CarMax 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2003 23

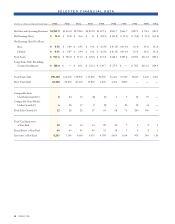

Selected Quarterly Financial Data (Unaudited)

(Amounts in thousands First Quarter Second Quarter Third Quarter Fourth Quarter Fiscal Year

except per share data) 2003 2002 2003 2002 2003 2002 2003 2002 2003 2002

Net sales and

operating revenues $1,005,803 $882,825 $1,080,682 $943,122 $936,819 $852,670 $946,640 $855,142 $3,969,944 $3,533,759

Gross profit $ 122,142 $107,785 $ 128,812 $112,738 $106,940 $ 94,889 $110,345 $103,981 $ 468,239 $ 419,393

CarMax Auto

Finance income $ 19,838 $ 15,685 $ 22,110 $ 18,555 $ 19,220 $ 18,027 $ 21,231 $ 14,206 $ 82,399 $ 66,473

Selling, general and

administrative expenses $ 93,037 $ 78,060 $ 97,997 $ 85,029 $101,810 $ 83,117 $ 99,573 $ 88,258 $ 392,417 $ 334,464

Separation costs $ 1,871 $—$ 1,265 $—$ 4,479 $—$ 153 $ 426 $ 7,768 $ 426

Selling, general and admin-

istrative expenses exclud-

ing separation costs $ 91,166 $ 78,060 $ 96,732 $ 85,029 $ 97,331 $ 83,117 $ 99,420 $ 87,832 $ 384,649 $ 334,038

Net earnings $ 29,238 $ 26,572 $ 31,714 $ 27,391 $ 14,717 $ 18,443 $ 19,133 $ 18,396 $ 94,802 $ 90,802

Net earnings excluding

separation costs $ 31,109 $ 26,572 $ 32,979 $ 27,391 $ 19,196 $ 18,443 $ 19,286 $ 18,822 $ 102,570 $ 91,228

Net earnings per share:

Basic $0.28$0.26$ 0.31 $ 0.27 $ 0.14 $ 0.18 $ 0.19 $ 0.18 $ 0.92 $ 0.89

Diluted $0.28$0.26$ 0.30 $ 0.26 $ 0.14 $ 0.18 $ 0.18 $ 0.18 $ 0.91 $ 0.87

Net earnings per share

excluding separation costs:

Basic $0.30$0.26$ 0.32 $ 0.27 $ 0.19 $ 0.18 $ 0.19 $ 0.18 $ 1.00 $ 0.89

Diluted $0.30$0.26$ 0.32 $ 0.26 $ 0.18 $ 0.18 $ 0.18 $ 0.18 $ 0.98 $ 0.88

Net Earnings

Net earnings were $94.8 million in fiscal 2003,

$90.8 million in fiscal 2002 and $45.6 million in fiscal 2001.

Excluding the non-tax-deductible, separation expenses of

$7.8 million in fiscal 2003 and $0.4 million in fiscal 2002,

earnings would have been $102.6 million in fiscal 2003 and

$91.2 million in fiscal 2002. Excluding the tax-affected

write-down of goodwill of $5.4 million in fiscal 2001, net

earnings would have been $51.0 million.

OPERATIONS OUTLOOK

CarMax continues to demonstrate that its consumer offer and

business model can produce strong sales and earnings growth.

At the beginning of fiscal 2002, CarMax announced that it

would resume geographic growth. This expansion is

proceeding as planned with a total of five stores opened during

fiscal 2003. In addition to one standard-sized superstore

originally planned in fiscal 2003 but opened in March of fiscal

2004, we plan to open approximately four standard-sized used

car superstores and three prototype satellite superstores in fiscal

2004.We may also open an eighth store in the fourth quarter.

In April of fiscal 2004, we sold the Jeep franchise in Kenosha,

Wis. Also in fiscal 2004, we plan to sell our five Mitsubishi new

car franchises.The sale of the Mitsubishi franchises, which are

integrated with used car superstores, will create more space for

used car sales expansion, which is more profitable for us. In

addition, in Los Angeles we intend to integrate our two

remaining stand-alone franchises with a used car superstore

during the second half of fiscal 2004.

Comparable store used unit sales growth is a primary driver

of CarMax’s profitability. We believe that our used unit

comparable sales growth will be in the range of 5% to

9% in fiscal 2004 and net earnings in the range of

$105 million to $116 million. This forecast assumes the

continuation of the reduced approval rates from our non-

prime loan providers experienced in the fourth quarter of

fiscal 2003. The expense leverage that we would normally

expect from the comparable store used unit growth is

estimated to be more than offset by the full year of incremental

costs associated with being a stand-alone company and some

additional costs related to our geographic growth. We estimate

the full-year effect of being a stand-alone company to be

approximately $20 to $22 million, with a majority of the

$11 million to $13 million incremental portion of this increase

during the first seven months of fiscal 2004.