CarMax 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 CARMAX 2003

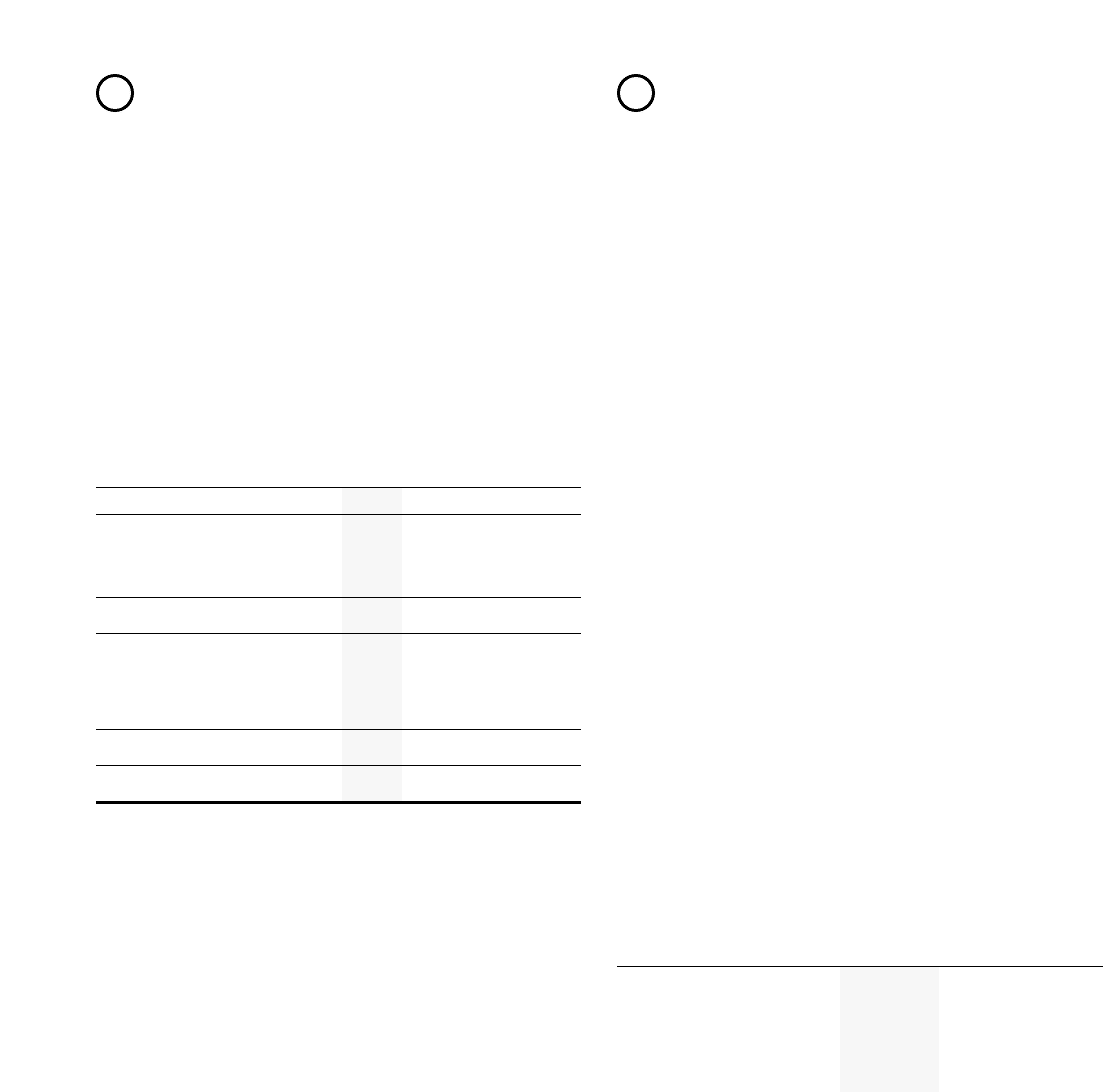

CARMAX AUTO FINANCE INCOME

The company’s finance operation, CarMax Auto Finance,

originates automobile loans to prime-rated customers at

competitive market rates of interest. The company sells the

majority of the loans it originates each month in a

securitization transaction discussed in Note 12. The majority

of the profit contribution from CAF is generated by the

spread between the interest rate charged to the customer and

the cost of funds. A gain results from recording a receivable

equal to the present value of the expected residual cash flows

generated by the securitized receivables. The cash flows are

calculated taking into account expected prepayment and

default rates.

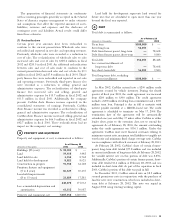

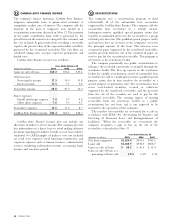

CarMax Auto Finance income was as follows:

Years Ended February 28

(Amounts in millions) 2003 2002 2001

Gains on sales of loans $68.2 $56.4 $35.4

Other income:

Servicing fee income 17.3 14.0 10.8

Interest income 11.5 7.7 5.2

Total other income 28.8 21.7 16.0

Direct expenses:

Payroll and fringes expense 7.0 5.7 4.2

Other direct expenses 7.6 5.9 4.5

Total direct expenses 14.6 11.6 8.7

CarMax Auto Finance income $82.4 $66.5 $42.7

CarMax Auto Finance income does not include any

allocation of indirect costs or income.The company presents

this information on a direct basis to avoid making arbitrary

decisions regarding the indirect benefit or costs that could be

attributed to CAF. Examples of indirect costs not included

are retail store expenses, retail financing commissions and

corporate expenses such as human resources, administrative

services, marketing, information systems, accounting, legal,

treasury and executive payroll.

SECURITIZATIONS

The company uses a securitization program to fund

substantially all of the automobile loan receivables

originated by CarMax Auto Finance.The company sells the

automobile loan receivables to a wholly owned,

bankruptcy-remote, qualified special purpose entity that

transfers an undivided interest in the receivables to a group

of third-party investors.The qualified special purpose entity

and investors have no recourse to the company’s assets for

the principal amount of the loans. The investors issue

commercial paper supported by the transferred receivables,

and the proceeds from the sale of the commercial paper are

used to pay for the securitized receivables. This program is

referred to as the warehouse facility.

The company periodically uses public securitizations to

refinance the receivables previously securitized through the

warehouse facility. This frees up capacity in the warehouse

facility. In a public securitization, a pool of automobile loan

receivables are sold to a bankruptcy-remote, qualified special

purpose entity that in turn transfers the receivables to a

special purpose securitization trust. The securitization trust

issues asset-backed securities, secured or otherwise

supported by the transferred receivables, and the proceeds

from the sale of the securities are used to pay for the

securitized receivables. The earnings impact of moving

receivables from the warehouse facility to a public

securitization has not been and is not expected to be

material to the operations of the company.

The transfers of receivables are accounted for as sales in

accordance with SFAS 140, “Accounting for Transfers and

Servicing of Financial Assets and Extinguishments of

Liabilities.” When the receivables are securitized, the

company recognizes a gain or loss on the sale of the

receivables as described in Note 11.

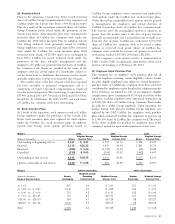

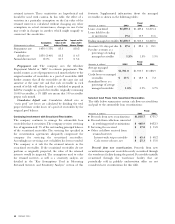

Years Ended February 28

(Amounts in millions) 2003 2002 2001

Net loans originated $1,189.0 $941.0 $785.5

Loans sold $1,185.9 $938.5 $818.7

Gains on sales of loans $ 68.2 $ 56.4 $ 35.4

Gains on sales of loans as a

percentage of loans sold 5.8% 6.0% 4.3%

11 12