CarMax 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2003 35

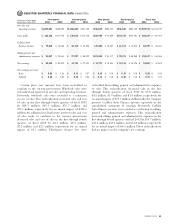

The preparation of financial statements in conformity

with accounting principles generally accepted in the United

States of America requires management to make estimates

and assumptions that affect the reported amounts of assets,

liabilities, revenues and expenses and the disclosure of

contingent assets and liabilities. Actual results could differ

from those estimates.

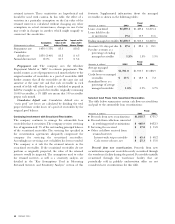

(T) Reclassifications

Certain prior year amounts have been reclassified to

conform to the current presentation. Wholesale sales were

reclassified and reported in net sales and operating revenues.

Previously, wholesale sales were recorded as a reduction to

cost of sales. The reclassification of wholesale sales to sales

increased sales and cost of sales by $325.6 million in fiscal

2002 and $253.5 in fiscal 2001.An additional reclassification

between sales and cost of sales made to conform to the

current presentation decreased sales and cost of sales by $9.1

million in fiscal 2002 and $7.4 million in fiscal 2001.Third-

party finance fees were reclassified and reported in net sales

and operating revenues. Previously, third-party finance fees

were recorded as a reduction to selling, general and

administrative expenses. The reclassification of third-party

finance fees increased sales and selling, general and

administrative expenses by $15.7 million in fiscal 2002 and

$11.5 million in fiscal 2001. Additionally, the company

presents CarMax Auto Finance income separately in the

consolidated statements of earnings. Previously, CarMax

Auto Finance income was recorded as a reduction to selling,

general and administrative expenses. The reclassification of

CarMax Auto Finance income increased selling, general and

administrative expenses by $66.5 million in fiscal 2002 and

$42.7 million in fiscal 2001. These reclassifications had no

impact on the company’s net earnings.

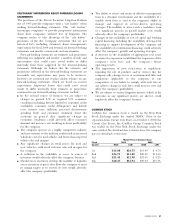

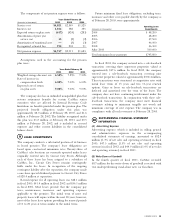

PROPERTY AND EQUIPMENT

Property and equipment, at cost, is summarized as follows:

As of February 28

(Amounts in thousands) 2003 2002

Buildings (25 years) $ 18,381 $—

Land 19,418 3,442

Land held for sale 3,354 8,762

Land held for development 8,021 8,021

Construction in progress 91,938 64,122

Furniture, fixtures and equipment

(5 to 8 years) 86,129 69,435

Leasehold improvements

(8 to 15 years) 21,029 17,281

248,270 171,063

Less accumulated depreciation and

amortization 61,112 50,087

Property and equipment, net $187,158 $120,976

Land held for development represents land owned for

future sites that are scheduled to open more than one year

beyond the fiscal year reported.

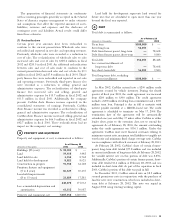

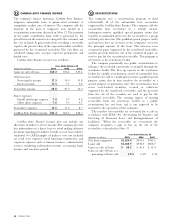

DEBT

Total debt is summarized as follows:

As of February 28

(Amounts in thousands) 2003 2002

Term loan $100,000 $—

Revolving loan 56,051 —

Debt from former parent, long-term —78,608

Debt from former parent, short-term —9,840

Total debt 156,051 88,448

Less current installments of

long-term debt —78,608

Less short-term debt 56,051 9,840

Total long-term debt, excluding

current installments $100,000 $—

In May 2002, CarMax entered into a $200 million credit

agreement secured by vehicle inventory. During the fourth

quarter of fiscal year 2003, the credit agreement was increased

from $200 million to $300 million. The credit agreement

includes a $200 million revolving loan commitment and a $100

million term loan. Principal is due in full at maturity with

interest payable monthly at a LIBOR-based rate. The credit

agreement is scheduled to terminate on May 17, 2004. The

termination date of the agreement will be automatically

extended one year each May 17 unless either CarMax or either

lender elects, prior to the extension date, not to extend the

agreement. As of February 28, 2003, the amount outstanding

under this credit agreement was $156.1 million. Under this

agreement, CarMax must meet financial covenants relating to

minimum current ratio, maximum total liabilities to tangible net

worth ratio and minimum fixed charge coverage ratio. CarMax

was in compliance with all such covenants at February 28, 2003.

At February 28, 2002, CarMax’s share of certain former-

parent, long-term debt totaled $77.8 million and was included

in current installments of long-term debt.At February 28, 2002,

the variable interest rate on this portion of debt was 2.25%.

Additionally, CarMax’s portion of certain former-parent, short-

term debt totaled $1.4 million at February 28, 2002, and was

included in short-term debt. As part of the separation in fiscal

2003, CarMax’s portion of this debt was paid in full.

In December 2001, CarMax entered into an $8.5 million

secured promissory note in conjunction with the purchase of

land for new store construction, which was included in short-

term debt at February 28, 2002. This note was repaid in

August 2002 using existing working capital.

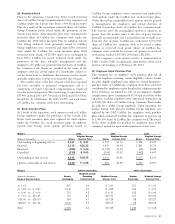

4

3