CarMax 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

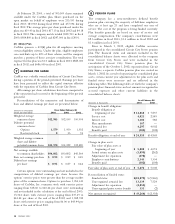

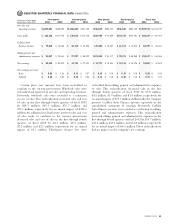

At February 28, 2003, a total of 903,509 shares remained

available under the CarMax plan. Shares purchased on the

open market on behalf of employees were 213,931 during

fiscal 2003; 183,902 during fiscal 2002; and 477,094 during

fiscal 2001. The average price per share purchased under the

plans was $19.43 in fiscal 2003, $17.13 in fiscal 2002 and $4.18

in fiscal 2001. The company match totaled $520,700 in fiscal

2003; $384,800 in fiscal 2002; and $247,000 in fiscal 2001.

(E) 401(k) Plan

CarMax sponsors a 401(k) plan for all employees meeting

certain eligibility criteria. Under the plan, eligible employees

can contribute up to 40% of their salaries, and the company

matches a portion of those associate contributions. The total

expense for this plan was $1.0 million in fiscal 2003; $885,000

in fiscal 2002; and $686,000 in fiscal 2001.

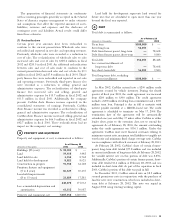

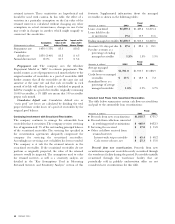

EARNINGS PER SHARE

CarMax was a wholly owned subsidiary of Circuit City Stores

during a portion of the periods presented. Earnings per share

have been presented to reflect the capital structure effective

with the separation of CarMax from Circuit City Stores.

All earnings per share calculations have been computed as

if the separation had occurred at the beginning of the periods

presented.

Reconciliations of the numerator and denominator of

basic and diluted earnings per share are presented below:

(Amounts in thousands Years Ended February 28

except per share data) 2003 2002 2001

Weighted average

common shares 102,983 102,039 100,994

Dilutive potential

common shares:

Options 1,579 1,950 1,332

Restricted stock 833 94

Weighted average common

shares and dilutive

potential common shares 104,570 104,022 102,420

Net earnings available

to common shareholders $94,802 $90,802 $45,564

Basic net earnings per share $ 0.92 $ 0.89 $ 0.45

Diluted net earnings

per share $ 0.91 $ 0.87 $ 0.44

Certain options were outstanding and not included in the

computation of diluted earnings per share because the

options’ exercise prices were greater than the average market

price of the common shares. Options to purchase 1,053,610

shares of CarMax, Inc. common stock with exercise prices

ranging from $18.60 to $43.44 per share were outstanding

and not included in the calculation at the end of fiscal 2003;

15,364 shares with exercise prices ranging from $37.49 to

$43.44 per share at the end of fiscal 2002; and 1,382,935

shares with exercise prices ranging from $6.06 to $43.44 per

share at the end of fiscal 2001.

38 CARMAX 2003

8

7

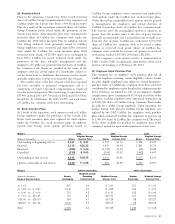

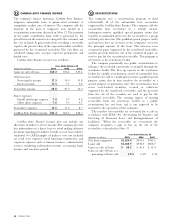

PENSION PLANS

The company has a noncontributory defined benefit

pension plan covering the majority of full-time employees

who are at least age 21 and have completed one year of

service. The cost of the program is being funded currently.

Plan benefits generally are based on years of service and

average compensation. The company’s contributions were

$2.3 million in fiscal 2003, $1.3 million in fiscal 2002 and

$1.6 million in fiscal 2001.

Prior to March 1, 2002, eligible CarMax associates

participated in the consolidated Circuit City Stores pension

plan. The financial status and amounts included in the

consolidated balance sheets were allocated to the company

from Circuit City Stores and were included in the

consolidated Circuit City Stores pension plan. In

anticipation of the October 1, 2002, separation from Circuit

City Stores, a separate CarMax pension plan was created on

March 1, 2002.As a result of separating the consolidated plan

assets, certain current year adjustments to the plan assets and

funded status were necessary and are reflected in the

following tables.The following tables set forth the company’s

pension plan’s financial status and net amounts recognized in

accrued expenses and other current liabilities in the

consolidated balance sheets:

As of February 28

(Amounts in thousands) 2003 2002

Change in benefit obligation:

Benefit obligation at

beginning of year $ 14,868 $ 7,837

Service cost 4,021 2,549

Interest cost 1,104 588

Plan amendments 367 —

Actuarial loss 4,297 4,002

Benefits paid (102) (108)

Benefit obligation at end of year $ 24,555 $14,868

Change in plan assets:

Fair value of plan assets at

beginning of year $ 5,008 $ 4,074

Actual return on plan assets (1,095) (262)

Adjustment for separation (478) —

Employer contributions 2,343 1,304

Benefits paid (102) (108)

Fair value of plan assets at end of year $ 5,676 $ 5,008

Reconciliation of funded status:

Funded status $(18,879) $ (9,860)

Unrecognized actuarial loss 13,339 7,524

Adjustment for separation (4,055) —

Unrecognized prior service benefit 331 (2)

Net amount recognized $ (9,264) $ (2,338)