CVS 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 ANNUAL REPORT 57

beginning of the offering period) using the Black-Scholes Option

Pricing Model and is recorded as a liability, which is adjusted to

refl ect the fair value of the award at the end of each reporting

period until settlement date.

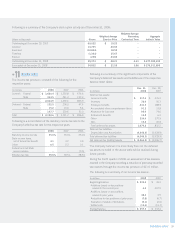

Following is a summary of the assumptions used to value the

ESPP awards for each of the respective periods:

2008 2007 2006

Dividend yield(1) 0.32% 0.33% 0.26%

Expected volatility(2) 25.22% 21.72% 26.00%

Risk-free interest rate(3) 2.75% 5.01% 5.08%

Expected life (in years)(4) 0.5 0.5 0.5

(1) The dividend yield is calculated based on semi-annual dividends paid

and the fair market value of the Company’s stock at the period end date.

(2) The expected volatility is based on the historical volatility of the Com-

pany’s daily stock market prices over the previous six month period.

(3) The risk-free interest rate is based on the Treasury constant maturity

interest rate whose term is consistent with the expected term of ESPP

options (i.e., 6 months).

(4) The expected life is based on the semi-annual purchase period.

The Company’s 1997 Incentive Compensation Plan (the “ICP”)

provides for the granting of up to 152.8 million shares of common

stock in the form of stock options and other awards to selected

offi cers, employees and directors of the Company. The ICP allows

for up to 7.2 million restricted shares to be issued. The Company’s

restricted awards are considered nonvested share awards as

defi ned under SFAS No. 123(R). The restricted awards require

no payment from the employee. Compensation cost is recorded

based on the market price on the grant date and is recognized

on a straight-line basis over the requisite service period.

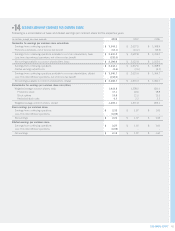

The Company granted 1,274,000, 1,129,000, and 673,000

restricted stock units with a weighted average fair value of

$40.70, $33.75, and $29.40 in 2008, 2007, and 2006, respec-

tively. In addition, the Company granted 5,000 shares of restricted

stock with a weighted average per share grant date fair value of

$28.71 in 2006. Compensation costs for restricted shares and

units totaled $18.9 million in 2008, $12.1 million in 2007, and

$9.2 million in 2006, respectively.

In 2007, the Board of Directors adopted and shareholders

approved the 2007 Incentive Plan. The terms of the 2007

Incentive Plan provide for grants of annual incentive and

long-term performance awards to executive offi cers and other

offi cers and employees of the Company or any subsidiary of

the Company. The payment of such annual incentive and

long-term performance awards will be in cash, stock, other

awards or other property, in the discretion of the Management

Planning and Development Committee of the Company’s

Board of Directors, with any payment in stock to be pursuant

to the ICP discussed previously in this document.

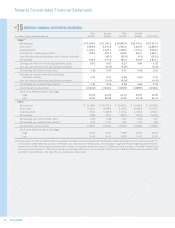

STOCK INCENTIVE PLANS

On January 1, 2006, the Company adopted SFAS No. 123(R),

“Share-Based Payment,” using the modifi ed prospective transition

method. Under this method, compensation expense is recog-

nized for options granted on or after January 1, 2006 as well as

any unvested options on the date of adoption. Compensation

expense for unvested stock options outstanding at January 1,

2006 is recognized over the requisite service period based on the

grant-date fair value of those options and awards as previously

calculated under the SFAS No. 123(R) pro forma disclosure

requirements. As allowed under the modifi ed prospective

transition method, prior period fi nancial statements have not

been restated. Prior to January 1, 2006, the Company accounted

for its stock-based compensation plans under the recognition and

measurement principles of APB No. 25, “Accounting for Stock

Issued to Employees,” and related interpretations. As such, no

stock-based employee compensation costs were refl ected in net

earnings for options granted under those plans since they had an

exercise price equal to the fair market value of the underlying

common stock on the date of grant.

Compensation expense related to stock options, which includes

the 1999 Employee Stock Purchase Plan (the “1999 ESPP”)

and the 2007 Employee Stock Purchase Plan (the “2007 ESPP”

and collectively, the “ESPP”) totaled $106.3 million for 2008,

compared to $84.5 million for 2007. The recognized tax ben-

efi t was $33.2 million and $26.9 million for 2008 and 2007,

respectively. Compensation expense related to restricted stock

awards totaled $18.9 million for 2008, compared to $12.1 million

for 2007. Compensation costs associated with the Company’s

share-based payments are included in selling, general and

administrative expenses.

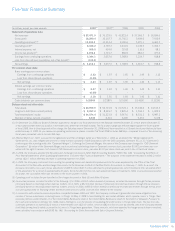

The 1999 ESPP provides for the purchase of up to 14.8 million

shares of common stock. As a result of the 1999 ESPP not having

suffi cient shares available for the program to continue beyond

2007, the Board of Directors adopted, and shareholders approved,

the 2007 ESPP. Under the 2007 ESPP, eligible employees may

purchase common stock at the end of each six-month offering

period, at a purchase price equal to 85% of the lower of the fair

market value on the fi rst day or the last day of the offering period

and provides for the purchase of up to 15.0 million shares of

common stock. During 2008, 2.2 million shares of common

stock were purchased, under the provisions of the 1999 ESPP, at

an average price of $35.67 per share. As of December 31, 2008,

14.8 million shares of common stock have been issued under

the 1999 ESPP. As of December 31, 2008, 1.4 million shares of

common stock had been issued under the 2007 ESPP.

The fair value of stock compensation expense associated with

the Company’s ESPP is estimated on the date of grant (i.e., the

NO 10