adversely

affect the company’s growth and operating strategies.

■A decrease in the availability of appropriate real estate

locations for expansion would limit the expansion of the

company’s store base and the company’s future

operating results.

■The imposition of new restrictions or regulations

regarding the sale of products and/or services that the

company sells, changes in tax or environmental rules and

regulations applicable to the company or our

competitors, or any failure to comply with such laws or

any adverse change in such laws could increase costs and

affect the company’s profitability.

■We are subject to various litigation matters, which, if the

outcomes in any significant matters are adverse, could

negatively affect the company’s business.

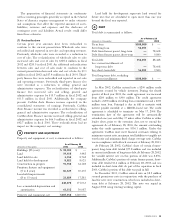

COMMON STOCK

CarMax, Inc. common stock is traded on the New York

Stock Exchange under the symbol “KMX.” Prior to the

separation from Circuit City Stores on October 1, 2002, the

Circuit City Stores, Inc.-CarMax Group Common Stock

was traded on the New York Stock Exchange under the

same symbol. No dividend data is shown since the company

pays no dividends at this time.

Market Price of Common Stock

Fiscal 2003 2002

Quarter HIGH LOW HIGH LOW

1st $34.00 $24.75 $15.49 $ 4.70

2nd $26.75 $13.00 $20.50 $11.50

3rd $21.45 $12.90 $21.00 $ 9.20

4th $20.47 $12.94 $29.02 $19.35