CVS 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 ANNUAL REPORT 51

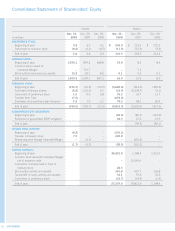

Following is a summary of the assets acquired and liabilities

assumed as of March 22, 2007.

Assets Acquired and Liabilities Assumed as of March 22, 2007

In millions

Cash and cash equivalents $ 1,293.4

Short-term investments 27.5

Accounts receivable 2,472.7

Inventories 442.3

Deferred tax asset 95.4

Other current assets 31.2

Total current assets 4,362.5

Property and equipment 305.3

Goodwill 20,924.3

Intangible assets(1) 9,319.7

Other assets 67.2

Total assets acquired 34,979.0

Accounts payable 960.8

Claims and discounts payable 2,430.1

Accrued expenses(2) 1,062.9

Total current liabilities 4,453.8

Deferred tax liability 3,581.4

Other long-term liabilities 93.2

Total liabilities 8,128.4

Net assets acquired $ 26,850.6

(1) Intangible assets include customer contracts and relationships ($2.9 bil-

lion) with an estimated weighted average life of 14.7 years, proprietary

technology ($108.1 million) with an estimated weighted average life

of 3.5 years, net favorable leasehold interests ($12.7 million) with an

estimated weighted average life of 6.2 years, covenants not to compete

($9.0 million) with an estimated average life of 2 years and trade names

($6.4 billion), which are indefi nitely lived.

(2) Accrued expenses include $54.9 million for estimated severance, ben-

efi ts and outplacement costs for approximately 340 Caremark employees

terminated in connection with the Caremark Merger. As of December 31,

2008, $49.7 million of the liability has been settled with cash payments.

The remaining liability will require future cash payments through 2009.

In addition, effective October 20, 2008, the Company acquired

Longs Drug Stores Corporation for approximately $2.6 billion

(the “Longs Acquisition”). The fair value of the assets acquired

and liabilities assumed were $4.4 billion and $1.8 billion,

respectively. The merger was accounted for using the purchase

method of accounting under SFAS 141. The Longs Acquisition

included 529 retail drug stores, RxAmerica, LLC, which provides

pharmacy benefi t management services and Medicare Part D

benefi ts and other related assets. The Company’s results of

operations and cash fl ows include the Longs Acquisition begin-

ning October 20, 2008.

and valuations techniques used to measure the fair value of plan

assets and signifi cant concentrations of risks within plan assets.

This statement is effective for fi nancial statements issued for fi scal

years ending after December 15, 2009. The Company is currently

evaluating the potential impact the adoption of this statement may

have on its consolidated fi nancial statement disclosures.

BUSINESS COMBINATIONS

Caremark Merger

Effective March 22, 2007, pursuant to the Agreement and Plan of

Merger dated as of November 1, 2006, as amended (the “Merger

Agreement”), Caremark Rx, Inc. was merged with a newly formed

subsidiary of CVS Corporation, with Caremark Rx, Inc., L.L.C.

(“Caremark”) continuing as the surviving entity (the “Caremark

Merger”). Following the merger, the Company changed its name

to CVS Caremark Corporation.

Under the terms of the Merger Agreement, Caremark shareholders

received 1.67 shares of common stock, par value $0.01 per

share, of the Company for each share of common stock of

Caremark, par value $0.001 per share, issued and outstanding

immediately prior to the effective time of the merger. In addition,

Caremark shareholders of record as of the close of business on

the day immediately preceding the closing date of the merger

received a special cash dividend of $7.50 per share.

The merger was accounted for using the purchase method of

accounting under SFAS No. 141, “Business Combinations”

(“SFAS 141”) using the purchase method of accounting. Under

the purchase method of accounting, CVS Corporation is consid-

ered the acquirer of Caremark for accounting purposes and the

total purchase price was allocated to the assets acquired and

liabilities assumed from Caremark based on their fair values as of

March 22, 2007. Under the purchase method of accounting, the

total consideration was approximately $26.9 billion and includes

amounts related to Caremark common stock ($23.3 billion),

Caremark stock options ($0.6 billion) and special cash dividend

($3.2 billion), less shares held in trust ($0.3 billion). The consid-

eration associated with the common stock and stock options was

based on the average closing price of CVS common stock for the

fi ve trading days ending February 14, 2007, which was $32.67

per share. The difference between the total consideration paid

and the amounts allocated to the assets acquired and liabilities

assumed has been recognized as goodwill in the accompanying

consolidated balance sheets. The results of the operations of

Caremark have been included in the consolidated statements of

operations since March 22, 2007.

NO 2