CVS 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 ANNUAL REPORT 29

• Our pharmacy gross profi t rates have been adversely affected

by the efforts of managed care organizations, pharmacy

benefi t managers and governmental and other third party

payors to reduce their prescription drug costs. In the event

this trend continues, we may not be able to sustain our

current rate of revenue growth and gross profi t dollars could

be adversely impacted.

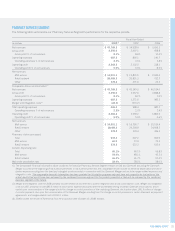

Total operating expenses, which include store and administrative

payroll, employee benefi ts, store and administrative occupancy

costs, selling expenses, advertising expenses, administrative

expenses and depreciation and amortization expense decreased

to 23.0% of net revenues in 2008, compared to 23.1% and

22.7% of net revenues in 2007 and 2006, respectively.

As you review our Retail Pharmacy Segment’s performance in

this area, we believe you should consider the following impor-

tant information:

• During 2008, total operating expenses as a percentage

of net revenues continued to be impacted by an increase in

generic drug revenues. Generic drugs typically have a lower

selling price than their brand named equivalents.

• Total operating expenses as a percentage of net revenues

increased during 2007 and 2006, due to increased store payroll

costs, primarily driven by the stores acquired in the Albertson’s

Acquisition, which operate at higher costs due to the geo-

graphic locations of the stores.

• Total operating expenses for 2006 were reduced by $40.2 mil-

lion due to the adoption of SAB 108.

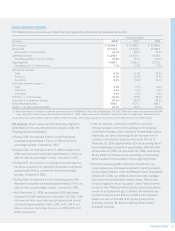

LIQUIDITY AND CAPITAL RESOURCES

Net cash provided by operating activities increased to

$3.9 billion in 2008. This compares to $3.2 billion in 2007

and $1.7 billion in 2006. 2008 includes a full year of net cash

provided by operating activities from Caremark, compared to

2007, which includes Caremark from the merger date (March 22,

2007) forward. 2008 also includes net cash provided by operat-

ing activities from the Longs Drug Stores and RxAmerica from the

acquisition date (October 20, 2008) forward. The increase in net

cash provided by operations during 2007 was primarily due to an

increase in cash receipts from revenues due to the Caremark

Merger and improved operating performance. The increase in net

cash provided by operating activities during 2006 was primarily

due to an increase in cash receipts from revenues received from

the stores acquired in the Albertson’s Acquisition and improved

operating performance.

Net cash used in investing activities increased to $4.6 billion

in 2008. This compares to $3.1 billion in 2007 and $4.6 billion in

2006. The increase in net cash used in investing activities during

2008 was primarily due to the Longs Acquisition. The $3.1 billion

of net cash used in investing activities during 2007 was primarily

due to the Caremark Merger. The increase in net cash used in

investing activities during 2006 was primarily due to the

Albertson’s Acquisition.

Gross capital expenditures totaled $2.2 billion during 2008,

compared to $1.8 billion in 2007 and 2006. During 2008,

approximately 58.3% of our total capital expenditures were

for new store construction, 16.4% were for store expansion

and improvements and 25.3% were for technology and other

corporate initiatives. During 2009, we plan to invest over

$2.8 billion in gross capital expenditures, which will include

spending for approximately 250-300 new or relocated stores.

Under the Company’s fee-based preferred developer program,

the Company directly funds approximately 65% of its new and

relocation store projects and typically monetizes those projects in

the institutional sale-leaseback market. Proceeds from sale-lease-

back transactions totaled $203.8 million in 2008. This compares

to $601.3 million in 2007 and $1.4 billion in 2006, which

included approximately $800 million in proceeds associated with

a sale-leaseback transaction that included certain properties

acquired in the Albertson’s Acquisition. Under the sale-leaseback

transactions, the properties are sold at fair value, which approxi-

mates net book value, and the resulting leases qualify and are

accounted for as operating leases. During 2008, we delayed our

scheduled fourth quarter sale-leaseback transaction because of

unfavorable market conditions. The specifi c timing and amount of

future sale-leaseback transactions will vary depending on future

market conditions and other factors.

Following is a summary of our store development activity for the

respective years:

2008 2007 2006

Total stores (beginning of year) 6,301 6,205 5,474

New and acquired stores 719 140 848

Closed stores (39) (44) (117)

Total stores (end of year) 6,981 6,301 6,205

Relocated stores(1) 129 137 118

(1) Relocated stores are not included in new or closed store totals.