CarMax 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2003 17

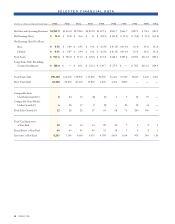

In this discussion, “we,” “our,” “CarMax,” “CarMax, Inc.” and

“the company” refer to CarMax, Inc. and its wholly owned

subsidiaries, unless the context requires otherwise. Amounts and

percents in the tables may not total due to rounding.

BACKGROUND

CarMax was formerly a wholly owned subsidiary of Circuit

City Stores, Inc. (“Circuit City Stores”). On September 10,

2002, the Circuit City Stores shareholders, which included

Circuit City Stores, Inc.–Circuit City Group Common Stock

shareholders and Circuit City Stores, Inc.–CarMax Group

Common Stock shareholders, approved the separation of the

CarMax business from Circuit City Stores, and the Circuit

City Stores board of directors authorized the redemption of

the CarMax Group Common Stock and the distribution of

CarMax, Inc. common stock to effect the separation. The

separation was effective October 1, 2002. Each outstanding

share of CarMax Group Common Stock was redeemed in

exchange for one share of new CarMax, Inc. common stock.

In addition, each holder of Circuit City Group Common

Stock received, as a tax-free distribution, a 0.313879 share of

CarMax, Inc. common stock for each share of Circuit City

Group Common Stock owned as of September 16, 2002, the

record date for the distribution. As a result of the separation,

all of the businesses, assets and liabilities of the CarMax Group

are now held in CarMax, Inc., an independent, separately

traded public company.

CRITICAL ACCOUNTING POLICIES

In Management’s Discussion and Analysis, we discuss the

results of operations and financial condition as reflected in

the company’s consolidated financial statements, which have

been prepared in accordance with accounting principles

generally accepted in the United States of America.

Preparation of financial statements requires management to

make estimates and assumptions affecting the reported

amounts of assets, liabilities, revenues and expenses and the

disclosures of contingent assets and liabilities. We use our

historical experience and other relevant factors when

developing our estimates and assumptions. We continually

evaluate these estimates and assumptions. Note 2 to the

company’s consolidated financial statements includes a

discussion of significant accounting policies.The accounting

policies discussed below are the ones we consider critical to

an understanding of the company’s consolidated financial

statements because their application places the most

significant demands on our judgment. Our financial results

might have been different if different assumptions had been

used or other conditions had prevailed.

Calculation of the Fair Value of Retained Interests in

Securitization Transactions

The company uses a securitization program to fund

substantially all of the automobile loan receivables originated

by its finance operation, CarMax Auto Finance (“CAF”).The

fair value of retained interests in securitization transactions

includes the present value of the expected residual cash flows

generated by the securitized receivables, the restricted cash on

deposit in various reserve accounts and an undivided

ownership interest in the receivables securitized through a

warehouse facility.The present value of the expected residual

cash flows generated by the securitized receivables is

determined by estimating the future cash flows using

management’s projections of key factors, such as finance

charge income, default rates, prepayment rates and discount

rates appropriate for the type of asset and risk. These

projections are derived from historical experience, projected

economic trends and anticipated interest rates.Adjustments to

one or more of these projections may have a material impact

on the fair value of retained interests.The fair value of retained

interests may be affected by external factors, such as changes

in the behavior patterns of customers, changes in the strength

of the economy and developments in the interest rate markets.

Note 2(C) to the company’s consolidated financial statements

includes a discussion of accounting policies related to

securitizations. Note 12 to the company’s consolidated

financial statements includes a discussion of securitizations.

Revenue Recognition

We recognize revenue when the earnings process is complete,

generally either at the time of sale to a customer or upon

delivery to a customer.The majority of our revenue is from the

sales of used and new vehicles. We recognize vehicle revenue

when a sales contract has been executed and the vehicle has

been delivered, net of a reserve for returns.A reserve for vehicle

returns is recorded based on historical experience and trends.

The estimated reserve for these returns could be affected if

future occurrences differ from historical averages.

The company also sells extended warranties on behalf of

unrelated third parties to customers who purchase a vehicle.

Because these third parties are the primary obligors under

these contracts, the company recognizes extended warranty

revenue at the time of the sale, net of a provision for estimated

warranty returns. The estimates for returns are based on

historical experience and trends.

Defined Benefit Retirement Plans

The plan obligations and related assets of the company’s

defined benefit retirement plans are presented in Note 8 to

the company’s consolidated financial statements. Plan assets,

which consist primarily of marketable equity and debt

instruments, are valued using market quotations. Plan

obligations and the annual pension expense are determined

by independent actuaries using a number of assumptions

provided by the company. Key assumptions in measuring the

plan obligations include the discount rate, the rate of salary

increases and the estimated future return on plan assets. In

determining the discount rate, the company utilizes the yield

MANAGEMENT’S DISCUSSION AND ANALYSIS