CarMax 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2003 39

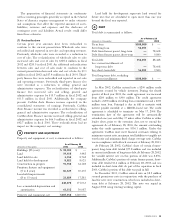

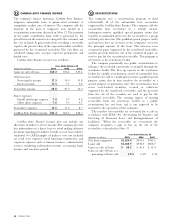

The components of net pension expense were as follows:

Years Ended February 28

(Amounts in thousands) 2003 2002 2001

Service cost $4,021 $2,549 $1,525

Interest cost 1,104 588 355

Expected return on plan assets (617) (424) (283)

Amortization of prior year

service cost 35 (2) (2)

Amortization of transitional asset —(3) (3)

Recognized actuarial loss 194 203 91

Net pension expense $4,737 $2,911 $1,683

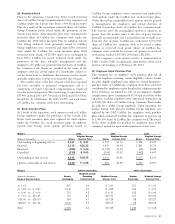

Assumptions used in the accounting for the pension

plan were:

Years Ended February 28

2003 2002 2001

Weighted average discount rate 6.50% 7.25% 7.50%

Rate of increase in

compensation levels 6.00% 7.00% 6.00%

Expected rate of return

on plan assets 9.00% 9.00% 9.00%

The company also has an unfunded nonqualified plan that

restores retirement benefits for certain CarMax senior

executives who are affected by Internal Revenue Code

limitations on benefits provided under the pension plan.The

projected benefit obligation under this plan was

approximately $2.0 million at February 28, 2003, and $1.6

million at February 28, 2002. The liability recognized under

this plan was $1.2 million at February 28, 2003, and $0.5

million at February 28, 2002, and is included in accrued

expenses and other current liabilities in the consolidated

balance sheets.

LEASE COMMITMENTS

The company conducts a substantial portion of its business

in leased premises. The company’s lease obligations are

based upon contractual minimum rates. Twenty-three of

CarMax’s sales locations are currently operated under leases

originally entered into by Circuit City Stores. Although

each of these leases has been assigned to a subsidiary of

CarMax, Inc., Circuit City Stores remains contingently

liable under the leases. In recognition of the ongoing

contingent liability after the separation, the company made

a one-time special dividend payment to Circuit City Stores

of $28.4 million at separation.

Rental expense for all operating leases was $48.1 million

in fiscal 2003, $41.4 million in fiscal 2002 and $36.1 million

in fiscal 2001. Most leases provide that the company pay

taxes, maintenance, insurance and operating expenses

applicable to the premises. The initial term of most real

property leases will expire within the next 20 years; however,

most of the leases have options providing for renewal periods

of 10 to 20 years at terms similar to the initial terms.

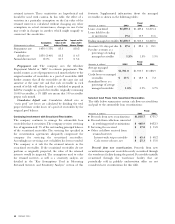

Future minimum fixed lease obligations, excluding taxes,

insurance and other costs payable directly by the company, as

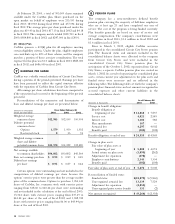

of February 28, 2003, were approximately:

Operating Lease

(Amounts in thousands) Commitments

2004 $ 48,200

2005 48,200

2006 47,500

2007 46,000

2008 46,300

After 2008 509,600

Total minimum lease payments $745,800

In fiscal 2003, the company entered into a sale-leaseback

transaction covering three superstore properties valued at

approximately $37.6 million. In fiscal 2002, the company

entered into a sale-leaseback transaction covering nine

superstore properties valued at approximately $102.4 million.

These transactions were structured at competitive rates with

initial lease terms of 15 years and two 10-year renewal

options. Gains or losses on sale-leaseback transactions are

deferred and amortized over the term of the leases. The

company does not have continuing involvement under the

sale-leaseback transactions. In conjunction with these sale-

leaseback transactions, the company must meet financial

covenants relating to minimum tangible net worth and

minimum coverage of rent expense. The company was in

compliance with all such covenants at February 28, 2003.

SUPPLEMENTAL FINANCIAL STATEMENT

INFORMATION

(A) Advertising Expense

Advertising expense, which is included in selling, general

and administrative expenses in the accompanying

consolidated statements of earnings, amounted to $52.4

million (1.3% of net sales and operating revenues) in fiscal

2003, $47.3 million (1.3% of net sales and operating

revenues) in fiscal 2002, and $44.9 million (1.6% of net sales

and operating revenues) in fiscal 2001.

(B) Write-Down of Goodwill

In the fourth quarter of fiscal 2001, CarMax recorded

$8.7 million for the write-down of goodwill associated with

two underperforming stand-alone new car franchises.

10

9