CVS 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 CVS CAREMARK

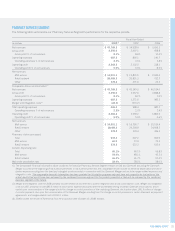

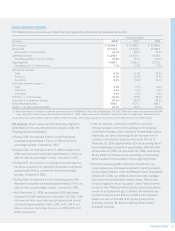

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

• Pharmacy revenue dollars continue to be negatively impacted in

all years by the conversion of brand named drugs to equivalent

generic drugs, which typically have a lower selling price. In

addition, our pharmacy growth has also been adversely affected

by a decline in utilization trends attributable to a weakening

economy which could continue in 2009, a decline in the

number of signifi cant new brand named drug introductions,

higher consumer co-payments and co-insurance arrangements,

and an increase in the number of over-the-counter remedies

that were historically only available by prescription.

Gross profi t, which includes net revenues less the cost of

merchandise sold during the reporting period and the related

purchasing costs, warehousing costs, delivery costs and actual

and estimated inventory losses, as a percentage of net revenues

was 30.1% in 2008. This compares to 29.1% in 2007 and

28.0% in 2006.

As you review our Retail Pharmacy Segment’s performance

in this area, we believe you should consider the following

important information:

• During 2008, our front store revenues increased to 32.5%

of total revenues, compared to 32.2% and 31.6% in 2007 and

2006, respectively. The increase in 2008 is primarily due to the

Longs Drug stores, which are larger than CVS/pharmacy stores

and devote more square footage to front store offerings, as well

as, the increase in generic drug revenues. On average, our

gross profi t on front store revenues is higher than our average

gross profi t on pharmacy revenues.

• During 2008, our front store gross profi t rate continued to benefi t

from improved product mix (including increases in private label

and proprietary brand product sales, which normally yield a

higher gross profi t rate than other front store products) and

benefi ts derived from our ExtraCare loyalty program.

• During 2008, our pharmacy gross profi t rate continued to

benefi t from a portion of the purchasing synergies resulting

from the Caremark Merger.

• During 2008, our pharmacy gross profi t rate continued to

benefi t from an increase in generic drug revenues, which

normally yield a higher gross profi t rate than equivalent brand

name drug revenues. However, the increased use of generic

drugs has augmented the efforts of third party payors to reduce

reimbursement payments to retail pharmacies for prescriptions.

This trend, which we expect to continue, reduces the benefi t

we realize from brand to generic product conversions.

• Sales to customers covered by third party insurance programs

have continued to increase and, thus, have become a larger

component of our total pharmacy business. On average, our

gross profi t on third party pharmacy revenues is lower than our

gross profi t on cash pharmacy revenues. Third party pharmacy

revenues were 96.1% of pharmacy revenues in 2008, compared

to 95.3% and 94.7% of pharmacy revenues in 2007 and 2006,

respectively. We expect this trend to continue.

• The Federal Government’s Medicare Part D benefi t is increasing

prescription utilization. However, it is also decreasing our

pharmacy gross profi t rates as our higher gross profi t business

(e.g., cash customers) continued to migrate to Part D coverage

during 2008.

• On February 8, 2006, the Defi cit Reduction Act of 2005 (the

“DRA”) was signed into law. The DRA seeks to reduce federal

spending by altering the Medicaid reimbursement formula for

multi-source (i.e., generic) drugs. According to the Congressional

Budget Offi ce, retail pharmacies are expected to negotiate

with individual states for higher dispensing fees to mitigate the

adverse effect of these changes. These changes were sched-

uled to begin to take effect during the fi rst quarter of 2007 and

were expected to result in reduced Medicaid reimbursement

rates for retail pharmacies.

During 2007, CMS issued a fi nal rule implementing provisions

under the DRA regarding prescription drugs under the Medicaid

program. Among other things, the rule defi nes AMP and “best

price,” and specifi es the items that must be included and

excluded in the calculation of each (the “AMP Rule”). Under

the AMP Rule, which became effective October 1, 2007, sales to

mail pharmacies would be included in the calculation of AMP, but

rebates and other discounts negotiated by PBMs in their capacity

as PBMs would be excluded. The rule also implements the DRA

provision establishing a new reimbursement formula for generic

drugs under Medicaid and establishes federal upper limits

(“FULs”) for generics based on 250 percent of the lowest AMP

in a given drug class. In December 2007, the U.S. District Court

for the District of Columbia preliminarily enjoined CMS from

implementing the AMP Rule to the extent such action affects

Medicaid reimbursement rates for retail pharmacies and from

posting online or disclosing any AMP data.

In October 2008, CMS issued a rule, subject to comment, which

modifi ed the defi nition of multiple source drugs, a component

of the AMP calculation, seeking to address one of the legal

challenges on which the injunction was issued. Plaintiffs in the

litigation responded with an amended complaint asserting that

the revised defi nition continues to be inconsistent with the DRA.

As a result of the above, we cannot currently determine the extent

or timing of any reductions in Medicaid reimbursement rates or

their future impact on the Company.