CarMax 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2003 Cov1

CARMAX, INC. ANNUAL REPORT

FISCAL YEAR 2003

Table of contents

-

Page 1

C A R M A X, I N C. A N N U A L R E P O R T FISCAL YEAR 2003 CARMAX 2003 Cov1 -

Page 2

... 4 Atlanta 4 Dallas/Fort Worth Houston 4 Orlando 1 Tampa 2 3 Miami Chicago 7 SOUTH CAROLINA Los Angeles Sacramento FLORIDA Greenville TENNESSEE 1 Los Angeles Miami Orlando Tampa GEORGIA Knoxville Nashville TEXAS Atlanta ILLINOIS Dallas/Fort Worth Houston San Antonio VIRGINIA Chicago NORTH... -

Page 3

..., separately traded public company. Details of the separation are discussed in "Management's Discussion and Analysis" and the "Notes to Consolidated Financial Statements" contained in this annual report. Before the separation, CarMax was a wholly owned subsidiary of Circuit City Stores, Inc... -

Page 4

... identify a new business opportunity to employ some of Circuit City's skills, capital and people to create significant value for shareholders in the 21st century.We looked in some depth at sporting goods, auto parts, furniture and various other areas trying to find an interesting idea. Our criteria... -

Page 5

... new CarMax board have worked hard to help us put in place a world-class corporate governance process. And most importantly, our 8,000-plus CarMax associates have stayed focused on doing what really matters: buying, reconditioning and selling great quality used cars and providing a superior customer... -

Page 6

... 43 million used cars and light trucks sold, nearly three times as many units as new vehicles sold. CarMax's primary focus-one- to six-year-old vehicles-is a market estimated at $260 billion in annual sales. In comparison, the home improvement market, in which Home Depot and Lowe's compete, is... -

Page 7

...quality with a five-day money-back guarantee, a 30-day warranty and extended service plans we sell that can extend coverage up to six years. Fragmented Competition â- â- â- â- There is no dominant retailer of used cars. We estimate that 65% of late-model-one- to six-year-old-vehicles are sold... -

Page 8

... fiscal 2003, our retail prices averaged more than $1,500 below Kelley Blue Book. â- The price of the extended service plan is competitive and fixed. It is based primarily on the repair history of like makes and models and the length of the coverage the customer prefers. â- The price of financing... -

Page 9

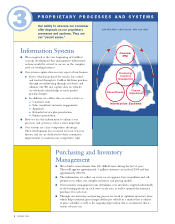

... transportation costs between markets.The store where the customer buys the vehicle is responsible for the sale and for follow-up customer care. Currently, more than 10% of cars sold are transferred at customer request, and more than 15% of sales are through our Internet sales process. CARMAX 2003... -

Page 10

... us to refine our complex inventory and pricing models. Our inventory management team determines core inventory targeted individually to the buying patterns in each store's trade area, as well as optimal discretionary purchases for each store. Through our inventory and pricing process we work to... -

Page 11

... vital part of assuring the best from our associates. Associates in our core store disciplines-sales, service, buying and business operations-receive classroom training and formal mentoring. Online training provides easily accessible continuing education and competency certification. CARMAX 2003 9 -

Page 12

... success. Store Management Teams Our CarMax superstores are the company. Sales, merchandising, reconditioning and service, and business office operations associates are the core of our business.The company's first priority is support for our store associates and store operations, and that support... -

Page 13

...performance excellence. Corporate Management Team Most of our corporate associates are also directly involved in store operations support.We recognize that the key to value creation is our ability to consistently deliver our consumer offer.That's where we focus our time and effort. CARMAX 2003 11 -

Page 14

...T R O N G R E S U LT S The large, stable used car market plus the CarMax consumer offer provides the opportunity for creating shareholder value. Revenue Growth $2,758.5 $3,533.8 $3,969.9 FY03 $20.5 $93.5 $... $(34) $(24) $1 FY00 FY01 FY02 FY03 FY94 FY95 FY96 FY97 FY99 FY98 12 CARMAX 2003 -

Page 15

... FY96 FY97 FY98 FY95 FY99 FY01 2.4% FY02 FY03 FY94 Return on Stockholders' Equity 21% 18% 12% (9)% (7)% 0% FY00 FY01 FY02 FY03 FY99 FY98 Note:The initial public offering of CarMax stock occurred February 7, 1997, and, therefore, the FY97 ROE calculation is not meaningful. CARMAX 2003 13 -

Page 16

... Chicago Louisville DC/Baltimore Richmond Greensboro Raleigh Charlotte Las Vegas Kansas City Nashville Knoxville Los Angeles Memphis Birmingham Dallas/ Fort Worth Houston San Antonio Greenville Atlanta Orlando Tampa Existing Markets (18) New Markets (5) New Satellite Stores (3) Miami... -

Page 17

...optimize our storing as we enter new multi-store markets beyond fiscal 2006. CarMax has a ten-year development advantage over any challenger who decides to copy our business. Building an organization, developing specialized processes and systems, refining execution...all take time. CarMax intends to... -

Page 18

...600 - 1,300 - Comparable Store Used Unit Growth(%) Comparable Store Vehicle Dollar Growth(%) Total Sales Growth(%) 8 6 12 24 28 28 13 17 25 (8) 2 37 (5) (2) 69 6 6 68 7 23 73 12 12 250 19 43 356 - - - Used Car Superstores at Year-End Retail Stores at Year-End Associates at Year-End 40... -

Page 19

..., are valued using market quotations. Plan obligations and the annual pension expense are determined by independent actuaries using a number of assumptions provided by the company. Key assumptions in measuring the plan obligations include the discount rate, the rate of salary increases and... -

Page 20

... rate of earnings expected on the invested funds of the plan. Insurance Liabilities Net Sales and Operating Revenues The company uses a combination of insurance and selfinsurance for a number of risks including workers' compensation, general liability and employee-related health care benefits... -

Page 21

... store implemented the new electronic repair order system, service department sales were impacted based on the time required for the training of service managers and technicians. The increase in fiscal 2002 relates to an overall increase in CarMax's customer base. Appraisal purchase processing fees... -

Page 22

...unit sold were $1,650 in fiscal 2003 and $1,660 in fiscal 2002 and 2001. In fiscal 2002, although CarMax achieved its specific used vehicle gross profit dollar targets per vehicle, increased average retail prices resulting from a higher mix of later-model used cars, luxury vehicles and sport utility... -

Page 23

... CarMax Auto Finance is the company's finance operation. CAF's lending business is limited to providing prime auto loans for CarMax's used and new car sales. Because the purchase of an automobile traditionally is reliant on the consumer's ability to obtain on-the-spot financing, it is important... -

Page 24

... related to independent company activity, such as the New York Stock Exchange listing, Securities and Exchange Commission filings and the cost of a board of directors. The increase in the expense ratio during fiscal 2003 was offset in part by comparable store sales growth, improved operational... -

Page 25

... per share data) First Quarter 2003 2002 Second Quarter 2003 2002 Third Quarter 2003 2002 Fourth Quarter 2003 2002 Fiscal Year 2003 2002 Net sales and operating revenues Gross profit CarMax Auto Finance income Selling, general and administrative expenses Separation costs $1,005,803 $882,825... -

Page 26

... spreads in order to maintain our competitive consumer offer.As the spread between the cost of funds and the retail interest rate paid by consumers ultimately returns to more normal levels, CAF's contribution as a percent of sales is expected to decrease. RECENT ACCOUNTING PRONOUNCEMENTS In August... -

Page 27

...-time special dividend to Circuit City Stores of $28.4 million, as well as the payment of separation expenses, and for general CarMax Auto Finance is the company's finance operation. CAF's lending business is limited to providing prime auto loans for CarMax's used and new car sales.The company uses... -

Page 28

... impact on cash and cash flows. Credit risk is the exposure to nonperformance of another party to an agreement. Credit risk is mitigated by dealing with highly rated bank counterparties. The market and credit risks associated with financial derivatives are similar to those relating to other types of... -

Page 29

... City Stores on October 1, 2002, the Circuit City Stores, Inc.-CarMax Group Common Stock was traded on the New York Stock Exchange under the same symbol. No dividend data is shown since the company pays no dividends at this time. Fiscal Quarter Market Price of Common Stock 2003 2002 LOW HIGH HIGH... -

Page 30

...2003 %(1) 2001 %(1) SALES AND OPERATING REVENUES: Used vehicle sales New vehicle sales Wholesale vehicle sales Other sales and revenues NET SALES AND OPERATING...- 2.7 1.0 1.7 Cost of sales GROSS PROFIT CARMAX AUTO FINANCE INCOME (NOTES 11 and 12) Selling, general and administrative expenses (... -

Page 31

...28 (Amounts in thousands except share data) 2003 2002 ASSETS CURRENT ASSETS: Cash and cash equivalents (NOTE 2) Accounts receivable, net Automobile loan receivables held for sale (NOTE 12) Retained interests in securitized receivables (NOTE 12) Inventory Prepaid expenses and other current assets... -

Page 32

... sales of property and equipment NET CASH (USED IN) PROVIDED BY INVESTING ACTIVITIES - (122,032) 41,621 (80,411) - (41,417) 98,965 57,548 (1,325) (10,834) 15,506 3,347 FINANCING ACTIVITIES: Increase (decrease) in short-term debt, net Issuance of long-term debt Payments on long-term debt Equity... -

Page 33

... - Special dividend - Recapitalization due to separation 103,014 Exercise of common stock options 39 Shares purchased for employee stock purchase plan - Shares issued under stock incentive plans 30 Tax benefit from stock issued - Unearned compensation-restricted stock - BALANCE AT FEBRUARY 28, 2003... -

Page 34

... a full range of related services, including the financing of vehicle purchases through its own finance operation, CarMax Auto Finance ("CAF"), and third-party lenders, the sale of extended warranties and vehicle repair service. On September 10, 2002, Circuit City Stores shareholders, which included... -

Page 35

...the plan obligations include the discount rate, the rate of salary increases and the estimated future return on plan assets. Insurance liability estimates for workers' compensation, general liability and employee-related health care benefits are determined by considering historical claims experience... -

Page 36

... average assumptions used in the model are as follows: Fiscal 2003 2002 2001 The company accounts for its stock-based compensation plans under the recognition and measurement principles of Accounting Principles Board Opinion ("APB") No. 25, "Accounting for Stock Issued to Employees," and related... -

Page 37

... in full. In December 2001, CarMax entered into an $8.5 million secured promissory note in conjunction with the purchase of land for new store construction, which was included in shortterm debt at February 28, 2002. This note was repaid in August 2002 using existing working capital. CARMAX 2003 35 -

Page 38

...federal benefit Non-deductible separation costs Effective income tax rate 35.0% 3.0 1.5 39.5% 35.0% 3.0 - 38.0% 35.0% 3.0 - 38.0% In conjunction with the separation from Circuit City Stores, a shareholder rights plan was adopted. CarMax, Inc. shareholders received preferred stock purchase rights... -

Page 39

...of February 28, 2003. (D) Employee Stock Purchase Plan As a result of the separation, stock options issued to CarMax Group employees under the provisions of the Circuit City Stores stock incentive plan were replaced by stock options under the CarMax, Inc. stock incentive plans. In addition, Circuit... -

Page 40

... of full-time employees who are at least age 21 and have completed one year of service. The cost of the program is being funded currently. Plan benefits generally are based on years of service and average compensation. The company's contributions were $2.3 million in fiscal 2003, $1.3 million in... -

Page 41

... Total minimum lease payments $ 48,200 48,200 47,500 46,000 46,300 509,600 $745,800 Assumptions used in the accounting for the pension plan were: Years Ended February 28 2003 2002 2001 Weighted average discount rate Rate of increase in compensation levels Expected rate of return on plan assets... -

Page 42

... The company's finance operation, CarMax Auto Finance, originates automobile loans to prime-rated customers at competitive market rates of interest. The company sells the majority of the loans it originates each month in a securitization transaction discussed in Note 12. The majority of the profit... -

Page 43

... receivables is determined by estimating the future cash flows using management's projections of key factors, such as finance charge income, default rates, prepayment rates and discount rates appropriate for the type of asset and risk. The value of interest-only strip receivables may be affected... -

Page 44

...%-2.40% Annual discount rate 12.0% $5.3 $3.2 $1.7 $10.2 $ 6.5 $ 3.4 27.6 1.5% 2003 1.5% Fiscal 2002 1.5% 2001 Prepayment rate. The company uses the Absolute Prepayment Model or "ABS" to estimate prepayments. This model assumes a rate of prepayment each month relative to the original number of... -

Page 45

... servicing fees. It includes cash collected on interestonly strip receivables and amounts released to the company from restricted cash accounts. Financial Covenants and Performance Triggers The market and credit risks associated with interest rate swaps are similar to those relating to other types... -

Page 46

... application of the provisions of SFAS No. 143 to have an impact on its financial position, results of operations or cash flows. In June 2002, the FASB issued SFAS No. 146,"Accounting for Costs Associated with Exit or Disposal Activities." This statement addresses financial accounting and reporting... -

Page 47

... FINANCIAL DATA (UNAUDITED) First Quarter 2003 2002 Second Quarter 2003 2002 Third Quarter 2003 2002 Fourth Quarter 2003 2002 Fiscal Year 2003 2002 (Amounts in thousands except per share data) Net sales and operating revenues Gross profit CarMax Auto Finance income $1,005,803 $ 122,142 $882... -

Page 48

...' REPORT To the Board of Directors and Stockholders CarMax, Inc.: We have audited the accompanying consolidated balance sheets of CarMax, Inc. and subsidiaries (the "Company") as of February 28, 2003 and 2002, and the related consolidated statements of earnings, stockholders' equity and cash flows... -

Page 49

...J. FOLLIARD EXECUTIVE VICE PRESIDENT STORE OPERATIONS MICHAEL K. DOLAN SENIOR VICE PRESIDENT CHIEF INFORMATION OFFICER JOSEPH S. KUNKEL SENIOR VICE PRESIDENT MARKETING AND STRATEGY STUART A. HEATON VICE PRESIDENT GENERAL COUNSEL CORPORATE SECRETARY EDWIN J. HILL VICE PRESIDENT SERVICE OPERATIONS KIM... -

Page 50

...THE BOARD private investor Retired Chairman and Chief Executive Officer Circuit City Stores, Inc. a consumer electronics specialty retailer Richmond, Virginia KEITH D. BROWNING EXECUTIVE VICE PRESIDENT CHIEF FINANCIAL OFFICER JEFFREY E. GARTEN Dean Yale School of Management Yale University New Haven... -

Page 51

... RIGHTS AGENT Wells Fargo Bank Minnesota, N.A. South St. Paul, Minnesota ANNUAL MEETING June 24, 2003, 10:00 a.m. The Sheraton Richmond West Hotel 6624 West Broad Street Richmond, Virginia I N V E S T O R I N F O R M AT I O N Investor Web site: http://investor.carmax.com Quarterly sales and... -

Page 52

CARMAX, INC. 4900 COX ROAD GLEN ALLEN VA 23060-6295 (804) 747-0422 www.carmax.com