BP 2014 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

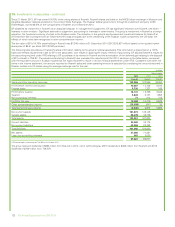

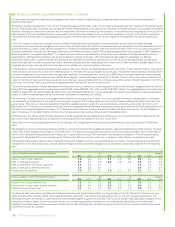

15. Investments in associates – continued

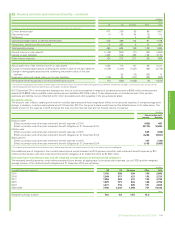

Since 21 March 2013, BP has owned 19.75% of the voting shares of Rosneft. Rosneft shares are listed on the MICEX stock exchange in Moscow and

its global depositary receipts are listed on the London Stock Exchange. The Russian federal government, through its investment company OJSC

Rosneftegaz, owned 69.5% of the voting shares of Rosneft at 31 December 2014.

BP classifies its investment in Rosneft as an associate because, in management’s judgement, BP has significant influence over Rosneft; see Note 1 –

Interests in other entities – Significant estimate or judgement: accounting for interests in other entities. The group’s investment in Rosneft is a foreign

operation, the functional currency of which is the Russian rouble. The reduction in the group’s equity-accounted investment balance for Rosneft at

31 December 2014 compared with 31 December 2013 was principally due to the weakening of the Russian rouble compared to the US dollar, the

effects of which have been recognized in other comprehensive income.

The fair value of BP’s 19.75% shareholding in Rosneft was $7,346 million at 31 December 2014 (2013 $15,937 million) based on the quoted market

share price of $3.51 per share (2013 $7.62 per share).

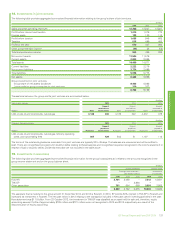

The following table provides summarized financial information relating to the group’s material associates. This information is presented on a 100%

basis and reflects adjustments made by BP to the associates’ own results in applying the equity method of accounting. BP adjusts Rosneft’s results for

the accounting required under IFRS relating to BP’s purchase of its interest in Rosneft and the amortization of the deferred gain relating to the disposal

of BP’s interest in TNK-BP. The adjustments relating to Rosneft have increased the reported profit for 2014, as shown in the table below, compared

with the equivalent amount in Russian roubles that we expect Rosneft to report in its own financial statements under IFRS. Consistent with other line

items in the income statement, the amount reported for Rosneft sales and other operating revenue is calculated by translating the amounts reported in

Russian roubles into US dollars using the average exchange rate for the year.

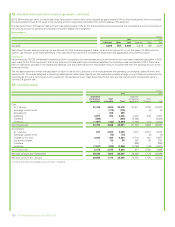

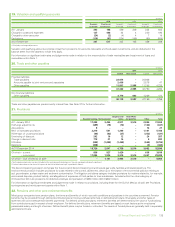

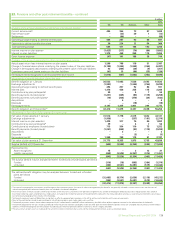

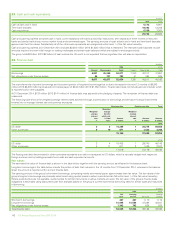

$ million

Gross amount

2014 2013 2012

Rosneft Rosneft TNK-BPa

Sales and other operating revenues 142,856 122,866 49,350

Profit before interest and taxation 19,367 14,106 8,810

Finance costs 5,230 1,337 168

Profit before taxation 14,137 12,769 8,642

Taxation 3,428 2,137 1,958

Non-controlling interests 71 213 712

Profit for the year 10,638 10,419 5,972

Other comprehensive income (13,038) (441) 26

Total comprehensive income (2,400) 9,978 5,998

Non-current assets 101,073 149,149

Current assets 38,278 48,775

Total assets 139,351 197,924

Current liabilities 36,400 43,175

Non-current liabilities 65,266 83,458

Total liabilities 101,666 126,633

Net assets 37,685 71,291

Less: non-controlling interests 663 2,020

37,022 69,271

aBP ceased equity accounting for TNK-BP on 22 October 2012.

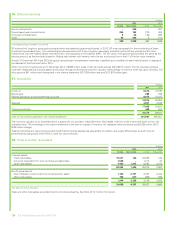

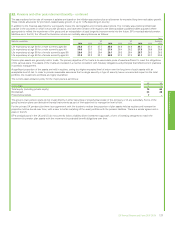

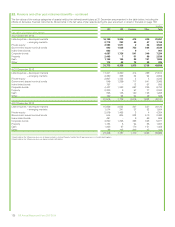

The group received dividends of $693 million from Rosneft in 2014, net of withholding tax (2013 dividends of $456 million from Rosneft and 2012

dividends of $709 million from TNK-BP).

132 BP Annual Report and Form 20-F 2014