CVS 2008 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2008 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 ANNUAL REPORT 21

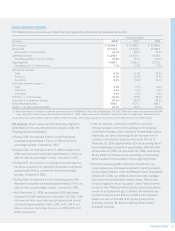

Gross profi t increased $2.2 billion and $4.4 billion during

2008 and 2007, respectively. As you review our performance

in this area, we believe you should consider the following

important information:

• During 2008, the Caremark Merger increased gross profi t by

approximately $553 million, compared to 2007. 2008 includes

a full year of gross profi t from Caremark, compared to 2007,

which includes gross profi t from Caremark from the merger

date (March 22, 2007) forward.

• During 2008, the Longs Acquisition increased gross profi t by

approximately $314 million, compared to 2007. 2008 includes

gross profi t from the Longs Drug Stores and RxAmerica from

the acquisition date (October 20, 2008) forward.

• During 2008, the 4 additional days in the 2008 reporting period

increased gross profi t by approximately $238 million, compared

to 2007.

• During 2008 and 2007, our gross profi t benefi ted from

signifi cant purchasing synergies from the Caremark Merger.

• In addition, our gross profi t continued to benefi t from the

increased utilization of generic drugs (which normally yield a

higher gross profi t rate than equivalent brand name drugs) in

both the Pharmacy Services and Retail Pharmacy Segments.

Please see the Segment Analysis later in this document for

additional information about our gross profi t.

Operating expenses increased $929.8 million and $2.0 billion

during 2008 and 2007, respectively. As you review our perfor-

mance in this area, we believe you should consider the following

important information:

• During 2008, the Caremark Merger increased total operating

expenses by approximately $92 million, compared to 2007.

2008 includes a full year of operating expenses from Caremark,

compared to 2007, which includes operating expenses from

Caremark from the merger date (March 22, 2007) forward.

• During 2008, the Longs Acquisition increased total operating

expenses by approximately $260 million, compared to 2007.

2008 includes operating expenses from the Longs Drug

Stores and RxAmerica from the acquisition date (October 20,

2008) forward.

• During 2008, the 4 additional days in the 2008 reporting

period increased total operating expenses by approximately

$146 million, compared to 2007.

• During 2007, our total operating expenses increased primarily

due to the Caremark Merger, which resulted in incremental

operating expenses, depreciation and amortization related to the

intangible assets acquired and merger-related integration costs.

• Total operating expenses for 2006 were reduced by

$40.2 million due to the adoption of Staff Accounting Bulletin

No. 108, “Considering the Effects of Prior Year Misstatements

when Quantifying Misstatements in Current Year Financial

Statements” (“SAB 108”).

Please see the Segment Analysis later in this document for

additional information about operating expenses.

Interest expense, net consisted of the following:

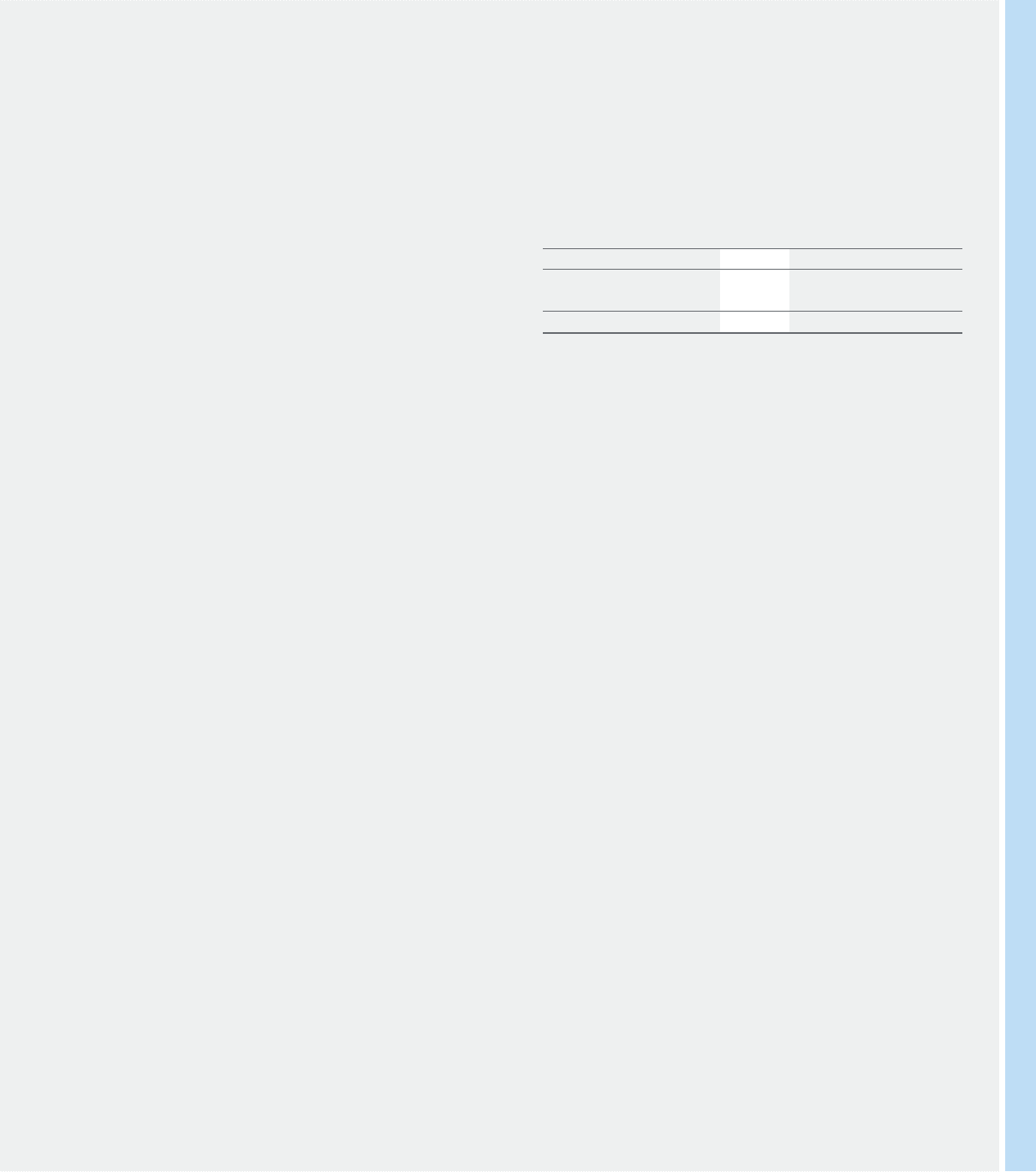

In millions 2008 2007 2006

Interest expense $ 529.8 $ 468.3 $ 231.7

Interest income (20.3) (33.7) (15.9)

Interest expense, net $ 509.5 $ 434.6 $ 215.8

During 2008, net interest expense increased by $74.9 million,

compared to 2007, due to a combination of higher interest rates

and an increase in our average debt balance, which resulted

primarily from the borrowings used to fund an accelerated share

repurchase program and the Longs Acquisition.

During 2007, net interest expense increased by $218.8 million,

compared to 2006, due to an increase in our average debt

balance, which resulted primarily from the borrowings used to

fund the special cash dividend paid to Caremark shareholders

and the accelerated share repurchase program that com-

menced subsequent to the Caremark Merger.

During 2006, net interest expense increased by $105.3 million,

compared to 2005, due to a combination of higher interest rates

and higher average debt balances, which resulted from the

borrowings used to fund the Albertson’s Acquisition.

Income tax provision. Our effective income tax rate was 39.6%

in 2008, 39.5% in 2007 and 38.5% in 2006.

As you review our results in this area, we believe you should

consider the following important information:

• During 2008 and 2007, our effective income tax rate was

negatively impacted by an increase in interest on income tax

reserves and higher state income taxes primarily due to the

Caremark Merger, which resulted in a change in the distribution

of our income between states.

• During the fourth quarter of 2006, the Company recorded

reductions of previously recorded income tax reserves through

the income tax provision of $11.0 million. For internal compari-

sons, we fi nd it useful to assess year-to-year performance by

excluding the effect of this reversal from our 2006 results. As

such, we consider 39.0% to be our comparable effective

income tax rate for 2006.