CarMax 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 CARMAX 2003

The company is at risk for the performance of the

securitized receivables managed to the extent that it maintains

a retained interest in the receivables. Supplemental information

on our portfolio of managed receivables is shown in the

following tables:

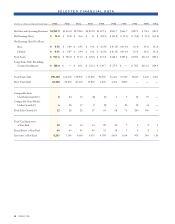

As of February 28

(Amounts in millions) 2003 2002 2001

Loans securitized $1,859.1 $1,489.4 $1,215.4

Loans held for sale

or investment 19.6 13.9 11.6

Ending managed receivables $1,878.7 $1,503.3 $1,227.0

Accounts 31+ days past due $ 27.6 $ 22.3 $ 18.1

Past due accounts as a

percentage of ending

managed receivables 1.5% 1.5% 1.5%

Years Ended February 28

(Amounts in millions) 2003 2002 2001

Average managed receivables $1,701.0 $1,393.7 $1,088.9

Credit losses on managed

receivables $ 17.5 $ 12.9 $ 7.2

Annualized losses as a

percentage of average

managed receivables 1.0% 0.9% 0.7%

The increase in annualized losses as a percent of average

managed receivables for fiscal 2003 compared with fiscal

2002 was primarily due to depressed wholesale vehicle

values which lead to lower recovery rates on repossessed

vehicles. The increase in fiscal 2002 annualized losses as a

percent of average managed receivables from fiscal 2001 was

due to a moderation in the growth of our portfolio

combined with general economic factors causing lower

recovery rates on repossessed vehicles.The recovery rate was

43% in fiscal 2003, 45% in fiscal 2002 and 48% in fiscal

2001.The recovery rate represents the average percentage of

the outstanding principal balance CarMax receives when a

vehicle is repossessed and liquidated.

If the managed receivables do not perform in accordance

with the assumptions used in determining the fair value of the

gain receivable, earnings could be impacted. Despite the

current weak economic environment, the managed

receivables continue to perform in line with our expectations.

In the fourth quarter, we adjusted both loss and prepayment

assumptions for certain pools of receivables.The changes were

substantially offsetting resulting in no material impact on

earnings or the fair value of retained interests. Detail

concerning the assumptions used to value the retained

interests and the valuation’s sensitivity to adverse changes in

the performance of the managed receivables are included in

Note 12 to the company’s consolidated financial statements.

Selling, General and Administrative Expenses

The selling, general and administrative expense ratio was 9.9%

of sales in fiscal 2003, 9.5% in fiscal 2002 and 10.8% in fiscal

2001. Excluding separation costs of $7.8 million in fiscal 2003

and $0.4 million in fiscal 2002, the selling, general and

administrative expense ratios would have been 9.7% and

9.5%, respectively. The increase in the expense ratio in fiscal

2003 was caused primarily by both geographic growth and

the incremental increase in expenses caused by diseconomies

of scale resulting from the separation from Circuit City Stores.

Growth related costs include increasing the size of the

management bench for store expansion and preopening

expenses for stores opening during fiscal 2004 and the first

quarter of fiscal 2005. Other growth related costs such as

training, recruiting and employee relocation for new stores

also moderate expense leverage. We experienced

approximately $9 million of expenses caused by the

diseconomies of scale associated with being a stand-alone

company during the last five months of fiscal 2003.

Approximately half of the incremental expenses relate to

employee medical benefits and workers’ compensation,

including benefits administration. Other larger incremental

expenses relate to insurance, such as directors’ and officers’

liability; necessary incremental staff, such as legal and treasury;

and expenses related to independent company activity, such as

the New York Stock Exchange listing, Securities and

Exchange Commission filings and the cost of a board of

directors. The increase in the expense ratio during fiscal 2003

was offset in part by comparable store sales growth, improved

operational effectiveness and expense management.

The improvement in the fiscal 2002 expense ratio reflects

significant expense leverage generated by strong comparable

store sales growth and continued expense management,

particularly of non-store expenses, the benefit of which

more than offset higher second half expenses related to

renewed geographic expansion.

Interest Expense

Interest expense was 0.1% of total sales in fiscal years 2003 and

2002 and 0.4% in fiscal 2001. Interest expense is primarily

incurred on debt used to fund new store growth and working

capital, including inventory. The fiscal 2002 decline in the

interest expense ratio reflects a reduction in debt levels and

lower interest rates. Refer to the “Financing Activities” section

for further information on changes in debt.

Earnings before Income Taxes

Earnings before income taxes were $156.7 million in fiscal

2003, compared with $146.5 million in fiscal 2002 and

$73.5 million in fiscal 2001. Excluding the non-tax-

deductible, separation expenses of $7.8 million in fiscal 2003

and $0.4 million in fiscal 2002, earnings before income taxes

would have been $164.5 million in fiscal 2003 and

$146.9 million in fiscal 2002. Excluding the write-off of

goodwill of $8.7 million in fiscal 2001, earnings before

income taxes would have been $82.2 million.

Income Taxes

Based on the non-deductibility of the separation expenses, the

effective income tax rate increased to 39.5% in fiscal 2003

from 38.0% in fiscal 2002 and 2001.