CVS 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 ANNUAL REPORT 59

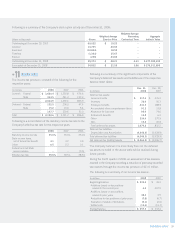

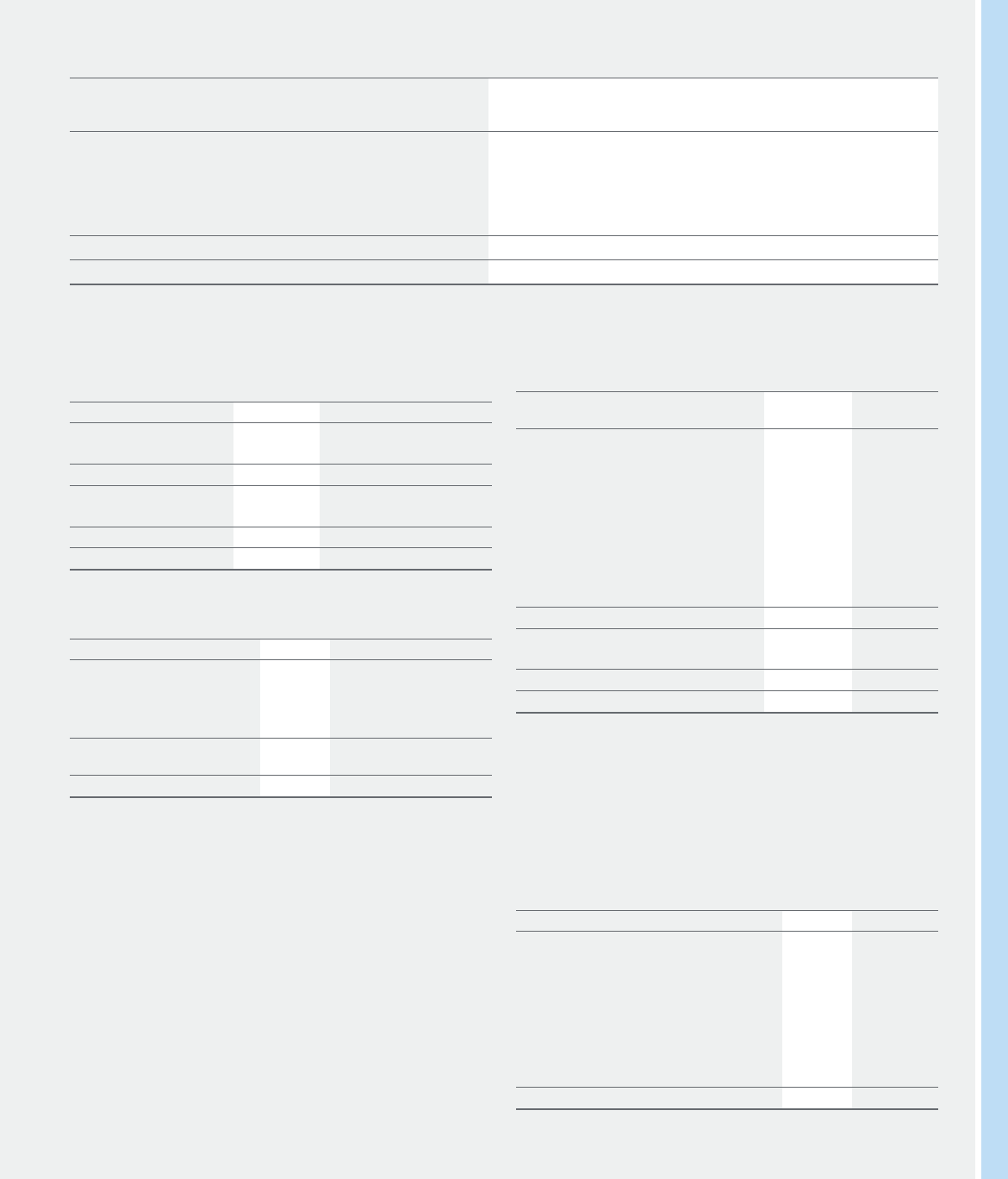

Following is a summary of the Company’s stock option activity as of December 31, 2008:

Weighted Average

Weighted Average Remaining Aggregate

Shares in thousands Shares Exercise Price Contractual Term Intrinsic Value

Outstanding at December 29, 2007 60,022 $ 19.23 – –

Granted 13,735 40.69 – –

Exercised (12,844) 18.59 – –

Forfeited (1,303) 35.67 – –

Expired (236) 23.82 – –

Outstanding at December 31, 2008 59,374 $ 28.21 4.63 $ 277,599,232

Exercisable at December 31, 2008 34,832 $ 21.55 3.86 $ 276,911,898

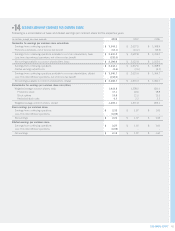

INCOME TAXES

The income tax provision consisted of the following for the

respective years:

In millions 2008 2007 2006

Current: Federal $ 1,680.4 $ 1,250.8 $ 676.6

State

364.5 241.3 127.3

2,044.9 1,492.1 803.9

Deferred: Federal 132.5 206.0 47.6

State

15.2 23.6 5.4

147.7 229.6 53.0

Total $ 2,192.6 $ 1,721.7 $ 856.9

Following is a reconciliation of the statutory income tax rate to the

Company’s effective tax rate for the respective years:

2008 2007 2006

Statutory income tax rate 35.0% 35.0% 35.0%

State income taxes,

net of federal tax benefi t 4.1 4.2 3.9

Other

0.5 0.3 0.1

Federal and net State

reserve release – – (0.5)

Effective tax rate 39.6% 39.5% 38.5%

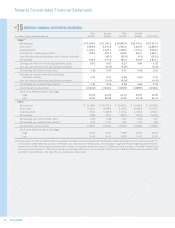

Following is a summary of the signifi cant components of the

Company’s deferred tax assets and liabilities as of the respective

balance sheet dates:

Dec. 31, Dec. 29,

In millions 2008 2007

Deferred tax assets:

Lease and rents $ 317.6 $ 276.2

Inventory 72.9 56.7

Employee benefi ts 241.3 188.9

Accumulated other comprehensive items 91.2 31.8

Allowance for bad debt 95.4 74.6

Retirement benefi ts 13.8 6.2

Other 234.4 170.9

NOL 13.2 26.9

Total deferred tax assets 1,079.8 832.2

Deferred tax liabilities:

Depreciation and Amortization (4,346.3) (3,928.9)

Total deferred tax liabilities (4,346.3) (3,928.9)

Net deferred tax (liability)/assets $ (3,266.5) $ (3,096.7)

The Company believes it is more likely than not the deferred

tax assets included in the above table will be realized during

future periods.

During the fourth quarter of 2006, an assessment of tax reserves

resulted in the Company recording a reduction of previously recorded

tax reserves through the income tax provision of $11.0 million.

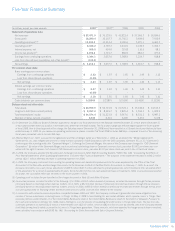

The following is a summary of our income tax reserve:

In millions 2008 2007

Beginning Balance $ 233.4 $ 43.2

Additions based on tax positions

related to the current year 6.0 207.5

Additions based on tax positions

related to prior years 48.4 4.5

Reductions for tax positions of prior years (7.8) (6.7)

Expiration of statute of limitations (9.1) (2.0)

Settlements (13.6) (13.1)

Ending Balance $ 257.3 $ 233.4

NO 11