CVS 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 CVS CAREMARK

Notes to Consolidated Financial Statements

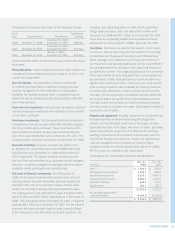

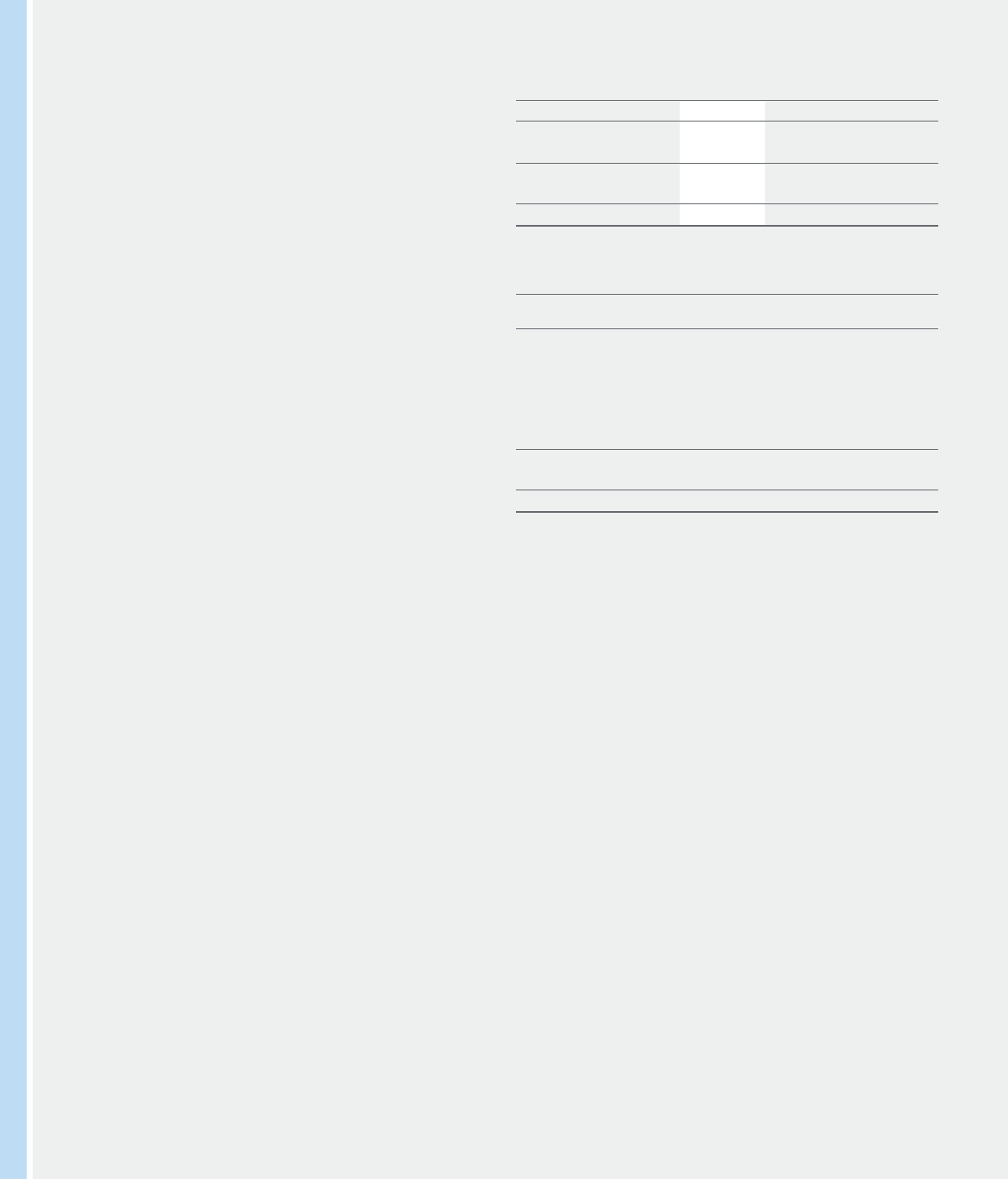

Following is a summary of the Company’s net rental expense for

operating leases for the respective years:

In millions 2008 2007 2006

Minimum rentals $ 1,691.3 $ 1,557.0 $ 1,361.2

Contingent rentals 57.8 65.1 61.5

1,749.1 1,622.1 1,422.7

Less: sublease income (24.9) (21.5) (26.4)

$ 1,724.2 $ 1,600.6 $ 1,396.3

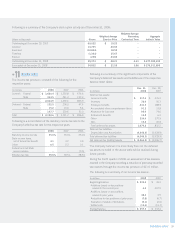

Following is a summary of the future minimum lease payments

under capital and operating leases as of December 31, 2008:

Capital Operating

In millions Leases Leases

2009 $ 17.0 $ 1,744.2

2010 17.2 1,854.4

2011 17.2 1,609.0

2012 17.6 1,682.6

2013 17.9 1,583.4

Thereafter 83.0 14,821.0

$ 169.9 $ 23,294.6

Less: imputed interest (125.6) –

Present value of capital lease obligations $ 44.3 $ 23,294.6

The Company fi nances a portion of its store development

program through sale-leaseback transactions. The properties

are sold and the resulting leases qualify and are accounted for

as operating leases. The Company does not have any retained

or contingent interests in the stores and does not provide any

guarantees, other than a guarantee of lease payments, in

connection with the sale-leaseback transactions. Proceeds

from sale-leaseback transactions totaled $203.8 million in 2008.

This compares to $601.3 million in 2007 and $1.4 billion in

2006, which included approximately $800 million in proceeds

associated with the sale and leaseback of some of the proper-

ties, acquired from Albertson’s, Inc. Under the transactions, the

properties are sold at fair value, which approximates net book

value, and the resulting leases qualify and are accounted for as

operating leases. The operating leases that resulted from these

transactions are included in the above table.

MEDICARE PART D

The Company offers Medicare Part D benefi ts through

SilverScript, which has contracted with CMS to be a PDP and,

pursuant to the Medicare Prescription Drug, Improvement and

Modernization Act of 2003 (“MMA”), must be a risk-bearing

entity regulated under state insurance laws or similar statutes.

In addition, RxAmerica offered Medicare Part D benefi ts

under insurance waivers from CMS. RxAmerica has acquired a

registered insurance company, subsequently renamed Accendo

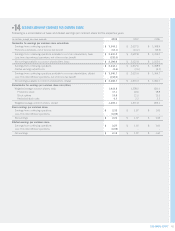

On September 10, 2008, the Company issued $350 million of

fl oating rate senior notes due September 10, 2010 (the “2008

Notes”). The 2008 Notes pay interest quarterly and may be

redeemed at any time, in whole or in part at a defi ned redemption

price plus accrued interest. The net proceeds from the 2008

Notes were used to fund a portion of the Longs Acquisition.

On May 22, 2007, the Company issued $1.75 billion of fl oating

rate senior notes due June 1, 2010, $1.75 billion of 5.75%

unsecured senior notes due June 1, 2017, and $1.0 billion of

6.25% unsecured senior notes due June 1, 2027 (collectively

the “2007 Notes”). Also on May 22, 2007, the Company entered

into an underwriting agreement pursuant to which the Company

agreed to issue and sell $1.0 billion of Enhanced Capital

Advantaged Preferred Securities (“ECAPS”) due June 1, 2062

to the underwriters. The ECAPS bear interest at 6.302% per year

until June 1, 2012 at which time they will pay interest based on

a fl oating rate. The 2007 Notes and ECAPS pay interest semi-

annually and may be redeemed at any time, in whole or in part

at a defi ned redemption price plus accrued interest. The net

proceeds from the 2007 Notes and ECAPS were used to repay

a portion of the bridge credit facility and commercial paper

borrowings used to fund a portion of the Longs Acquisition

purchase price and retire $353 million of debt assumed as

part of the Longs Acquisition.

The credit facilities, back-up credit facility, unsecured senior

notes and ECAPS contain customary restrictive fi nancial and

operating covenants. The covenants do not materially affect the

Company’s fi nancial or operating fl exibility.

The aggregate maturities of long-term debt for each of the fi ve

years subsequent to December 31, 2008 are $653.3 million in

2009, $2.1 billion in 2010, $803.9 million in 2011, $1.0 billion

in 2012 and $3.8 million in 2013.

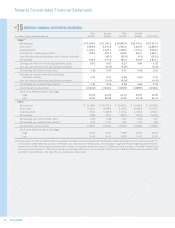

LEASES

The Company leases most of its retail and mail locations, ten

of its distribution centers and certain corporate offi ces under

non-cancelable operating leases, with initial terms of 15 to 25

years and with options that permit renewals for additional periods.

The Company also leases certain equipment and other assets

under non-cancelable operating leases, with initial terms of

3 to 10 years. Minimum rent is expensed on a straight-line

basis over the term of the lease. In addition to minimum rental

payments, certain leases require additional payments based

on sales volume, as well as reimbursement for real estate taxes,

common area maintenance and insurance, which are expensed

when incurred.

NO

7

NO 6