CVS 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 CVS CAREMARK

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

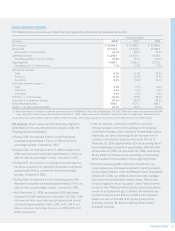

• During 2008, the 4 additional days in the 2008 reporting period

increased our total net revenue by approximately $495 million,

compared to 2007.

• During 2008, our comparable mail service claims processed

decreased 17.6% to 60.9 million claims, compared to 73.9 million

claims in 2007. This decrease was primarily due to the termina-

tion of the Federal Employees Health Benefi t Plan (“FEP”) mail

contract on December 31, 2007. During 2007, our comparable

mail service claims increased 0.9% to 73.9 million claims,

compared to 73.3 million claims in 2006.

• During 2008 and 2007, our comparable average revenue per

mail service claim increased by 7.8% and 7.2%, compared to

2007 and 2006, respectively. These increases were primarily

due to an increase in specialty mail service claims (which

have signifi cantly higher average net revenues per claim) and

higher drug costs. This was offset, in part, by an increase in

the percentage of generic drugs dispensed and changes in

client pricing.

• During 2008 and 2007, our comparable mail service generic

dispensing rates increased to 54.4% and 48.1%, compared to

2007 and 2006, respectively. These increases were primarily

due to new generic drug introductions and our continued efforts

to encourage plan participants to use generic drugs when

they are available. In addition, the termination of the FEP mail

contract caused our comparable mail service generic dispens-

ing rate to increase by approximately 120 basis points during

2008, compared to 2007.

• During 2008, our comparable retail network claims processed

increased to 572.5 million, compared to 533.3 million and

532.6 million in 2007 and 2006, respectively. These increases

were primarily due to the addition of approximately 13.5 million

RxAmerica claims (beginning October 20, 2008), growth in our

existing business (including our Medicare Part D business), the

4 additional days in the 2008 reporting period and new clients.

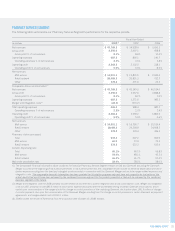

During 2008 and 2007, the Pharmacy Services Segment’s

results of operations were signifi cantly affected by the Caremark

Merger. As such, the primary focus of our Pharmacy Services

Segment discussion is based on the comparable fi nancial

information presented previously in this document. Prior to the

Caremark Merger, our pharmacy services business did not meet

the threshold for separate disclosure and the trends for the

pharmacy services business, which included our PharmaCare

Management Services, L.L.C. (“PharmaCare”) subsidiary, did

not differ materially from the trends of the consolidated Company.

Consequently, we do not believe that a comparison of the

historical fi nancial results provides meaningful information.

Net revenues. As you review our Pharmacy Services Segment’s

revenue performance, we believe you should consider the

following important information:

• During 2008 and 2007, the Caremark Merger increased

net revenues by $7.9 billion and $29.8 billion, compared to

2007 and 2006, respectively. 2008 includes a full year of net

revenues from Caremark, compared to 2007, which includes

net revenues from Caremark from the merger date (March 22,

2007) forward. 2006 includes no net revenues from Caremark.

• The Pharmacy Services Segment recognizes revenues for

its national retail pharmacy network transactions based on

individual contract terms. In accordance with Emerging Issues

Task Force Issue (“EITF”) No. 99-19, “Reporting Revenue

Gross as a Principal versus Net as an Agent,” Caremark’s

contracts are predominantly accounted for using the gross

method. Prior to September 2007, PharmaCare’s contracts

were accounted for using the net method. Effective September

1, 2007, we converted a number PharmaCare’s retail pharmacy

network contracts to the Caremark contract structure, which

resulted in those contracts being accounted for using the gross

method. As a result, net revenues increased by approximately

$1.8 billion and $1.0 billion during 2008 and 2007, compared

to 2007 and 2006, respectively. RxAmerica’s contracts are also

accounted for using the net method. We expect to convert a

number of RxAmerica’s contracts to the Caremark contract

structure during 2009. See Note 1 to the consolidated fi nancial

statements for additional information about the Pharmacy

Services Segment’s revenue recognition policies.