BP 2014 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

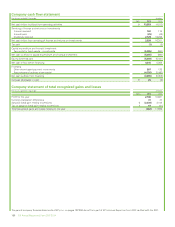

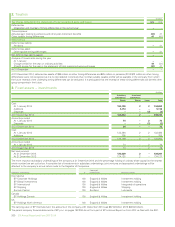

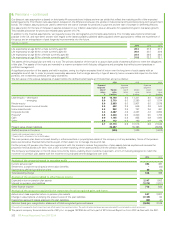

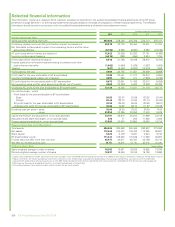

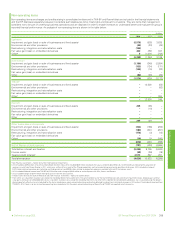

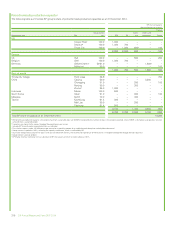

Selected financial information

This information, insofar as it relates to 2014, has been extracted or derived from the audited consolidated financial statements of the BP group

presented on page 89. Note 1 to the financial statements includes details on the basis of preparation of these financial statements. The selected

information should be read in conjunction with the audited financial statements and related notes elsewhere herein.

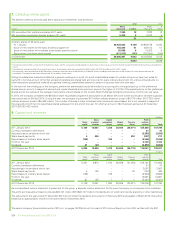

$ million except per share amounts

2014 2013 2012 2011 2010

Income statement data

Sales and other operating revenues 353,568 379,136 375,765 375,713 297,107

Underlying replacement cost (RC) profit before interest and taxation*20,818 22,776 26,454 33,601 31,704

Net favourable (unfavourable) impact of non-operating items*and fair value

accounting effects*(8,196) 9,283 (6,091) 3,580 (37,190)

RC profit (loss) before interest and taxation*12,622 32,059 20,363 37,181 (5,486)

Inventory holding gains (losses)*(6,210) (290) (594) 2,634 1,784

Profit (loss) before interest and taxation 6,412 31,769 19,769 39,815 (3,702)

Finance costs and net finance expense relating to pensions and other

post-retirement benefits (1,462) (1,548) (1,638) (1,587) (1,605)

Taxation (947) (6,463) (6,880) (12,619) 1,638

Profit (loss) for the year 4,003 23,758 11,251 25,609 (3,669)

Profit (loss) for the year attributable to BP shareholders 3,780 23,451 11,017 25,212 (4,064)

Inventory holding (gains) losses, net of taxation 4,293 230 411 (1,800) (1,195)

RC profit (loss) for the year attributable to BP shareholders 8,073 23,681 11,428 23,412 (5,259)

Non-operating items and fair value accounting effects, net of taxation 4,063 (10,253) 5,643 (2,242) 25,436

Underlying RC profit for the year attributable to BP shareholders 12,136 13,428 17,071 21,170 20,177

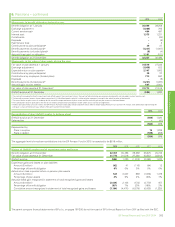

Per ordinary share – cents

Profit (loss) for the year attributable to BP shareholders

Basic 20.55 123.87 57.89 133.35 (21.64)

Diluted 20.42 123.12 57.50 131.74 (21.64)

RC profit (loss) for the year attributable to BP shareholders 43.90 125.08 60.05 123.83 (28.01)

Underlying RC profit for the year attributable to BP shareholders 66.00 70.92 89.70 111.97 107.39

Dividends paid per share – cents 39.00 36.50 33.00 28.00 14.00

– pence 23.850 23.399 20.852 17.404 8.679

Capital expenditure and acquisitions, on an accruals basis 23,781 36,612 25,204 31,959 23,016

Acquisitions and asset exchanges, on an accruals basis 420 71 200 11,283 3,406

Organic capital expenditure*a, on an accruals basis 22,892 24,600 23,950 19,580 18,218

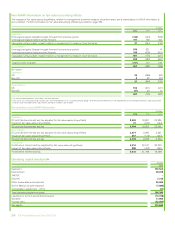

Balance sheet data (at 31 December)

Total assets 284,305 305,690 300,466 292,907 272,262

Net assets 112,642 130,407 119,752 112,585 95,891

Share capital 5,023 5,129 5,261 5,224 5,183

BP shareholders’ equity 111,441 129,302 118,546 111,568 94,987

Finance debt due after more than one year 45,977 40,811 38,767 35,169 30,710

Net debt to net debt plus equity*16.7% 16.2% 18.7% 20.4% 21.2%

Ordinary share databShares million

Basic weighted average number of shares 18,385 18,931 19,028 18,905 18,786

Diluted weighted average number of shares 18,497 19,046 19,158 19,136 18,998

aOrganic capital expenditure excludes acquisitions and asset exchanges, and: in 2014 $469 million relating to the purchase of an additional 3.3% equity in Shah Deniz, Azerbaijan and the South Caucasus

Pipeline; in 2013 $11,941 million relating to our investment in Rosneft; in 2012 $1,054 million associated with deepening our US natural gas and North Sea asset bases; in 2011 $1,096 million

associated with deepening our US natural gas bases; in 2010 $900 million relating to the formation of a partnership with Value Creation Inc. to develop the Terre de Grace oil sands acreage and

$492 million for the purchase of additional interests in the Valhall and Hod fields in the North Sea.

bThe number of ordinary shares shown has been used to calculate the per share amounts.

208 BP Annual Report and Form 20-F 2014