BP 2014 Annual Report Download - page 251

Download and view the complete annual report

Please find page 251 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Major shareholders

The disclosure of certain major and significant shareholdings in the share

capital of the company is governed by the Companies Act 2006, the UK

Financial Conduct Authority’s Disclosure and Transparency Rules (DTR)

and the US Securities Exchange Act of 1934.

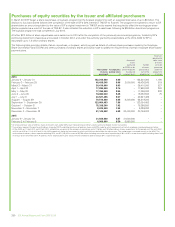

Register of members holding BP ordinary shares as at

31 December 2014

Range of holdings

Number of ordinary

shareholders

Percentage of total

ordinary shareholders

Percentage of total

ordinary share capital

excluding shares

held in treasury

1-200 56,090 20.67 0.02

201-1,000 95,613 35.24 0.28

1,001-10,000 107,541 39.63 1.79

10,001-100,000 10,659 3.93 1.18

100,001-1,000,000 773 0.29 1.59

Over 1,000,000a659 0.24 95.14

Totals 271,335 100.00 100.00

aIncludes JPMorgan Chase Bank, N.A. holding 28.79% of the total ordinary issued share capital

(excluding shares held in treasury) as the approved depositary for ADSs, a breakdown of which is

shown in the table below.

Register of holders of American depositary shares (ADSs) as at

31 December 2014a

Range of holdings

Number of

ADS holders

Percentage of total

ADS holders

Percentage of total

ADSs

1-200 55,981 58.01 0.35

201-1,000 25,960 26.90 1.42

1,001-10,000 13,816 14.32 4.14

10,001-100,000 740 0.77 1.42

100,001-1,000,000 8 0.00 0.13

Over 1,000,000b1 0.00 92.54

Totals 96,506 100.00 100.00

aOne ADS represents six 25 cent ordinary shares.

bOne holder of ADSs represents 979,038 underlying shareholders.

As at 31 December 2014, there were also 1,483 preference

shareholders. Preference shareholders represented 0.46% and ordinary

shareholders represented 99.54% of the total issued nominal share

capital of the company (excluding shares held in treasury) as at that date.

In accordance with DTR 5, we have received notification that as at

31 December 2014 BlackRock, Inc held 5.91%, The Capital Group

Companies, Inc held 3.31% and Legal & General Group plc held 3.21% of

the voting rights of the issued share capital of the company. As at

17 February 2015 BlackRock, Inc held 6.25%, The Capital Group

Companies, Inc held 3.51% and Legal & General Group plc held 3.27% of

the voting rights of the issued share capital of the company.

Under the US Securities Exchange Act of 1934 BP has received

notification of the following interests as at 17 February 2015:

Holder

Holding of

ordinary shares

Percentage

of ordinary

share capital

excluding

shares held

in treasury

JPMorgan Chase Bank N.A., depositary

for ADSs, through its nominee

Guaranty Nominees Limited 5,301,883,023 29.07

BlackRock, Inc. 1,139,520,000 6.25

The company’s major shareholders do not have different voting rights.

The company has also been notified of the following interests in

preference shares as at 17 February 2015:

Holder

Holding of 8%

cumulative first

preference shares

Percentage

of class

The National Farmers Union Mutual

Insurance Society 945,000 13.07

M & G Investment Management Ltd. 528,150 7.30

Duncan Lawrie Ltd. 364,876 5.04

Holder

Holding of 9%

cumulative second

preference shares

Percentage

of class

The National Farmers Union Mutual

Insurance Society 987,000 18.03

M & G Investment Management Ltd. 644,450 11.77

Smith & Williamson Investment

Management Ltd. 333,200 6.09

Bank Julius Baer 294,000 5.37

Barclays Bank PLC. 279,172 5.10

In accordance with DTR 5.8.12, The Capital Group of Companies, Inc.

notified the company on 24 September 2012 that due to their group

reorganization their holdings would not be reported separately but as

combined holdings, thereby taking their interest in shares above the 3%

threshold as of 1 September 2012.

Smith and Williamson Holdings Limited disposed of its interest in 32,500

8% cumulative first preference shares during 2014.

In accordance with DTR 5.6, BlackRock, Inc. notified the company that its

indirect interest in ordinary shares decreased below 5% during 2014.

UBS Investment Bank notified the company that its indirect interest in

ordinary shares increased above 3% on 9 February 2015 and that it

decreased below the notifiable threshold on 16 February 2015.

As at 17 February 2015, the total preference shares in issue comprised

only 0.46% of the company’s total issued nominal share capital

(excluding shares held in treasury), the rest being ordinary shares.

Annual general meeting

The 2015 AGM will be held on Thursday 16 April 2015 at 11.30am at

ExCeL London, One Western Gateway, Royal Victoria Dock, London, E16

1XL. A separate notice convening the meeting is distributed to

shareholders, which includes an explanation of the items of business to

be considered at the meeting.

All resolutions for which notice has been given will be decided on a poll.

Ernst & Young LLP have expressed their willingness to continue in office

as auditors and a resolution for their reappointment is included in the

Notice of BP Annual General Meeting 2015.

Memorandum and Articles of Association

The following summarizes certain provisions of the company’s

Memorandum and Articles of Association and applicable English law. This

summary is qualified in its entirety by reference to the UK Companies Act

2006 (the Act) and the company’s Memorandum and Articles of

Association. For information on where investors can obtain copies of the

Memorandum and Articles of Association see Documents on display on

page 251.

At the AGM held on 17 April 2008 shareholders voted to adopt new

Articles of Association, largely to take account of changes in UK company

law brought about by the Act. Further amendments to the Articles of

Association were approved by shareholders at the AGM held on 15 April

2010. New Articles of Association are being proposed at our AGM in

2015.

Shareholder information

BP Annual Report and Form 20-F 2014 247