CVS 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 CVS CAREMARK

Notes to Consolidated Financial Statements

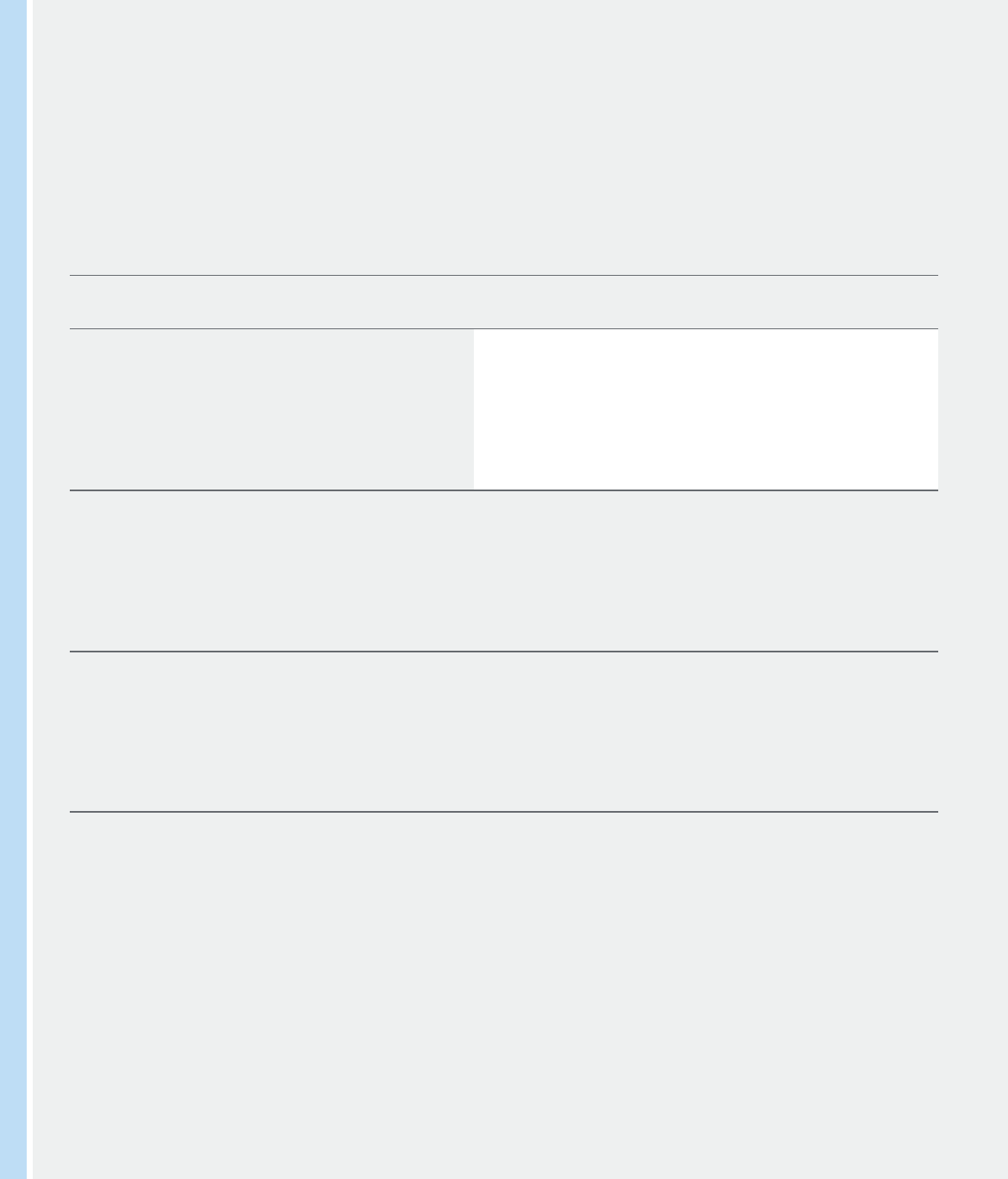

BUSINESS SEGMENTS

The Company currently operates two business segments:

Pharmacy Services and Retail Pharmacy. The operating seg-

ments are businesses of the Company for which separate

fi nancial information is available and for which operating results

are evaluated on a regular basis by executive management in

deciding how to allocate resources and in assessing performance.

The Company’s business segments offer different products and

services and require distinct technology and marketing strategies.

The Company evaluates segment performance based on

net revenues, gross profi t and operating profi t before the effect

of certain intersegment activities and charges. See Note 1

previously in this document for a description of the Pharmacy

Services and Retail Pharmacy businesses and related signifi cant

accounting policies.

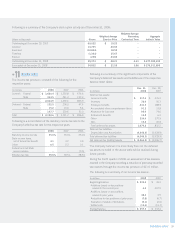

Following is a reconciliation of the Company’s business segments to the consolidated fi nancial statements:

Pharmacy Retail

Services Pharmacy Intersegment Consolidated

In millions Segment(1) Segment Eliminations(2) Totals

2008:

Net revenues $ 43,769.2 $ 48,989.9 $ (5,287.2) $ 87,471.9

Gross profi t 3,550.0 14,740.4 18,290.4

Operating profi t 2,562.5 3,483.7 6,046.2

Depreciation and amortization 355.0 919.2 1,274.2

Total assets 32,904.1 28,404.5 (348.7) 60,959.9

Goodwill 18,817.6 6,676.3 25,493.9

Additions to property and equipment 252.9 1,927.0 2,179.9

2007:

Net revenues $ 34,938.4 $ 45,086.5 $ (3,695.4) $ 76,329.5

Gross profi t 2,997.1 13,110.6 16,107.7

Operating profi t 2,102.0 2,691.3 4,793.3

Depreciation and amortization 289.3 805.3 1,094.6

Total assets 32,133.4 22,844.3 (255.8) 54,721.9

Goodwill 18,454.9 5,467.4 23,922.3

Additions to property and equipment 94.1 1,711.2 1,805.3

2006:

Net revenues $ 3,691.3 $ 40,285.6 $ (155.5) $ 43,821.4

Gross profi t 458.8 11,283.4 11,742.2

Operating profi t 318.1 2,123.5 2,441.6

Depreciation and amortization 41.4 691.9 733.3

Total assets 1,603.4 19,038.8 (68.1) 20,574.1

Goodwill 622.8 2,572.4 3,195.2

Additions to property and equipment 18.4 1,750.5 1,768.9

(1) Net Revenues of the Pharmacy Services Segment include approximately $6,348.3 million and $4,618.2 million of Retail Co-Payments in 2008 and 2007

respectively.

(2) Intersegment eliminations relate to intersegment revenues and accounts receivable that occur when a Pharmacy Services Segment customer uses a Retail

Pharmacy Segment store to purchase covered products. When this occurs, both segments record the revenue on a standalone basis.

NO 13