CarMax 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 CARMAX 2003

CarMax currently operates 23 of its sales locations

pursuant to various leases under which Circuit City Stores

was the original tenant and primary obligor. Circuit City

Stores and not CarMax had originally entered into these

leases so that CarMax could take advantage of the

favorable economic terms available to Circuit City Stores

as a large retailer. Circuit City Stores has assigned each of

these leases to CarMax. Despite the assignment and

pursuant to the terms of the leases, Circuit City Stores

remains contingently liable under the leases. In

recognition of this ongoing contingent liability, CarMax

made a one-time special dividend payment of $28.4

million to Circuit City Stores on October 1, 2002, the

separation date.

CAPITAL STRUCTURE

During fiscal 2003, stockholders’ equity increased 14% to

$554.6 million from $485.5 million in fiscal 2002.

Capitalization for the past three years is illustrated in the

“Capitalization” table below. The return on equity was

18.2% in fiscal 2003, compared with 20.7% in fiscal 2002.

Excluding separation costs of $7.8 million in fiscal 2003 and

$0.4 million in fiscal 2002, the return on equity in fiscal

2003 was 19.7% and 20.8% in fiscal 2002.

MARKET RISK

Automobile Installment Loan Receivables

At February 28, 2003, and February 28, 2002, all loans in the

portfolio of automobile loan receivables were fixed-rate

installment loans. Financing for these automobile loan

receivables is achieved through asset securitization programs

that, in turn, issue both fixed- and floating-rate securities.

Interest rate exposure relating to floating-rate securitizations

is managed through the use of interest rate swaps.

Receivables held for investment or sale are financed with

working capital. Generally, changes in interest rates

associated with underlying swaps will not have a material

impact on earnings. However, changes in interest rates

associated with underlying swaps may have a material impact

on cash and cash flows.

Credit risk is the exposure to nonperformance of another

party to an agreement. Credit risk is mitigated by dealing

with highly rated bank counterparties. The market and

credit risks associated with financial derivatives are similar to

those relating to other types of financial instruments. Refer

to Note 13 to the company’s consolidated financial

statements for a description of these items.

The total principal amount of ending managed

receivables as of February 28, 2003, and February 28, 2002,

was as follows:

(Amounts in millions) 2003 2002

Fixed-rate securitizations $1,385.1 $1,075.4

Floating-rate securitizations

synthetically altered to fixed 473.2 413.3

Floating-rate securitizations 0.8 0.7

Held for investment(1) 16.0 11.8

Held for sale(2) 3.6 2.1

Total $1,878.7 $1,503.3

(1) The majority is held by a bankruptcy-remote, qualified special purpose entity.

(2) Held by a bankruptcy-remote, qualified special purpose entity.

Interest Rate Exposure

The company also has interest rate risk from changing

interest rates related to our outstanding debt. Substantially all

of the debt is floating-rate debt based on LIBOR. A 100-

basis point increase in market interest rates would not have

had a material effect on our fiscal 2003 results of operations

or cash flows.

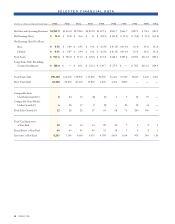

Capitalization

Fiscal (Dollar amounts in millions) 2003 2002 2001

Long-term debt, excluding current installments $100.0 15% $ — 0% $ 83.1 17%

Other long-term liabilities 14.9 2 11.4 2 10.5 2

Total stockholders’ equity 554.6 83 485.5 98 391.5 81

Total capitalization $669.5 100% $496.8 100% $485.1 100%

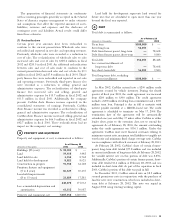

CONTRACTUAL OBLIGATIONS

2 to 3 4 to 5 After 5

(Amounts in millions) Total 1 Year Years Years Years

Contractual obligations:

Long-term debt $100.0 $ — $100.0 $ — $ —

Operating leases 745.8 48.2 95.7 92.3 509.6

Lines of credit 56.1 56.1 — — —

Total $901.9 $104.3 $195.7 $92.3 $509.6