CVS 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 CVS CAREMARK

Notes to Consolidated Financial Statements

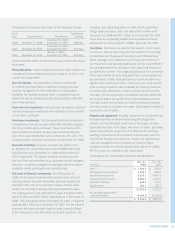

Indefi nitely-lived intangible assets are tested by comparing

the estimated fair value of the asset to its carrying value. If the

carrying value of the asset exceeds its estimated fair value, an

impairment loss is recognized and the asset is written down to

its estimated fair value.

The carrying amount of goodwill was $25.5 billion and

$23.9 billion as of December 31, 2008 and December 29,

2007, respectively. During 2008, goodwill increased primarily

due to the Longs Acquisition.

The carrying amount of indefi nitely-lived assets was $6.4 billion

as of December 31, 2008 and December 29, 2007.

Intangible assets with fi nite useful lives are amortized over

their estimated useful lives. The increase in the gross carrying

amount of the Company’s amortizable intangible assets was

primarily due to the preliminary purchase price allocations

(which may change and the result of such changes, if any,

may be material) the Company recorded in connection with the

Longs Acquisition. Amortization expense for intangible assets

totaled $405.0 million in 2008, $344.1 million in 2007 and

$161.2 million in 2006. The anticipated annual amortization

expense for these intangible assets is $421.4 million in 2009,

$408.8 million in 2010, $399.0 million in 2011, $376.3 million

in 2012 and $355.0 million in 2013.

GOODWILL AND OTHER INTANGIBLES

The Company accounts for goodwill and intangibles under

SFAS No. 142, “Goodwill and Other Intangible Assets.” Under

SFAS No. 142, goodwill and other indefi nitely-lived assets are not

amortized, but are subject to annual impairment reviews, or more

frequent reviews if events or circumstances indicate an impair-

ment may exist.

When evaluating goodwill for potential impairment, the Company

fi rst compares the fair value of the reporting unit, based on

estimated future discounted cash fl ows, to its carrying amount.

If the estimated fair value of the reporting unit is less than its

carrying amount, an impairment loss calculation is prepared. The

impairment loss calculation compares the implied fair value of a

reporting unit’s goodwill with the carrying amount of its goodwill.

If the carrying amount of the goodwill exceeds the implied fair

value, an impairment loss is recognized in an amount equal to the

excess. During the third quarter of 2008, the Company performed

its required annual goodwill impairment tests. The Company

concluded there were no goodwill impairments as of the testing

date or December 31, 2008.

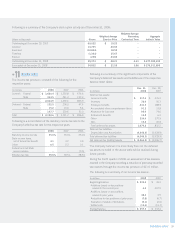

Following is a summary of the Company’s intangible assets as of the respective balance sheet dates:

Dec. 31, 2008 Dec. 29, 2007

Gross Gross

Carrying Accumulated Carrying Accumulated

In millions Amount Amortization Amount Amortization

Trademarks (indefi nitely-lived) $ 6,398.0 $ – $ 6,398.0 $ –

Customer contracts and relationships and Covenants

not to compete 4,748.8 (1,240.4) 4,444.1 (876.9)

Favorable leases and Other 719.3 (179.5) 623.0 (158.6)

$ 11,866.1 $ (1,419.9) $ 11,465.1 $ (1,035.5)

NO 3