CarMax 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 CARMAX 2003

(N) Revenue Recognition

The company recognizes revenue when the earnings

process is complete, generally either at the time of sale to a

customer or upon delivery to a customer. As part of its

customer service strategy, the company guarantees the

vehicles it sells with a five-day or 250-mile money-back

guarantee. If a customer returns the vehicle purchased

within the limits of the guarantee, the company will refund

the customer’s money. A reserve for returns is recorded

based on historical experience and trends.

The company sells extended warranties on behalf of

unrelated third parties. These warranties have terms of

coverage from 12 to 72 months. Because these third parties are

the primary obligors under these warranties, commission

revenue is recognized at the time of sale, net of a provision for

estimated customer returns of the warranties. The estimates

for returns are based on historical experience and trends.

(O) Advertising Expenses

All advertising costs are expensed as incurred.

(P) Net Earnings Per Share

Basic net earnings per share is computed by dividing net

earnings by the weighted average number of shares of

common stock outstanding. Diluted net earnings per share is

computed by dividing net earnings by the sum of the

weighted average number of shares of common stock

outstanding and dilutive potential common stock.

(Q) Stock-Based Compensation

The company accounts for its stock-based compensation

plans under the recognition and measurement principles of

Accounting Principles Board Opinion (“APB”) No. 25,

“Accounting for Stock Issued to Employees,” and related

interpretations. As such, compensation expense would be

recorded on the date of grant and amortized over the

period of service only if the current market value of the

underlying stock exceeded the exercise price. No stock-

based employee compensation cost is reflected in net

earnings, as options granted under those plans had an

exercise price equal to the market value of the underlying

common stock on the date of grant.

In December 2002, the Financial Accounting Standards

Board (“FASB”) issued SFAS No. 148 “Accounting for

Stock-Based Compensation–Transition and Disclosure–an

Amendment of SFAS No. 123.” The company adopted the

disclosure provisions of SFAS 148 in the fourth quarter of

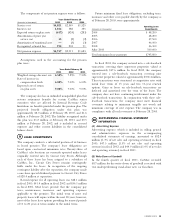

fiscal 2003. The following table illustrates the effect on net

earnings per share as if the fair value method of accounting

had been applied to all outstanding stock awards in each

reported period as follows:

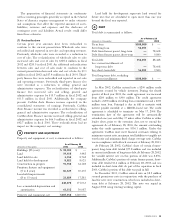

Years Ended February 28

(Amounts in thousands) 2003 2002 2001

Net earnings, as reported $94,802 $90,802 $45,564

Total stock-based compen-

sation expenses determined

under fair value based

method for all awards,

net of related tax effects 4,391 1,559 979

Pro forma net earnings $90,411 $89,243 $44,585

Earnings per share:

Basic, as reported $ 0.92 $ 0.89 $ 0.45

Basic, pro forma $ 0.88 $ 0.87 $ 0.44

Diluted, as reported $ 0.91 $ 0.87 $ 0.44

Diluted, pro forma $ 0.86 $ 0.86 $ 0.44

The pro forma effect on fiscal year 2003 may not be

representative of the pro forma effects on net earnings for

future years.

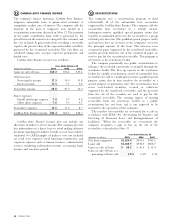

For the purpose of computing the pro forma amounts

indicated above, the fair value of each option on the date of

grant was estimated using the Black-Scholes option-pricing

model.The weighted average assumptions used in the model

are as follows:

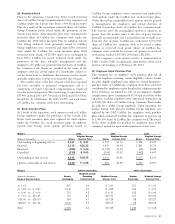

Fiscal 2003 2002 2001

Expected dividend yield ———

Expected stock volatility 76% 79% 71%

Risk-free interest rates 4% 5% 7%

Expected lives (in years) 544

Using these assumptions in the Black-Scholes model, the

weighted average fair value of options granted was $17 per

share in fiscal 2003, $3 per share in fiscal 2002 and $1 per

share in fiscal 2001.

(R) Derivative Financial Instruments

In connection with securitization activities through the

warehouse facility, the company enters into interest rate

swap agreements to manage exposure to interest rates and to

more closely match funding costs to the use of funding.The

company recognizes the interest rate swaps as either assets or

liabilities on the consolidated balance sheets at fair value

with changes in fair value included in earnings.

(S) Risks and Uncertainties

CarMax retails used and new cars.The diversity of CarMax’s

customers and suppliers reduces the risk that a severe impact

will occur in the near term as a result of changes in its

customer base, competition or sources of supply. However,

because of CarMax’s limited overall size, management

cannot assure that unanticipated events will not have a

negative impact on the company.