CVS 2008 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2008 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 CVS CAREMARK

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

RESULTS OF OPERATIONS

Fiscal Year Change. On December 23, 2008, the Board of

Directors of the Company approved a change in the Company’s

fi scal year end from the Saturday nearest December 31 of each

year to December 31 of each year to better refl ect the Company’s

position in the health care, rather than the retail industry. The fi scal

year change was effective beginning with the fourth quarter of

fi scal 2008. Prior to Board approval of this change, the Saturday

nearest December 31, 2008 would have resulted in a 53-week

fi scal year that would have ended January 3, 2009.

As you review our operating performance, please consider the

impact of the fi scal year change as set forth below:

Fiscal Fiscal Period

Year Fiscal Year-End Fiscal Period Includes

December 30, 2007 –

2008 December 31, 2008 December 31, 2008 368 days

December 31, 2006 –

2007 December 29, 2007 December 29, 2007 364 days

January 1, 2006 –

2006 December 30, 2006 December 30, 2006 364 days

Unless otherwise noted, all references to years relate to the above

fi scal years.

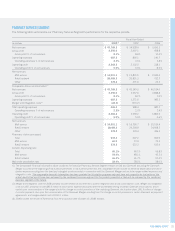

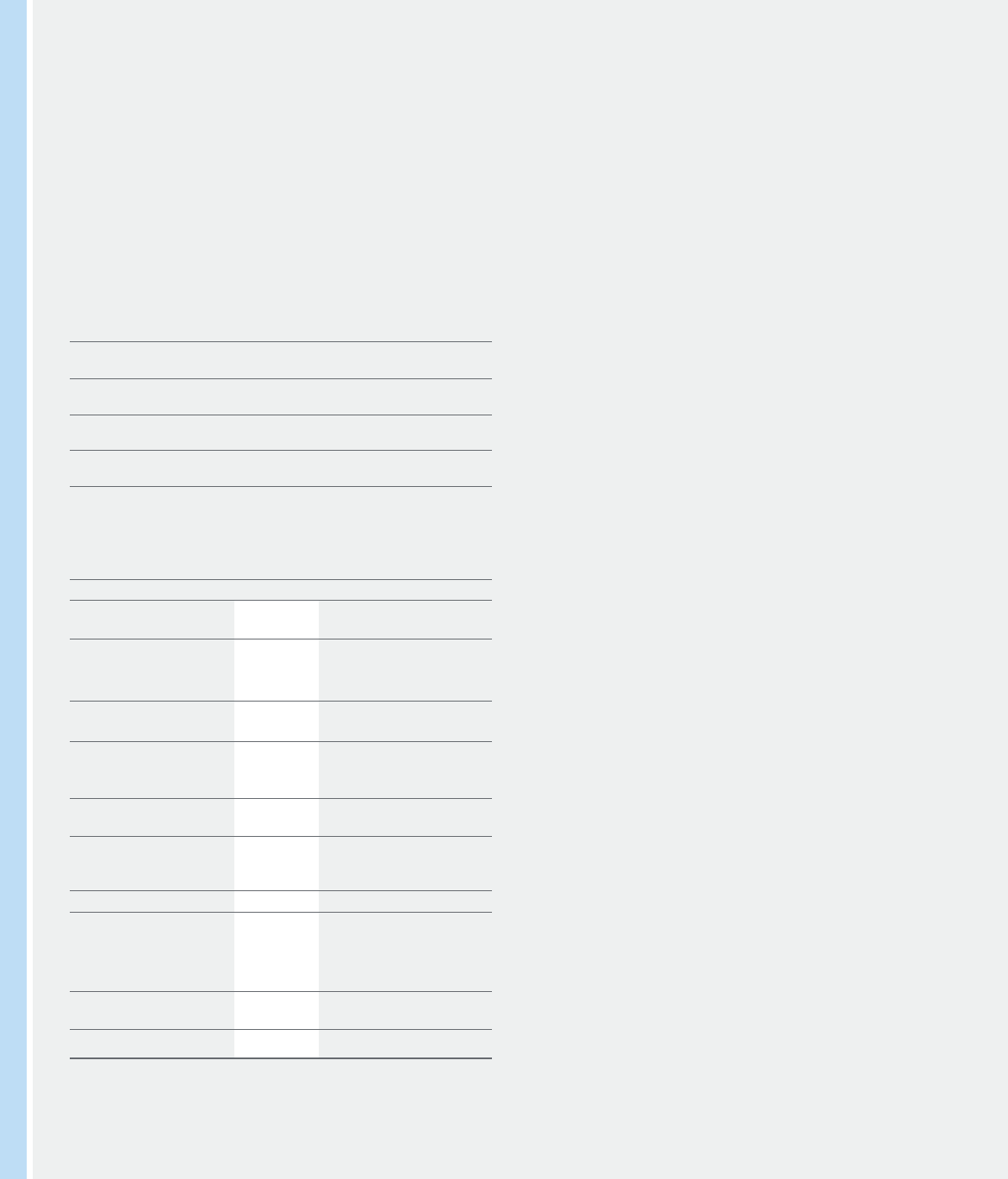

Summary of our Consolidated Financial Results

Fiscal Year

In millions, except per

common share amounts 2008 2007 2006

Net revenues $ 87,471.9 $ 76,329.5 $ 43,821.4

Gross profi t 18,290.4 16,107.7 11,742.2

Total operating expenses 12,244.2 11,314.4 9,300.6

Operating profi t 6,046.2 4,793.3 2,441.6

Interest expense, net 509.5 434.6 215.8

Earnings before income

tax provision 5,536.7 4,358.7 2,225.8

Income tax provision 2,192.6 1,721.7 856.9

Earnings from continuing

operations 3,344.1 2,637.0 1,368.9

Loss from discontinued

operations, net of income

tax benefi t of $82.4 (132.0) – –

Net earnings $ 3,212.1 $ 2,637.0 $ 1,368.9

Diluted earnings per

common share:

Earnings from continuing

operations $ 2.27 $ 1.92 $ 1.60

Loss from discontinued

operations (0.09) – –

Net earnings $ 2.18 $ 1.92 $ 1.60

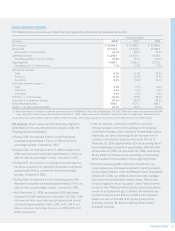

Net revenues increased $11.1 billion and $32.5 billion during

2008 and 2007, respectively. As you review our performance

in this area, we believe you should consider the following

important information:

• During 2008, the Caremark Merger increased net revenues by

$6.9 billion (net of intersegment eliminations of $1.0 billion),

compared to 2007. 2008 includes a full year of net revenues

from Caremark, compared to 2007, which includes net

revenues from Caremark from the merger date (March 22,

2007) forward.

• Effective October 20, 2008, we acquired Longs Drug Stores

Corporation, which included 529 retail drug stores (the “Longs

Drug Stores”), RxAmerica, LLC (“RxAmerica”), which provides

pharmacy benefi t management services and Medicare Part D

benefi ts, and other related assets (the “Longs Acquisition”).

2008 includes net revenues from the Longs Drug Stores and

RxAmerica from the acquisition date forward. During 2008,

the Longs Acquisition increased net revenues by $1.1 billion,

compared to 2007.

• During 2008, the 4 additional days in the 2008 reporting period

increased net revenues by $1.1 billion, compared to 2007.

• During 2007, the Caremark Merger increased net revenues by

$26.5 billion (net of intersegment eliminations of $3.3 billion),

compared to 2006. As noted previously in this document, 2007

includes net revenues from Caremark from the merger date

(March 22, 2007) forward, compared to 2006, which includes

no net revenues from Caremark.

• On June 2, 2006, we acquired 701 standalone drug stores

and other related assets from Albertson’s, Inc. (the “Albertson’s

Acquisition”). 2007 includes a full year of net revenues from

these stores, compared to 2006, which includes net revenues

from these stores from the acquisition date forward. During

2007, the Albertson’s Acquisition increased net revenues by

$2.2 billion, compared to 2006.

Please see the Segment Analysis later in this document for

additional information about our net revenues.